Here you'll find a list of help articles and step-by-step instructions for getting the most out of QuickBooks Online Advanced Payroll.

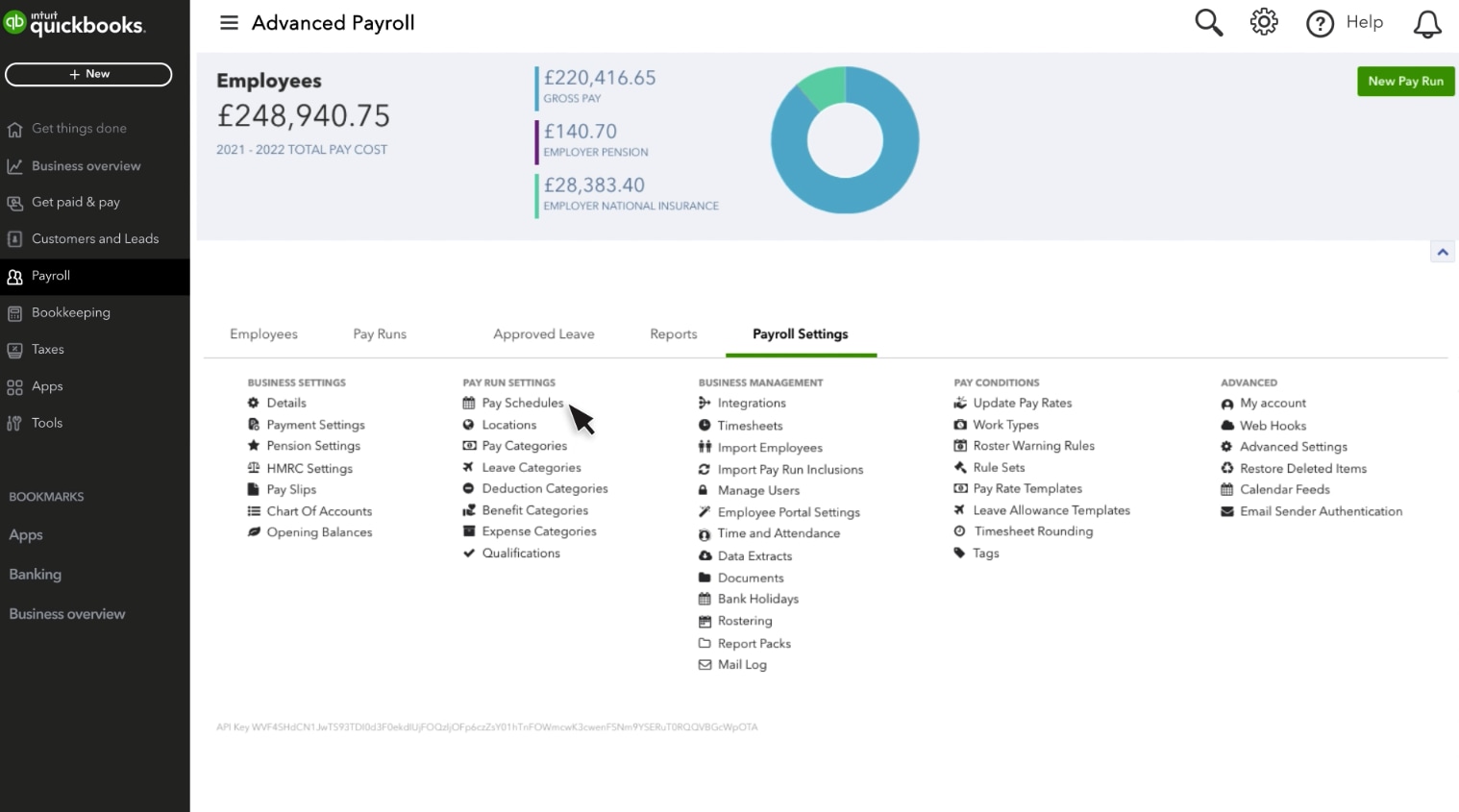

If your payroll dashboard looks like the one shown here, it means that you're using QuickBooks Advanced Payroll.

If you want to find articles on a specific topic, jump to the relevant section:

- Set up payroll

- Payroll year end and tax updates

- Move your data

- Payroll settings

- Employees

- Pay runs

- Payslips

- Expenses and timesheets

- Leave taken and deductions

- Statutory pay

- Reporting to HMRC

- Pensions

- Employee portal and WorkZone app

- Fix errors and issues

- Bureau Payroll

Set up payroll

Payroll year end and tax updates

Move your data

- Import Full Payment Summary (FPS), Excel and Sage50 files

- Import employees from Excel

- Import or export a pay run

- Import timesheets

Payroll settings

- Change your HMRC settings

- Set up payment file (BACS) settings

- Add, delete or export users

- Add pay categories and employer liability categories

- Map general ledger accounts

- Set up pay conditions

- Pay condition rule definitions

- Set up payrolling benefits

- Set up DKIM (DomainKeys Identified Mail) email sender authentication

Employees

- Add an employee

- Add a new pay rate

- Add or delete qualifications

- Add court orders

- Edit or change employee info

- Pay Apprenticeship Levy

- Use the employee self setup

- Set employee year-to-date opening balances

- Import employees

- Pay employees with day rates

- Terminate an employee

- Give employee P45 form

- Create a P60 form

- Update employee locations

- Assign locations

Pay runs

- Set up automated pay runs

- Set up pay schedules

- Set up pay run approvals

- Create a new pay run

- Process week 53

- Export a pay run

- Import a pay run

- Add pay earnings line to a pay run

- Add and remove employees from a pay run

- Adjust pay period dates within a pay run

- Apply a leave application to a pay run

- Split costs and hours across multiple locations

- Unlock a pay run and add a message

- Finalise a pay run

- Process ad hoc pay runs

- Decline a pay run

- Delete a pay run

- Pay run warnings

- View pay run payments

- Set up recurring pay run inclusions

- Add additional earnings within a pay run

- Back calculate National Insurance contributions

- Add or edit dimensions and dimension values

Payslips

- View payslips

- Customise payslips

- Add a note or message to payslips

- Send payslips to employees

- Hide units on payslips

- Set up email addresses to send payslips

Expenses and timesheets

- Set up and use timesheets

- Create timesheets on behalf of employees

- Enter timesheets

- Re-import timesheets into a pay run

- Create and manage expense categories

- Add employees expenses to a pay run

- Set budgets

- Import timesheets

Leave taken and deductions

- Set up leave categories and leave accrual

- Set up deductions

- Leave scenarios and examples

- Manage leave without pay

- Add accrued leave

- Add leave taken

- Make a leave adjustment

- Enter Keeping In Touch (KIT) days

Statutory pay

- Add Sick Pay (SSP)

- Add Maternity Pay (SMP)

- Add Paternity Pay (SSP)

- Add Parental Bereavement Leave (SPBL)

Reporting to HMRC

- Switch on RTI (Real Time Information) reporting

- P32 Report

- Report Apprenticeship Levy

- Submit P11D and P11D(b) forms

- IR35 off-payroll working rules

- Submit Employment Payment Summary (EPS)

- Submit Full Payment Summary (FPS)

- View audit report for pay run payments

Pensions

- Set up a pension scheme

- Set up salary sacrifice

- Re-enrol an employee into a pension scheme

- Postpone employee pension scheme

- Manual pension scheme setup

- PensionSync dashboard guide

- Opt employee out of a pension scheme

- PensionSync errors

Employee portal and WorkZone app

- Give access to the Employee Portal

- Get started with the WorkZone mobile app

- Swap employee shifts in the WorkZone mobile app

Fix errors and issues

Bureau Payroll

Need help using Bureau Payroll? Find step-by-step guides here.