Learn how to close your books in QuickBooks Desktop.

In QuickBooks Desktop, you don't have to worry about closing your books at the end of every financial year. QuickBooks creates automatic adjustments in preparation for the coming year.

Year-end adjustments QuickBooks makes automatically

QuickBooks performs certain year-end adjustments based on your financial year start month.

- QuickBooks adjusts your Income and Expense accounts at year-end to zero them out so you start your new financial year with zero net income.

- QuickBooks makes an adjusting entry to your net income. For example, if your profit for the year was £12,000, the equity section of your Balance Sheet shows a line for a net income of £12,000 on the last day of your financial year.

- On the first day of the new financial year, QuickBooks increases your Retained Earnings equity account by the previous year's net income (£12,000 in this example) and decreases your net income by the same amount. This way, you start each new financial year with a net income of zero.

Before you close your books, consider these important points:

| Advantages to closing your books |

|

| Advantages to not closing your books |

|

Closing entries

- Closing entries are entries made at the end of the financial year to transfer the balance from the Income and Expense accounts to Retained Earnings. The goal is to zero out your Income and Expense accounts, then add your financial year's net income to Retained Earnings.

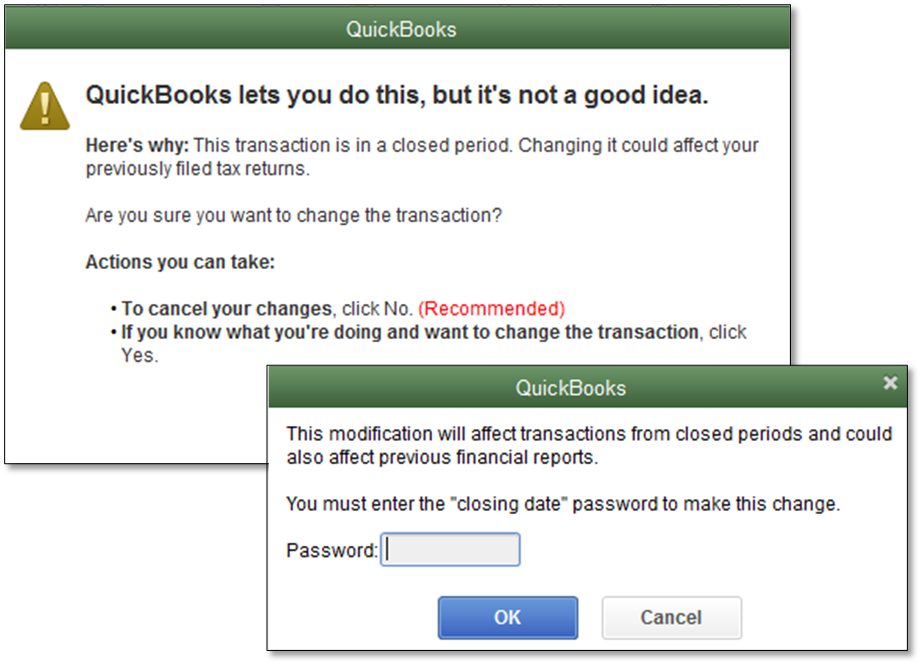

- Closing entries are made after you record all adjusting entries. Once the books are closed, you aren't supposed to enter any entry for that financial year. Some programs prohibit you from making any entry even if that entry corrects or makes your books more accurate. QuickBooks Desktop allows you to enter transactions that affect the balance of the closed financial year, but it will either tell you that it isn't recommended, or ask for the closing date password (if you set one up).

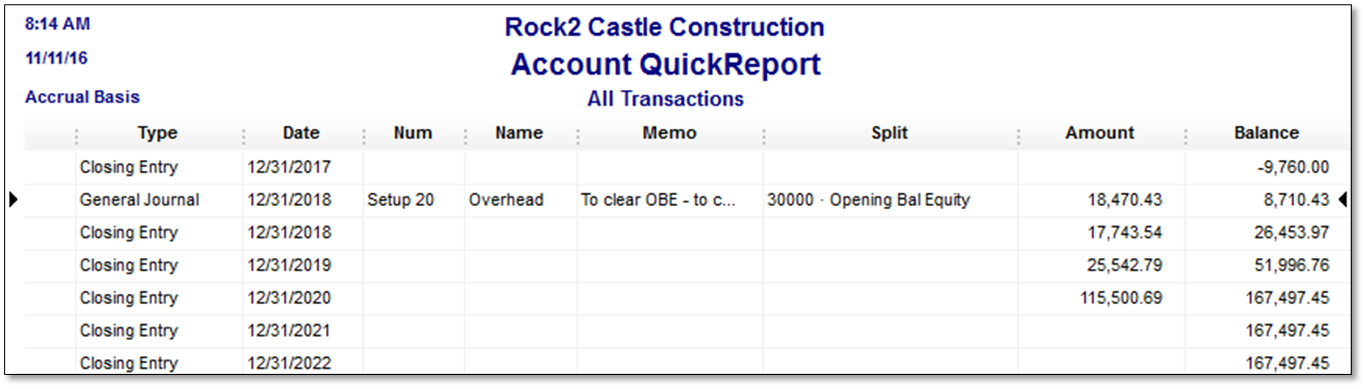

- QuickBooks Desktop doesn't have an actual transaction for closing entries it automatically creates. The program computes the adjustments when you run a report (for example QuickReport of Retained Earnings) but you can't "QuickZoom" on these transactions, unlike the manual adjustments you recorded.

Closing entries are entries made at the end of the financial year to transfer the balance from the Income and Expense accounts to Retained Earnings. The goal is to zero out your Income and Expense accounts, then add your financial year's net income to Retained Earnings.

Closing entries are made after you record all adjusting entries. Once the books are closed, you aren't supposed to enter any entry for that financial year. Some programs prohibit you from making any entry even if that entry corrects or makes your books more accurate. QuickBooks Desktop allows you to enter transactions that affect the balance of the closed financial year, but it will either tell you that it isn't recommended, or ask for the closing date password (if you set one up).

QuickBooks Desktop doesn't have an actual transaction for closing entries it automatically creates. The program computes the adjustments when you run a report (for example QuickReport of Retained Earnings) but you can't "QuickZoom" on these transactions, unlike the manual adjustments you recorded.