Submit an FPS to HMRC in QuickBooks Advanced Payroll

by Intuit•11• Updated 4 months ago

When you process a pay run in QuickBooks Online Advanced Payroll, you need to submit a Full Payment Summary (FPS) to HMRC on or before the employee’s pay day. The FPS form contains important information about the payments made to employees, including their earnings, deductions and tax contributions.

This article is for customers who use QuickBooks Online Advanced Payroll.

This article will cover:

Before you begin

- To send an FPS, you'll must finalise the pay run, which means it cannot be edited afterwards.

- If it's your first time submitting an FPS, set up RTI reporting in QuickBooks so that it automatically sends the FPS every time you run payroll.

Submit an FPS to HMRC

- Go to Payroll, and select the Pay Runs tab.

- Select the pay run to open its details.

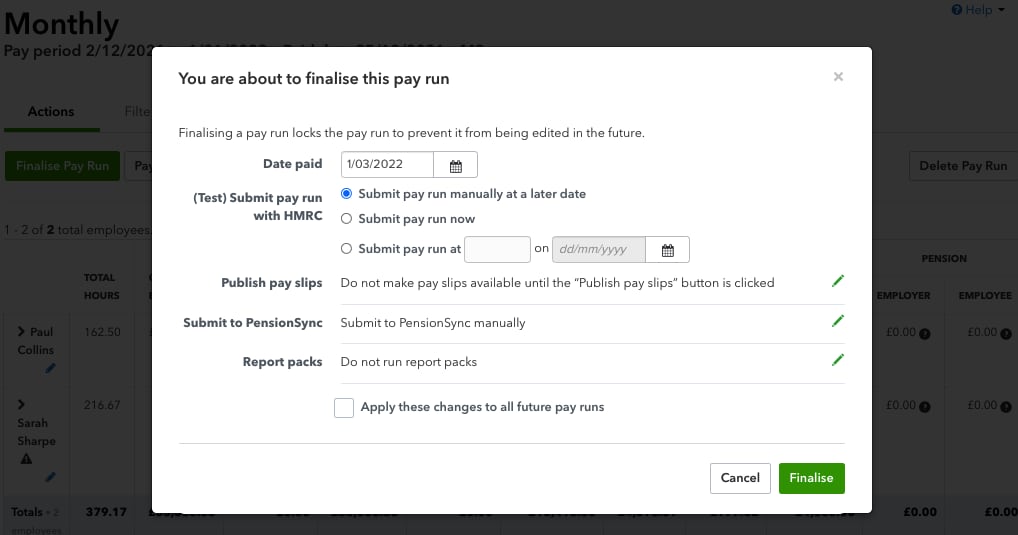

- Select Finalise Pay Run.

- Choose your submission options:

- Submit pay run manually at a later date: This finalises the pay run but doesn’t send the FPS to HMRC immediately.

- Submit pay run now: This finalises the pay run and sends the FPS to HMRC immediately.

- If you choose to submit the pay run later, specify the date and time for the FPS submission.

- Select Finalise.

Mark submission as late

If you send an FPS after your employee's payday, you can let HMRC know why. Here’s how:

- Go to Payroll, and select the Pay Runs tab.

- Open the pay run.

- Select Pay run actions.

- Select Mark all as late submission.

- Choose the reason for the delay.

- Select Apply.

Check submission status

- Go to Payroll.

- Select the Reports tab.

- Within HMRC reporting, select RTI submission messages.

- Select the date range.

- Select Search. You will see a list of your submissions and the status–successful, pending or rejected by HMRC.