Already using CIS in QuickBooks?

by Intuit•9• Updated 2 years ago

Already using CIS in QuickBooks?

With QuickBooks now supporting CIS there’s some changes to look out for, especially if you’ve already been using a workaround. Let us help you move from your solution to ours.

Contractors and subcontractors

Contractors and subcontractors can now be added to QuickBooks. We use the info you give us to calculate the CIS withheld.

Add a contractor

To add a contractor, follow the steps below.

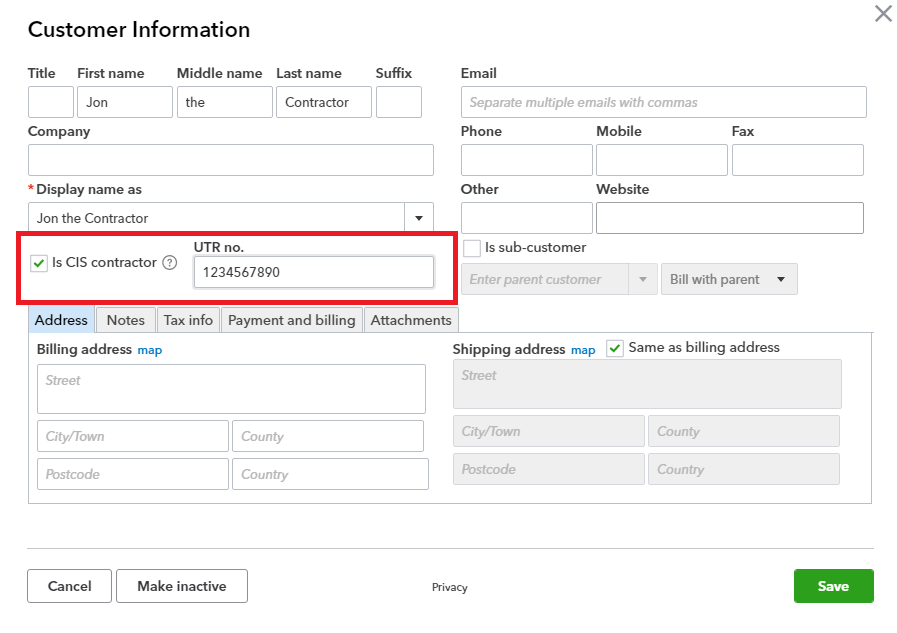

- Go to Sales, select Customers (Take me there) and then select New Customer.

- Enter your customer's details and tick the Is CIS Contractor checkbox and enter their UTR number.

If the customer has already been added, click on the customer record followed by the Edit button to amend the customer record.

Add a subcontractor

To add a subcontractor, follow the steps below:

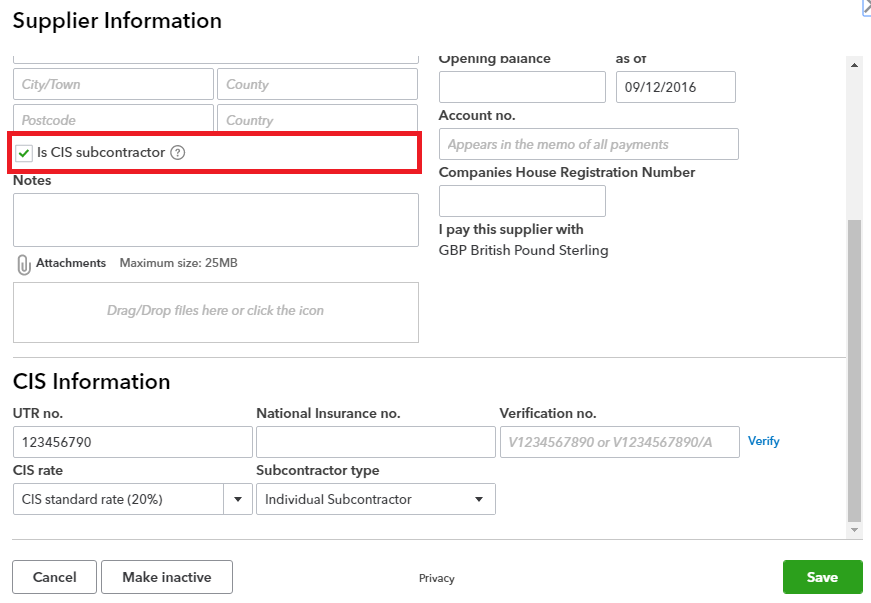

- Go to Expenses, select Suppliers (Take me there), then select New supplier.

- Enter your subcontractor's details and select the Is Subcontractor checkbox.

If you already have your subcontractor created, go to Edit supplier to amend their record.

Creating CIS transactions

When you turn on CIS, we’ll create the accounts you need to be able to track it. That means, when you create CIS transactions we’ll calculate the CIS withheld.

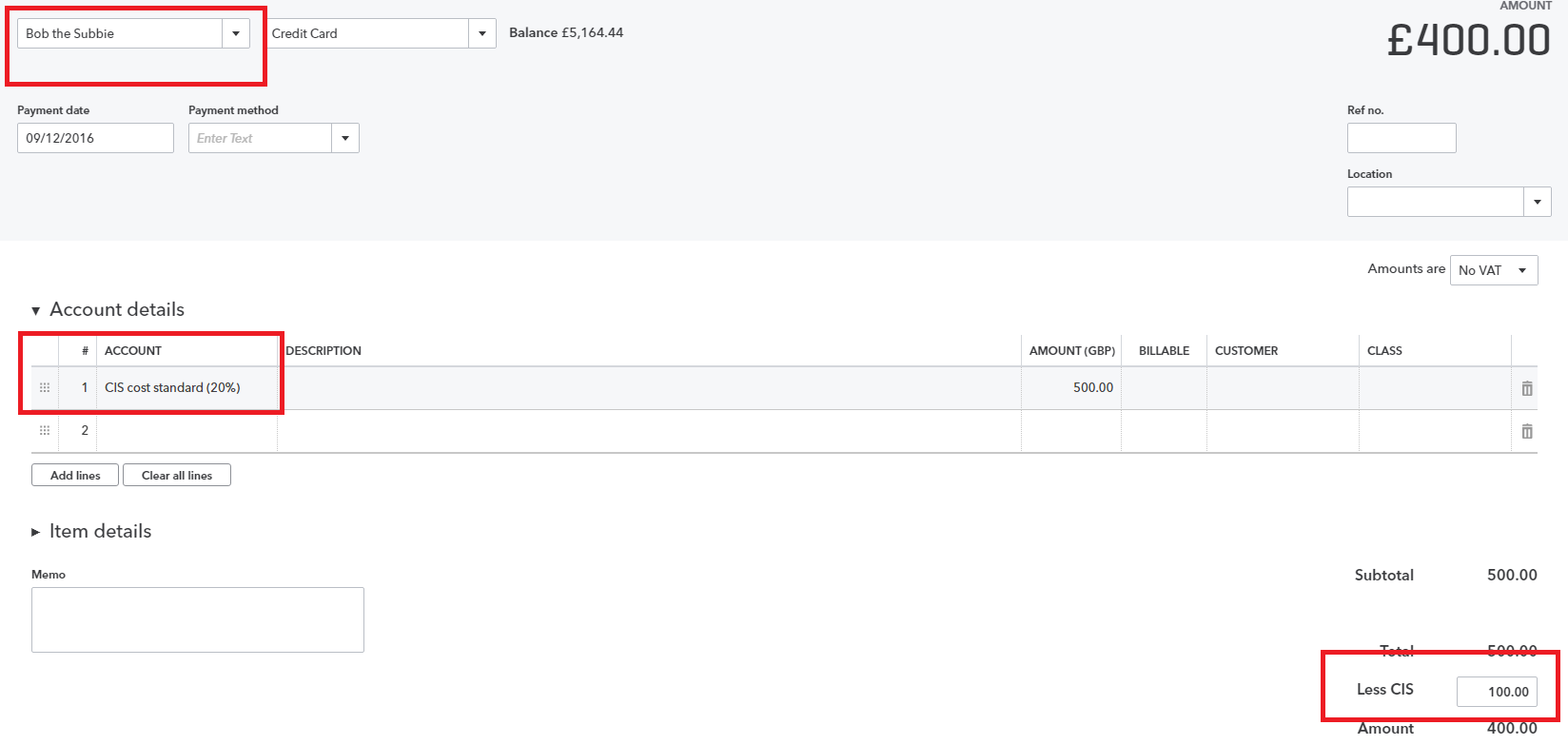

I’m a contractor, how do I create a CIS expense?

To create a CIS expense, follow the steps below:

- Select + New.

- Select Expense.

- Select a subcontractor from the supplier drop down. This tells QuickBooks that it’s a CIS transaction and will automatically select the correct labour account for you based on this subcontractors CIS rate.

Less CIS is the CIS withheld on this transaction. Use the CIS reports to track your CIS withheld. Contractors can also apply CIS to a Bill.

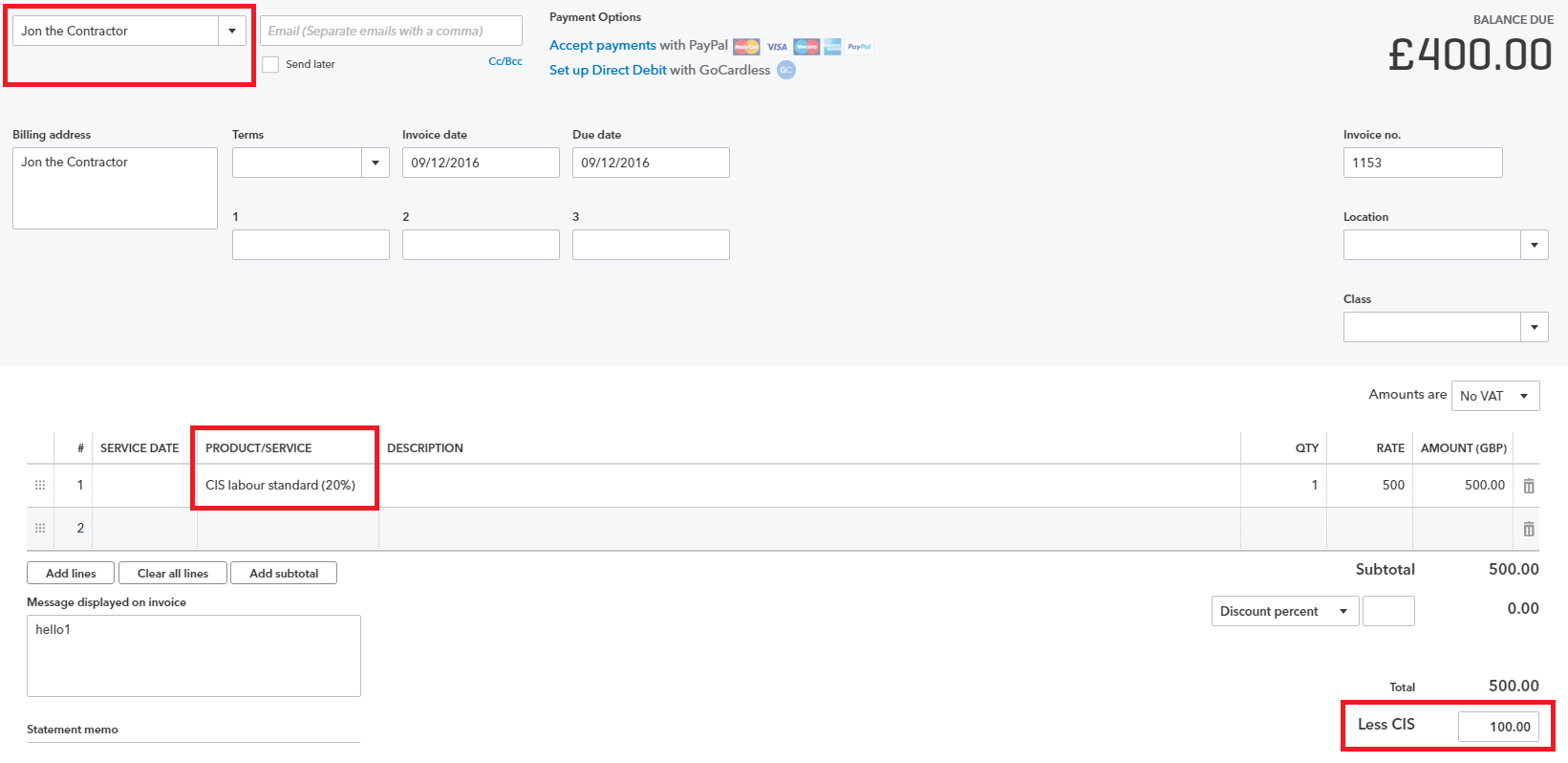

I’m a subcontractor, how do I create a CIS invoice?

To create a CIS invoice, follow the steps below:

- Select + New.

- Select Invoice.

- Select a subcontractor from the customer drop down. This tells QuickBooks that it’s a CIS transaction and will automatically select the correct CIS account for you based on your CIS rate.

Less CIS is the CIS you will suffer on this transaction. Use your CIS report to track the total CIS suffered. Subcontractors can also apply CIS to a sales receipt.

What happens if I already have CIS accounts?

What happens if I already have CIS accounts?

The new accounts we create have the ability to calculate CIS on your transactions. They also map to your CIS reports allowing you to effortlessly track the CIS withheld. If you already have CIS accounts but want us to start helping you’ll need to assign our accounts in your CIS transactions. It’s possible to rename your accounts or make them inactive.

Note: QuickBooks currently doesn't support itemising CIS accounts that are manually created (for example, new sub-accounts), as accounts manually created will not map in the CIS reports and returns.

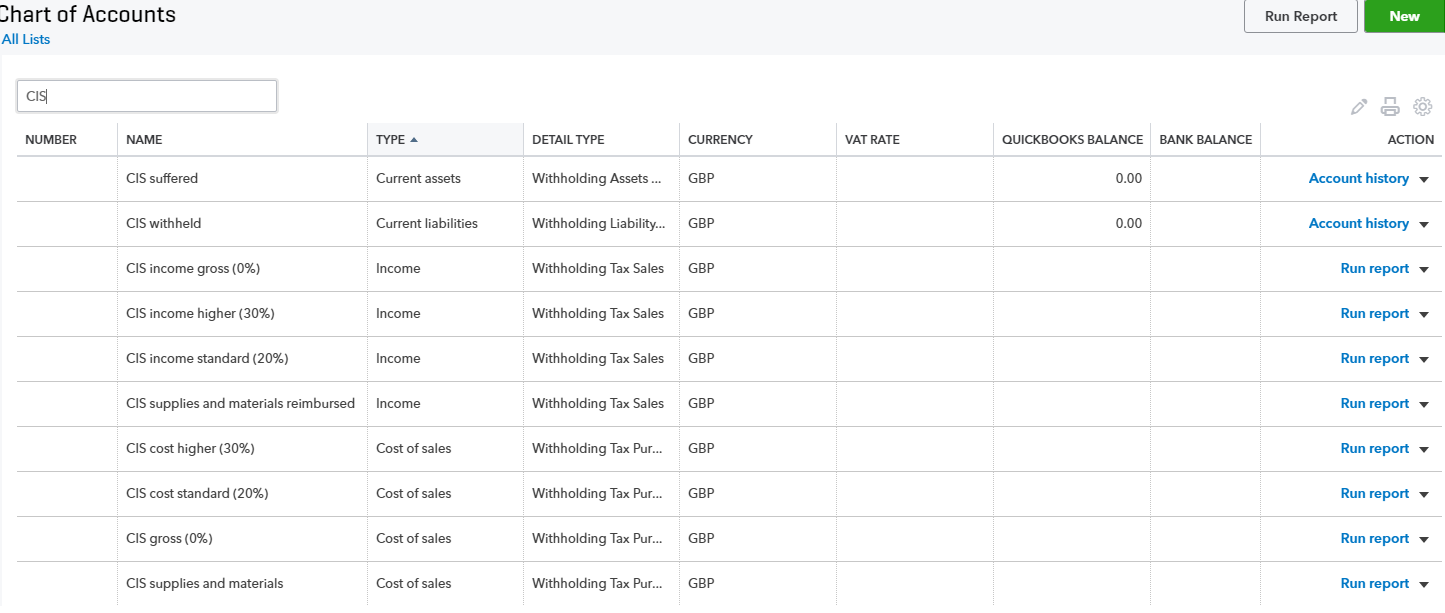

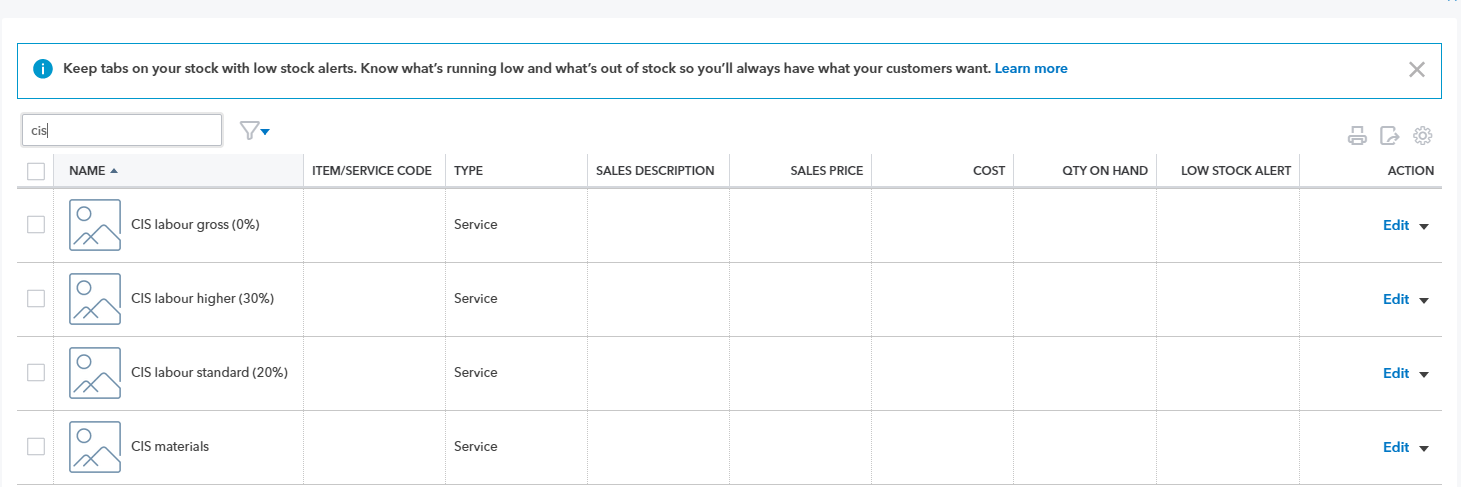

What accounts does QuickBooks create?

When you turn on CIS, QBO creates the relevant accounts in your chart of accounts. These can be found in the Chart of Accounts and the Products and Services list.

You must sign in to vote.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

Take control of your business finances with QuickBooks

![[object Object]](https://digitalasset.intuit.com/content/dam/intuit/sbsegcs/en_gb/quickbooks-online/images/sdr/refer-an-accountant-hero.jpg)

Not relevant to you? Sign in to get personalised recommendations.