Standard Payroll hub | QuickBooks Online

by Intuit•5• Updated 11 months ago

Here you'll find help articles and step-by-step instructions for specific features in QuickBooks Online Standard Payroll.

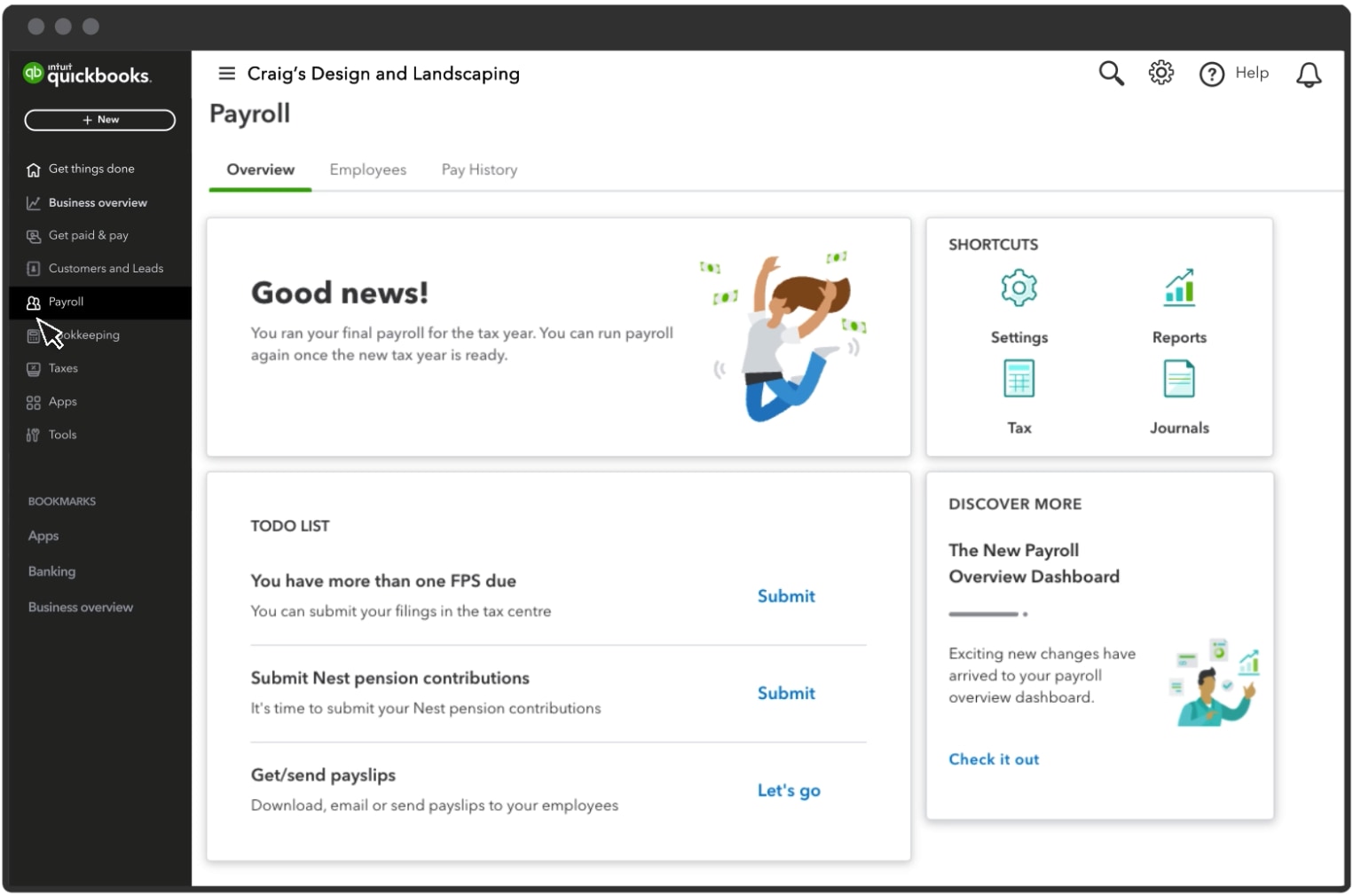

If your payroll dashboard looks like the one shown here, it means that you're using Standard Payroll.

If you want to find articles on a specific topic, jump to the relevant section:

- Set up payroll

- Payroll year end and tax updates

- Move your data

- Employees

- Pay runs

- Payslips

- Leave taken and deductions

- Statutory pay

- Reporting to HMRC

- Pensions

- Fix errors and issues

- Connect to QuickBooks Time

Set up payroll

- Learn about Standard Payroll

- Set up Standard Payroll

- Turn on Standard Payroll

- Turn on Real Time Information (RTI)

- Set up Small Employers' Relief (SER)

- Set up tax code notifications

Payroll year end and tax updates

Move your data

Employees

- Add employees

- Edit employee details

- Change employee status

- Invite employees to QuickBooks Workforce

- Give employees their P45 form

- Issue P60 forms

- Add or remove a company director

Pay runs

- How to run payroll

- Delete or roll back a pay run

- Process week 53

- Create a pay schedule

- Set up multiple pay schedules

- Make changes to a company pay schedule

- Pay employees outside of a pay period

Payslips

Leave taken and deductions

- Add or customise employee deductions and loans

- Add or customise payroll deductions

- Record deductions suffered under the Construction Industry Scheme (CIS)

- Add or customise overtime, bonus, holiday pay and other pay types

- Add unpaid leave

Statutory pay

- Add, edit or delete sick pay (SSP)

- Add, edit or delete maternity pay (SMP)

- Add, edit or delete paternity pay (SPP)

Reporting to HMRC

- Turn on Real Time Information (RTI) reporting

- Submit a Full Payment Summary (FPS)

- Submit an Employment Payment Summary (EPS)

- View FPS and EPS submissions made to HMRC

- Set up Small Employers' Relief (SER)

- Run Employment Payment Record (P32) report

- View journals and payroll liabilities

Pensions

- Set up a workplace pension

- Auto enrolment and postponement for workplace pensions

- Opt an employee out of a pension scheme

- Set up multiple pensions

- Set up automated NEST submissions

- Send pension reports to pension provider

- Pension re-enrolment

- Delete a pension scheme

- Run pension reports

Fix errors and issues

Connect to QuickBooks Time

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.