Make Self Assessment easier with QuickBooks Self-Employed

by Intuit•1• Updated 2 years ago

With the Self Assessment deadline around the corner, it's time to tidy up your accounts. From organising bank transactions to adding personal allowances, here are 5 simple things you can do in QuickBooks Self-Employed to get there faster.

When you're done, read through this checklist to get ready and complete your Self Assessment tax return.

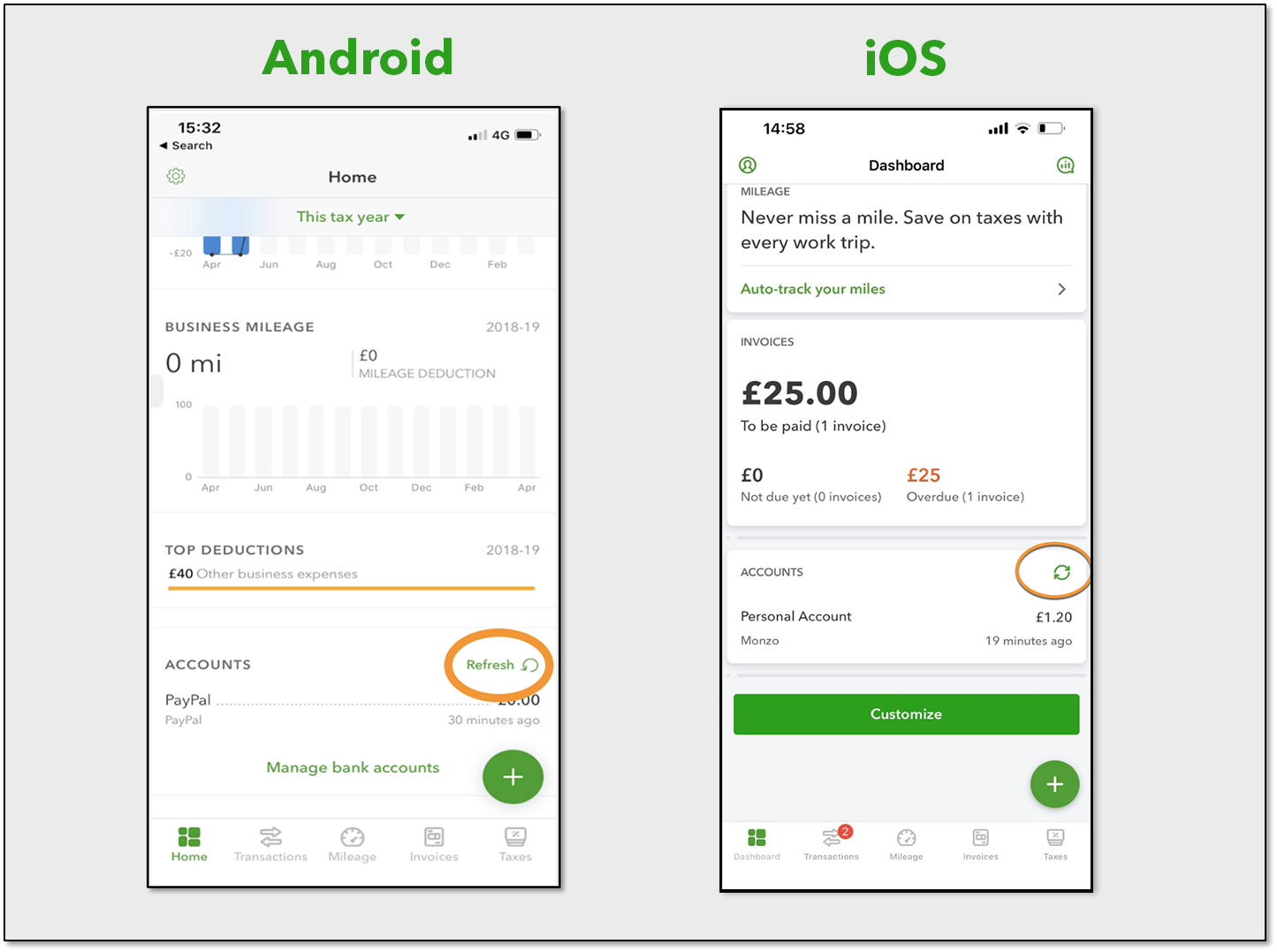

Ever signed in to QuickBooks Self-Employed and wondered why some of your recent bank transactions are missing? If so, try this quick fix:

From the mobile app

- Go to Dashboard, or Home if you use Android.

- Scroll down to Accounts.

- Select Refresh. QuickBooks will search for any new transactions.

From a desktop browser

- Go to Home.

- Find the Accounts square and select View.

- Select Refresh all.

QuickBooks will search for any new transactions.

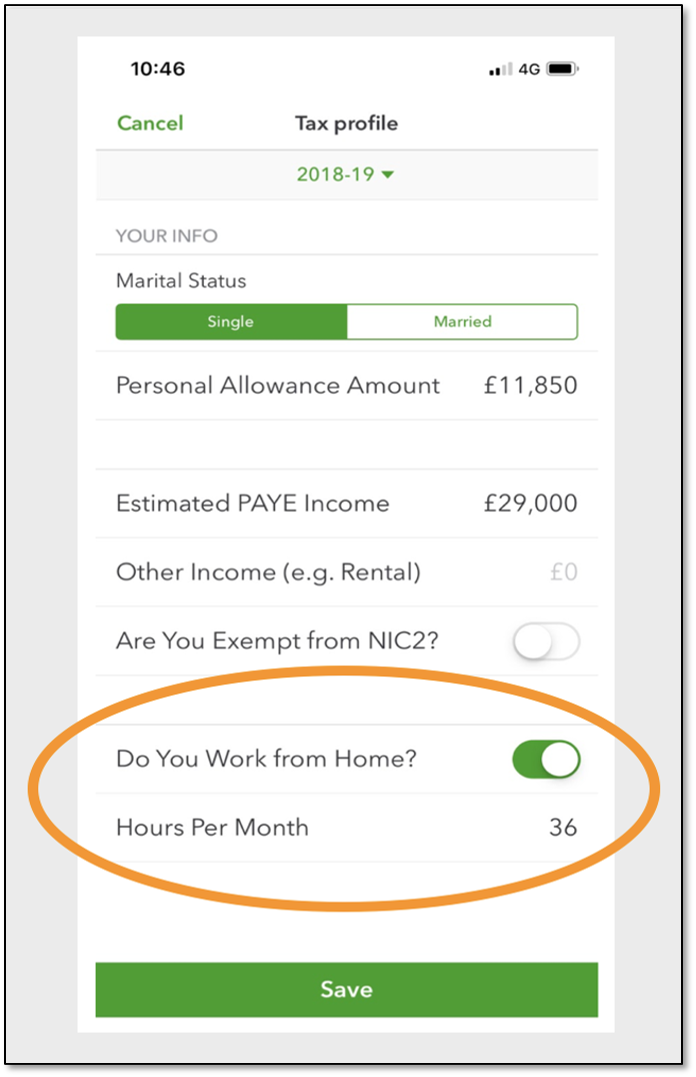

Simplified expenses are a way of calculating some of your business expenses using a flat rate set by HMRC. It’s faster and more straightforward than recording every expense individually. And HMRC allows you to do it for expenses relating to working from home.

| There are pros and cons to recording these expenses this way, which you should check out first using HMRC’s simple expenses calculator. |

The good news is you can set up QuickBooks Self-Employed to work out your simplified expense calculations automatically.

If you entered 25 hours or more, QuickBooks automatically knows the simplified amount you can claim and will add that to your tax report.

Remember, if you want to claim the actual costs and not use the simplified method, then leave Do You Work from Home? switched off (mobile) or keep the box blank (web). You’ll need to continue categorising your bank transactions as normal.

From the mobile app

- Go to Dashboard. Or, Home if you use Android.

- Select the Profile icon. If you use Android, select the Gear icon.

- Select Tax profile.

- Switch on Do You Work from Home?

- Select Hours Per Month and enter the number of hours you work from home every month.

- Finally, select Save and Done.

From a desktop browser

- Go to Home.

- Select Gear icon.

- Select Tax profile.

- Find Do you work from home? and in the box, enter the number of hours you work from home every month.

- Select Save.

Married or in a civil partnership? HMRC may let you transfer £1,260 of your Personal Allowance to your partner.

If this does apply to you, then QuickBooks Self-Employed can easily add that tax saving to your tax report. Here’s how to add the Marriage Allowance to QuickBooks Self Employed.

| To find out if you’re eligible and how to apply check out HMRC’s website. |

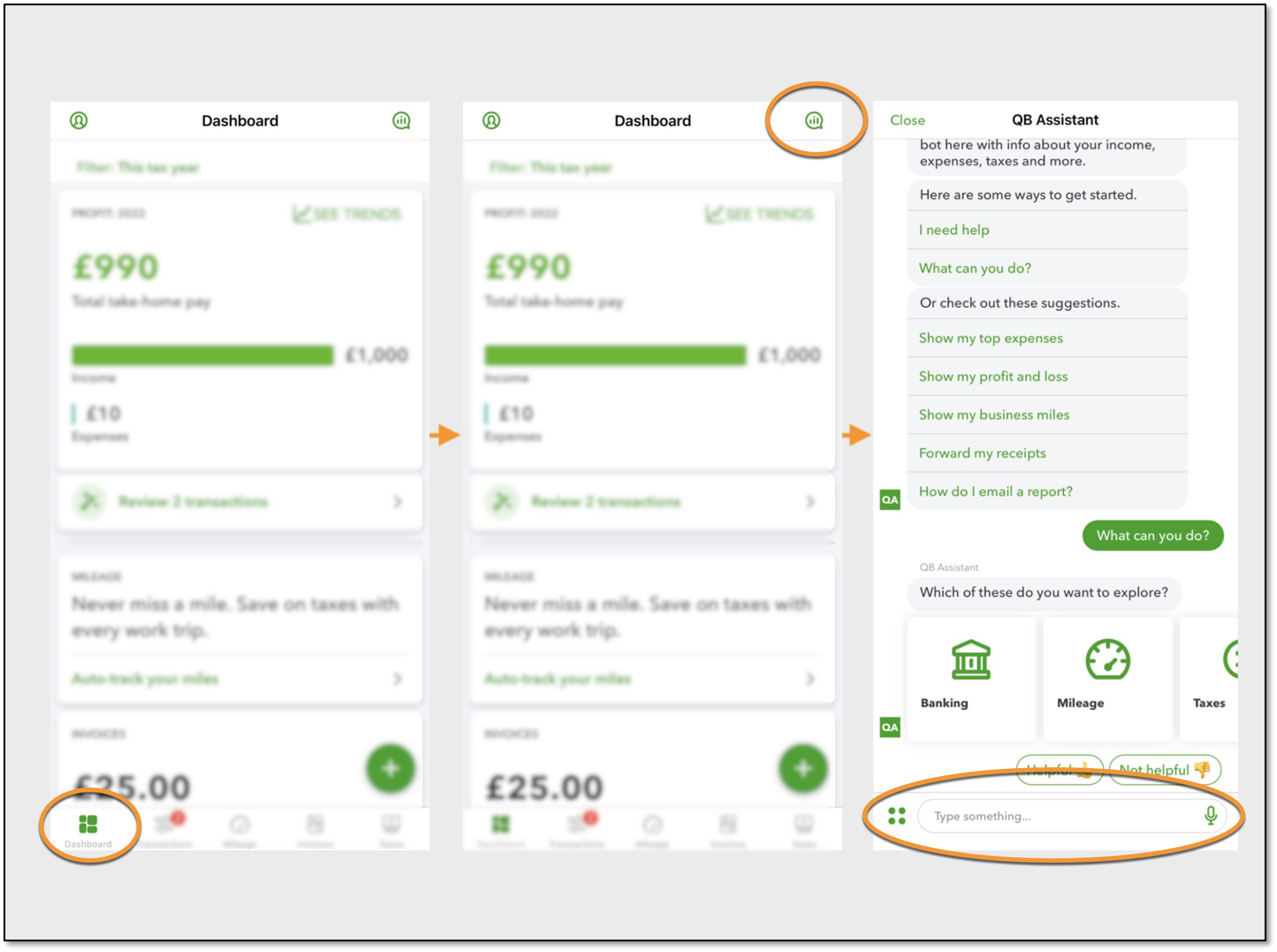

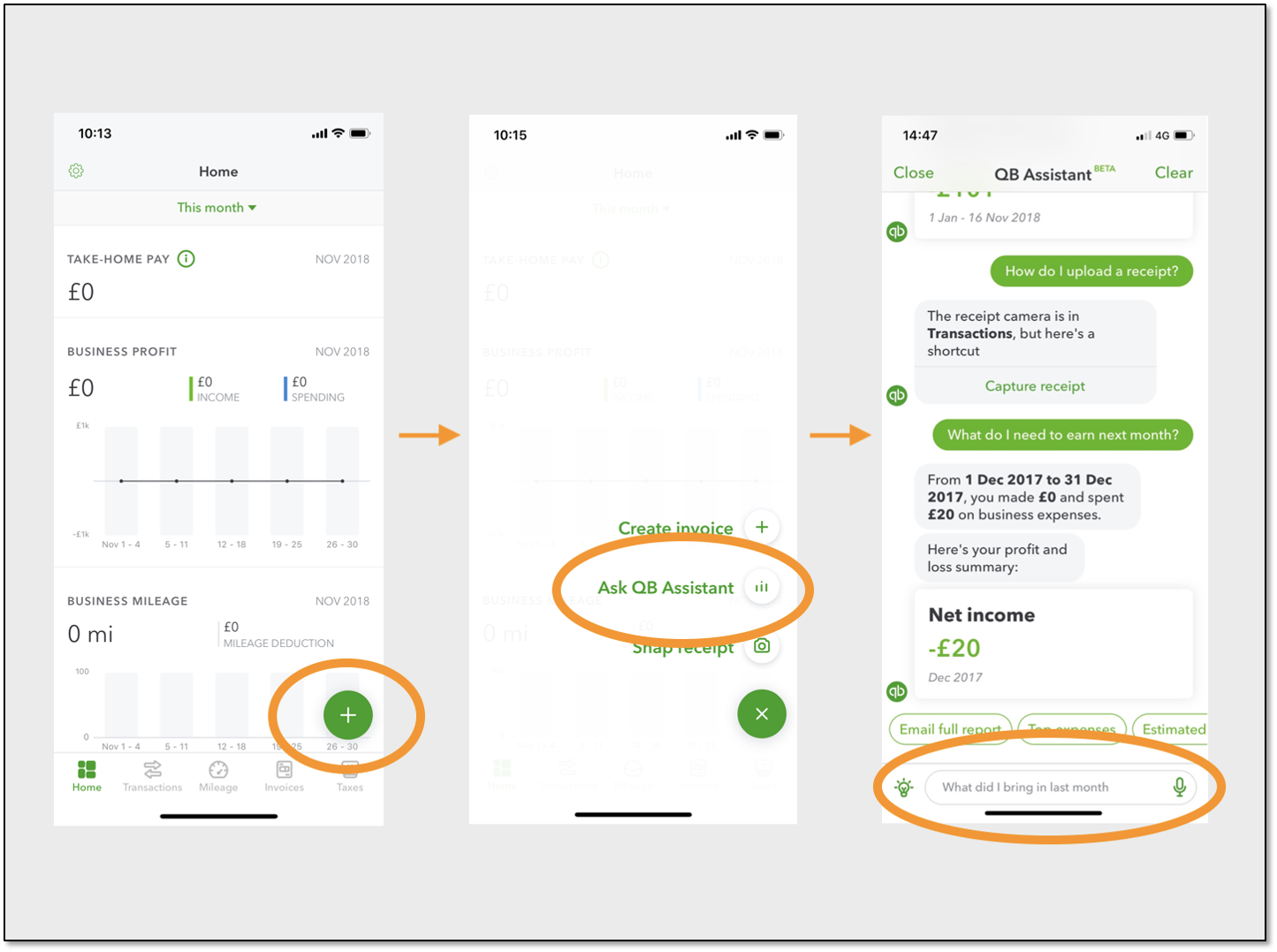

QB Assistant is your personal helper that lives inside the QuickBooks Self- Employed mobile app. If you’ve haven’t got around to using QB Assistant yet, now is a great time to start.

QB Assistant can answer all kinds of Self Assessment-related questions you might have, like “how much did I earn this year?”, “what tax do I owe”, as well as help with practical things like and “how do I upload a receipt?” Here’s how to find it in QuickBooks.

From the mobile app

For iOS:

- Go to Dashboard.

- Select the QB Assistant icon on the top right of the screen.

- Type in your question into the text field.

For Android:

- Go to Home.

- Select the Plus icon (+) on the bottom right-hand side of the screen.

- Then select Ask QB Assistant.

- When the screen opens, type in your question into the field at the bottom of the screen.

From a desktop browser

- Select the QB Assistant icon.

- Type in your question into the text field.

QuickBooks can help you save time by excluding more than one transaction at a time.

- Sign in to the web version of QuickBooks Self-Employed.

- Go to the Transactions.

- Choose which transactions you’d like to exclude by selecting the box next to the date of each transaction.

- Select Exclude.

- Select Apply to confirm.

| The lowdown on adding expense categories Ever wondered why the expense categories in QuickBooks Self-Employed are fixed? It’s because they mirror the categories used by HMRC for self-employed individuals. There are two benefits of this: Come tax time you can be confident that all your financial data in QuickBooks will match HMRC’s reporting – which makes things much easier. But it also means you can be confident you’re claiming back every penny you’re owed. |