Set up Marriage Allowance in QuickBooks Self-Employed

by Intuit• Updated 1 year ago

Marriage Allowance is a tax perk for married couples or those in civil partnerships. It lets the partner who earns less to transfer £1,260 of their Personal Allowance to their spouse, who pays tax at the basic rate. This lowers the tax burden for the higher-earning partner.

This article will cover:

Who qualifies for Marriage Allowance?

To qualify, the lower-earning partner’s income must be below the standard Personal Allowance threshold, and the higher-earning partner’s salary must fall between the basic-rate tax threshold.

You can apply for Marriage Allowance on the government website.

How is Marriage Allowance calculated?

Let’s break it down with an example from the government website.

Disclaimer: This example is for illustration purposes only and may not reflect your tax situation. Please consult government guidance or with your accountant for more information.

If your income is £11,500 and your Personal Allowance is £12,750, you don’t have to pay tax.

Your partner’s income is £20,000 and their Personal Allowance is also £12,570. They have to pay tax on £7,430 of their income.

But when you claim Marriage Allowance, you can transfer £1,260 of your Personal Allowance to your partner. This means that your Personal Allowance becomes £11,310, and your partner gets a ‘tax credit’ on £1,260 of their taxable income.

As a result, you’ll now pay tax on only £190, while your partner will pay tax on £6,170. Together, you’ll be paying tax on a total of £6,360 instead of £7,430. This saves you £214 in tax.

Want to know how much tax you can save as a couple? Use the online Marriage Allowance calculator.

Setting up Marriage Allowance in QuickBooks

- Select the gear icon.

- Select Tax profile.

- Select the appropriate tax year.

- Indicate your marital status by selecting Yes.

- Enter the amount for your Personal Allowance.

- Specify whether you have Received or Sent a transfer allowance, and then enter the amount.

- Select Save.

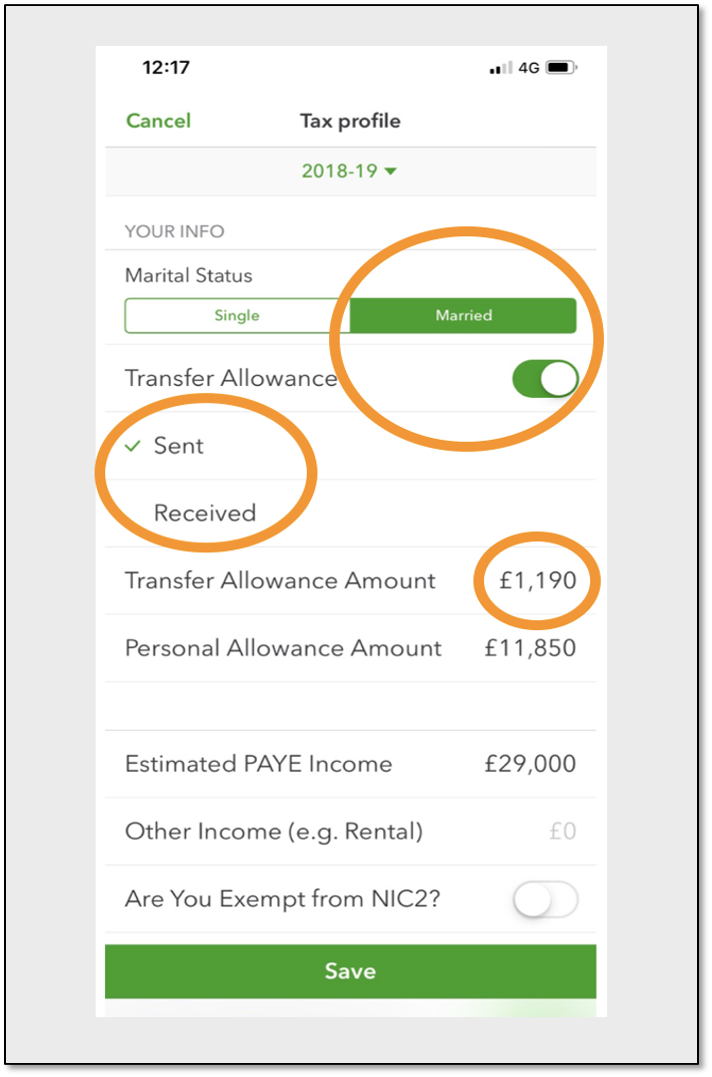

On the mobile app

- Go to Dashboard. Or, Home if you use Android.

- Select Profile icon. If you use Android, select the Gear icon.

- Select Tax profile.

- Below Marital Status select Married.

- Switch on Transfer Allowance.

- Select Sent if you would like to transfer any of your allowance to a spouse, or Received if your spouse is transferring any of their allowance to you.

- Then, next to Transfer Allowance Amount, add the amount being transferred.

- Finally, select Save.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.