Record a director's loan in QuickBooks Online

by Intuit•25• Updated 2 weeks ago

As a company director, you might sometimes have to cover business expenses with your personal funds. Whether it's a business lunch or buying office equipment, it's important to keep track of these payments.

This article will show you how to:

1. Set up the director's loan account

- Go to Transactions and select Chart of accounts (Take me there).

- Select New.

- Complete the following fields:

- Account Type: Non-current liabilities

- Detail Type: Shareholder Notes Payable

- Name: [Director's name] Loan Account

- Description: This is optional but helpful in tracking the account's purpose

- In the Unpaid balance field, enter the amount owed to the director. Make sure to set the correct date of when the amount was owed.

- Select Save and Close.

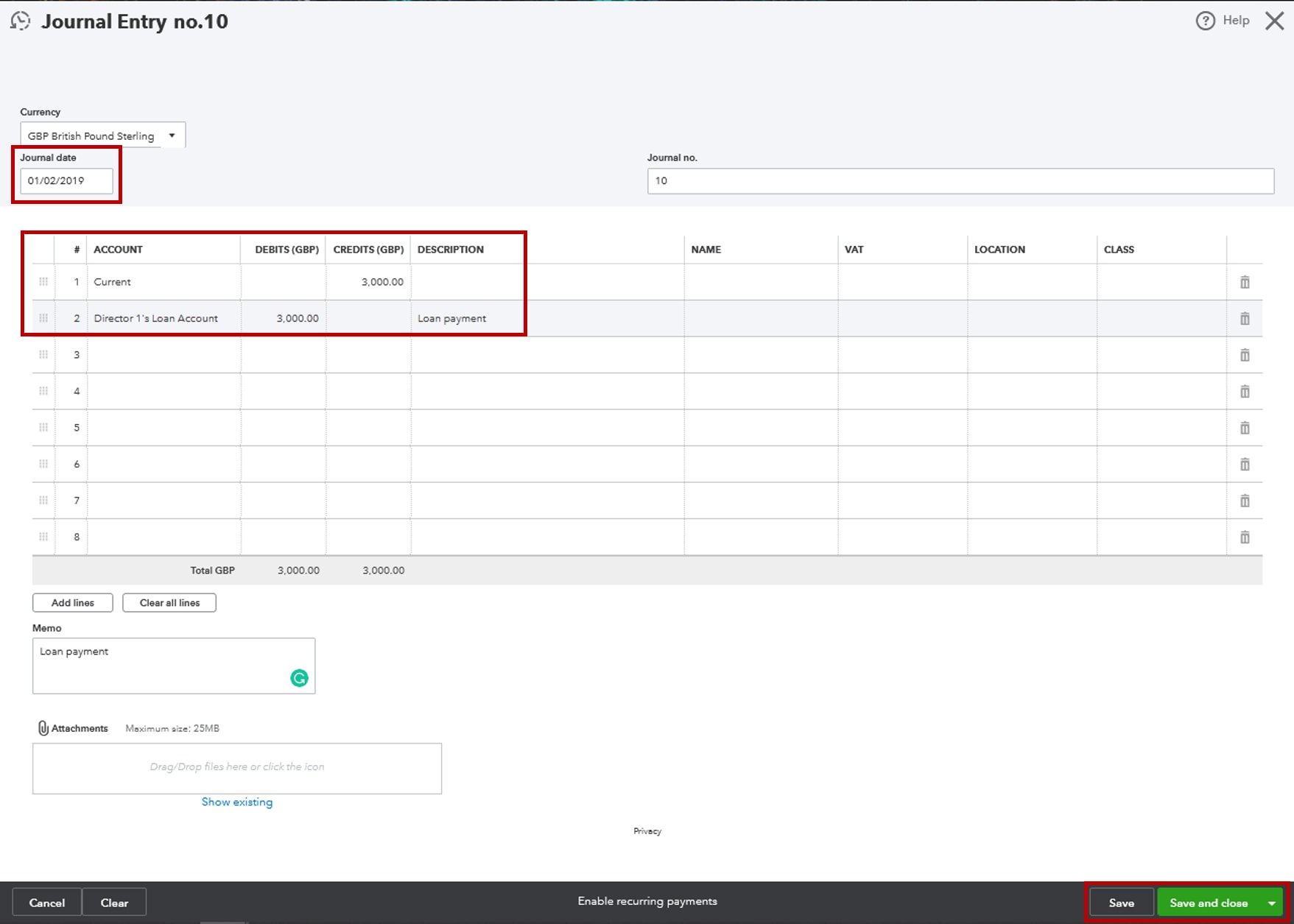

2. Record the payment for the loan

- Select + New.

- Select Journal entry.

- Under the Account column, add the company's bank account where the payment will come from and the director's loan account where the payment should go to.

- Under the Credits column and in the same row as the bank account, enter the payment amount.

- Under the Debits column and in the same row as the director's loan account, enter the same payment amount.

- Add a note in the Memo box. This will make it easier to track your loan payments later.

- Select Save and close.

3. Track loan payments

It's important to keep track of all the money coming in and going out of your company. One way to do this is by opening the director's loan account register.

This account will list the original amount of money owed by the business, as well as any payments made by the business.

- Go to Settings ⚙.

- Select Chart of accounts.

- Look for the director's loan account, and then select Account history.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.