Tax code notices in QuickBooks Online Standard Payroll

by Intuit•1• Updated 6 months ago

Learn how to turn on tax code notifications in Standard Payroll.

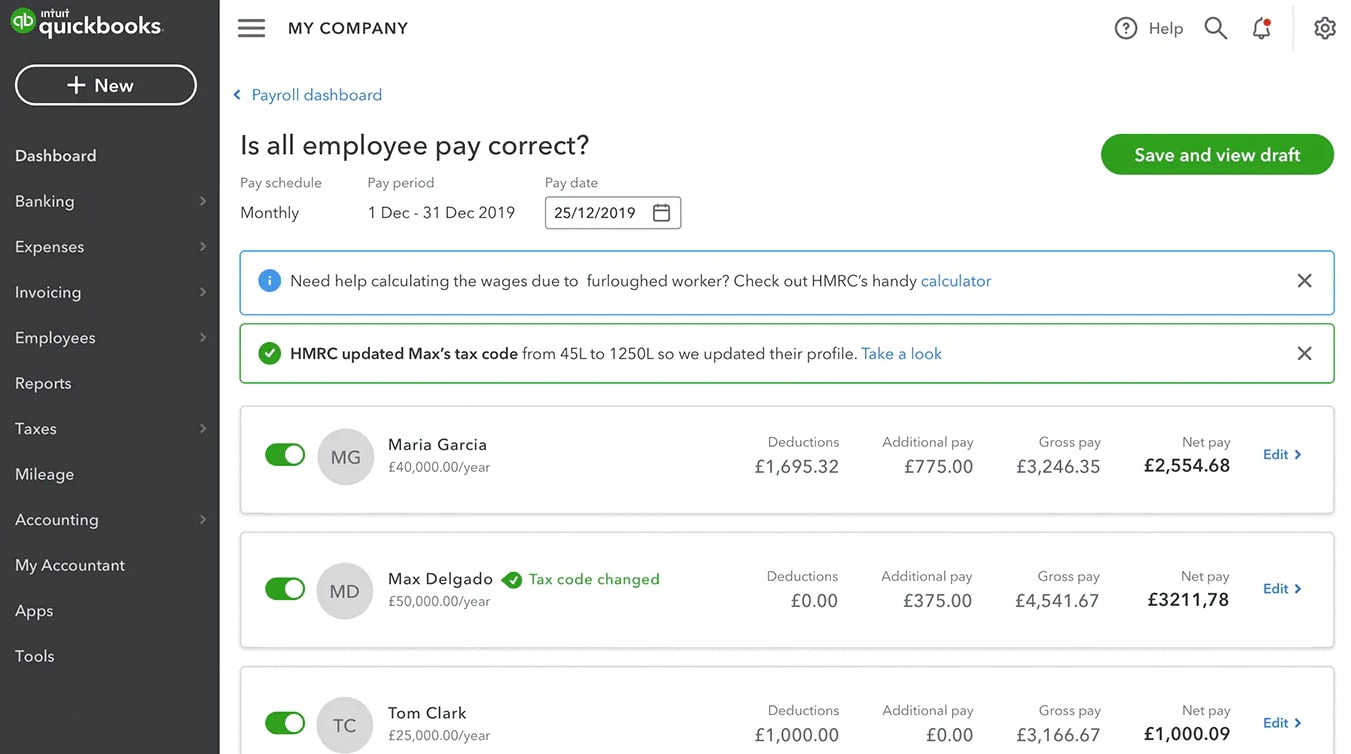

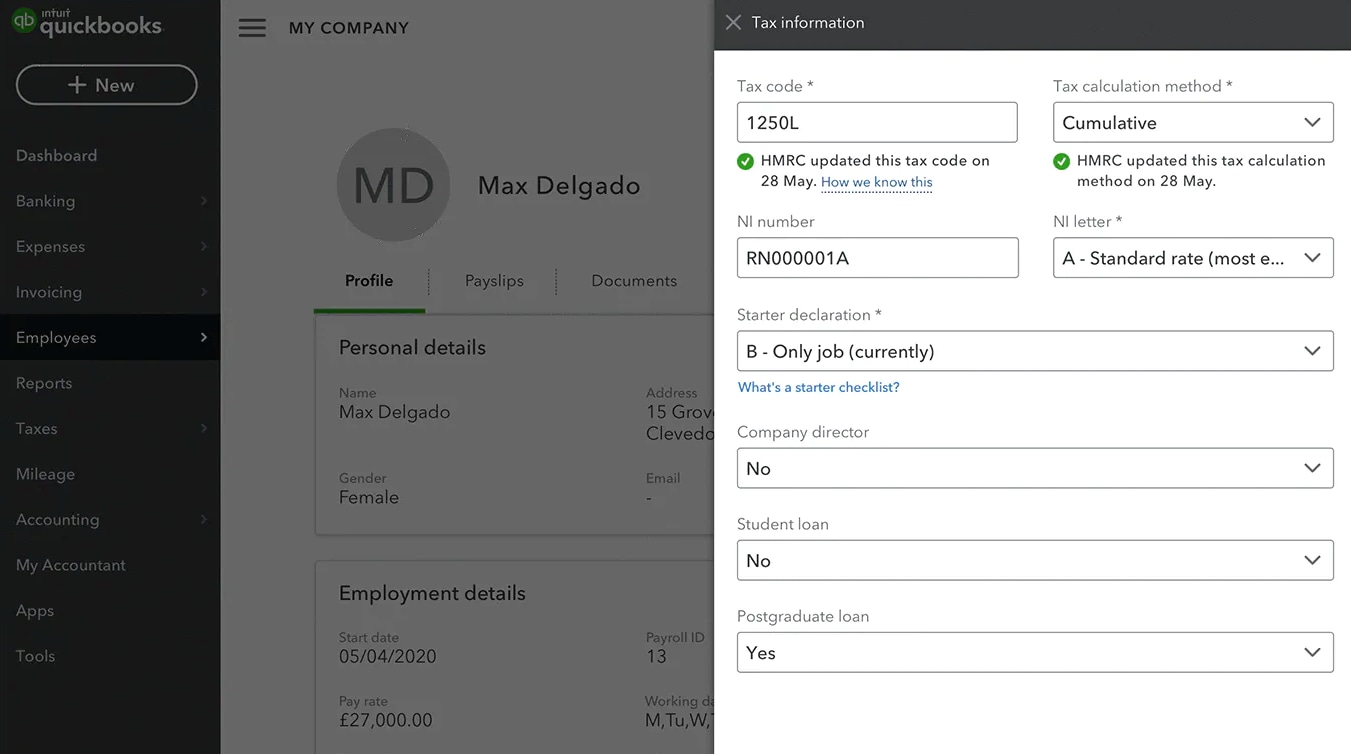

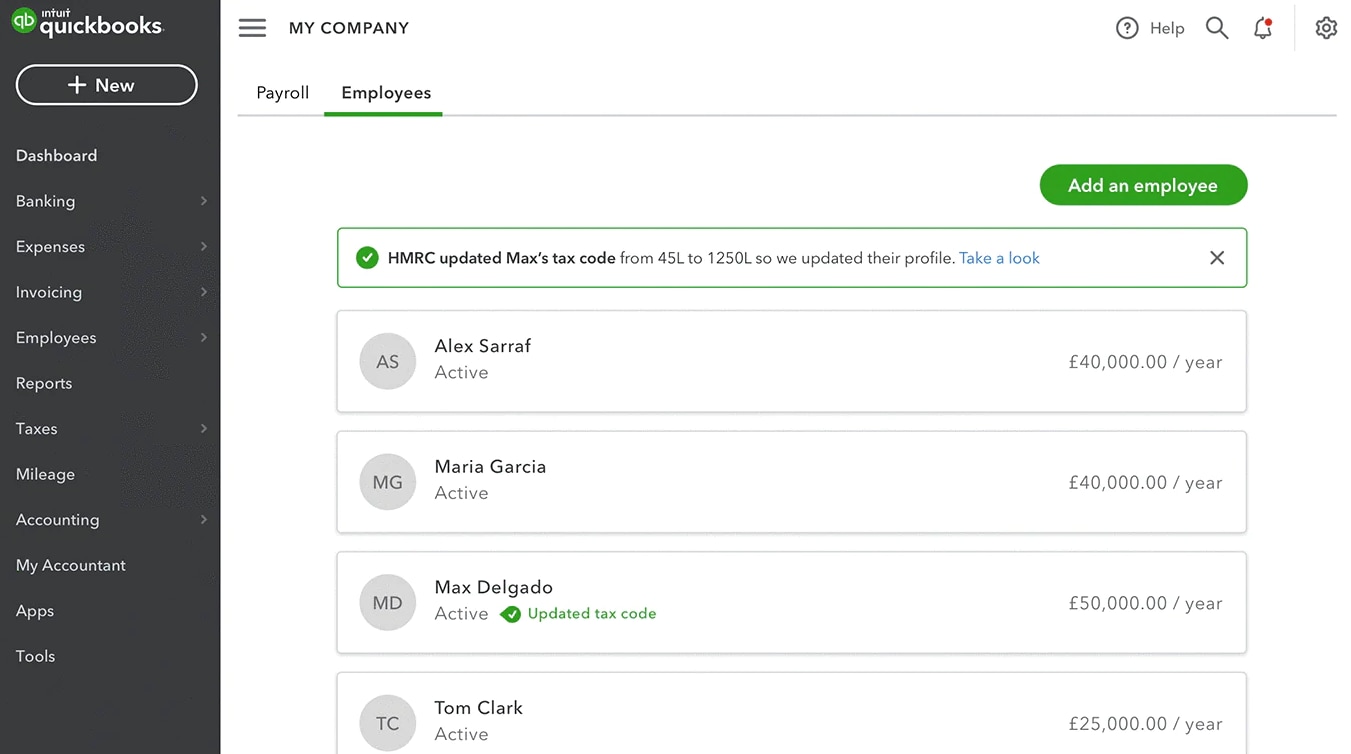

The tax code notification feature in Standard Payroll lets you know about changes and updates made to your employees' tax codes. We'll show you how to set this up in QuickBooks.

Note: To learn more about tax code notices in QuickBooks Online Core Payroll, see this article.

Step 1. Check your notification settings

For this feature to work, you need to log into your HMRC PAYE dashboard and make sure that all your notice options are set to Yes. To do so:

- Sign in to the HMRC PAYE dashboard and go to Messages.

- Select Notice Preferences and Notice Options.

- Set notices to Yes. Any new notices will automatically update in QuickBooks.

If the notice option is not set, you'll see a banner in QuickBooks advising you that the PAYE reference in incorrect.

Step 2. Enter your HMRC reference

To receive notifications in QuickBooks, you need to enter your HMRC reference. Here's how:

- Select the gear icon and select Account and settings.

- Select the Payroll tab.

- Select the pencil icon next to HMRC reference.

- Enter your HMRC reference and Accounts Office reference.

- Select Save and Done.

If you are an accountant using payroll on behalf of a client, enter the credentials that allow you to retrieve notifications.

Frequently asked questions

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.