- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Reports and Accounting

- :

- How do I allocate journal entry (payment for expense/bill) to journal entry (expense/bill)? Transactions imported from different software.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Level 1

posted

February 17, 2021

05:33 AM

last updated

February 16, 2021

9:33 PM

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I allocate journal entry (payment for expense/bill) to journal entry (expense/bill)? Transactions imported from different software.

Solved! Go to Solution.

Labels:

0 Cheers

Best answer February 17, 2021

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I allocate journal entry (payment for expense/bill) to journal entry (expense/bill)? Transactions imported from different software.

Help has arrived, @userequiptrainingser.

Thank you for providing screenshots and information about your issue. This helps me to come up with a solution to help you. Let me first share some insights about how journal transactions work in QuickBooks. If the bill and payment were created as a JE, it will be displayed as overdue if you did not link the same JE and remained open to the A/P account.

To resolve this, let’s create a dummy bill to link those JE's. Here's how:

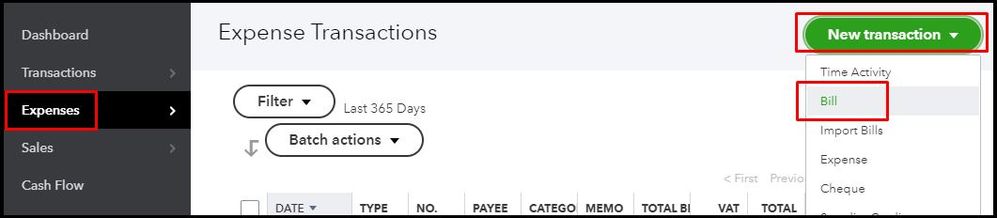

- Go to the Expense menu.

- Click New Transaction.

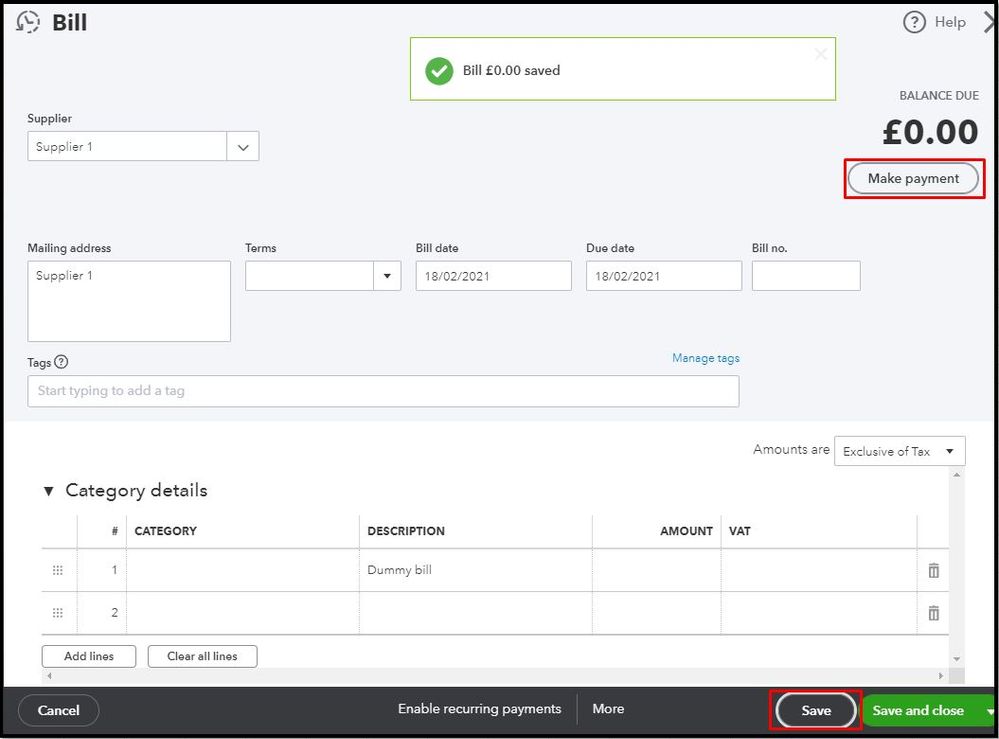

- Select Bill to create a dummy bill (you only need to enter the description for this bill).

- Tap Save (not Save and close or Save and new).

- Hit the Make Payment option.

- You'll then see the journal entries (both for payment and expense).

- Tick the box for both so they will be linked and closed as paid.

For more info about the process, please see this article: Enter bills and record bill payments in QuickBooks Online.

Also, in QuickBooks, accessing a supplier report to view all money you paid is a breeze. For the detailed guide, visit this page: Run a report with supplier totals.

Let me know how this goes and leave a reply below if you need further assistance in managing your journal transactions in QuickBooks. I'm just a post away if you need help. Have a good one.

0 Cheers

5 REPLIES 5

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I allocate journal entry (payment for expense/bill) to journal entry (expense/bill)? Transactions imported from different software.

Thanks for posting your concern in the Community space, userequiptrainingser.

The option to allocate the journal entry to another one is unavailable. You may delete the other journal entry to combine the payment and the expense/bill. However, we recommend consulting first your accountant about this one. They'll also guide you on what posting accounts you'll need to use when creating the transaction. You can also find an accountant if you need one.

Here's how to create a journal entry:

- Tick the+ New Plus icon.

- Select Journal entry.

- On the first line, choose an account from the Account field. Depending on if you need to debit or credit the account, enter the amount in the correct column.

- On the next line, select the other account you're moving money to or from. Depending on if you entered a debit or credit on the first line, enter the same amount in the opposite column.

- Check the amounts - you should have the same amount in the Credit column on one line and the Debit column on the other. This means the accounts are in balance.

- Enter information in the memo section so you know why you made the journal entry.

- Press Save and close.

To learn more about importing a journal entry, see the Import journal entries in QuickBooks Online article. Feel free to visit our Expenses and suppliers page for more insights about entering expenses, paying bills, and managing stock.

I'd like to know how you get on after trying the steps and consulting your accountant, as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. Take care always.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I allocate journal entry (payment for expense/bill) to journal entry (expense/bill)? Transactions imported from different software.

Just want to make sure that this is correct way to do it for me.

I have attached screenshot of the journals that transferred from different software.

There were two invoices from Amazon which were paid and payment was allocated to them in the old software but in Quickbooks it shows as overdue (I would like those journals for payment to be allocated to those journals for expenses). Otherwise if I have another payment made to Amazon I still have an option to choose those journal and allocate the payment to it.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I allocate journal entry (payment for expense/bill) to journal entry (expense/bill)? Transactions imported from different software.

Hello Userequiptrainingser, thanks for getting back to us on this thread, the attachment is not letting us access it(it looks like it has not fully uploaded as it has a virus scan message) could you re-add the attachment and we'll certainly have a look at the journals

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I allocate journal entry (payment for expense/bill) to journal entry (expense/bill)? Transactions imported from different software.

I have attached it again. For some reason attachments do not open unless they are downloaded.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I allocate journal entry (payment for expense/bill) to journal entry (expense/bill)? Transactions imported from different software.

Help has arrived, @userequiptrainingser.

Thank you for providing screenshots and information about your issue. This helps me to come up with a solution to help you. Let me first share some insights about how journal transactions work in QuickBooks. If the bill and payment were created as a JE, it will be displayed as overdue if you did not link the same JE and remained open to the A/P account.

To resolve this, let’s create a dummy bill to link those JE's. Here's how:

- Go to the Expense menu.

- Click New Transaction.

- Select Bill to create a dummy bill (you only need to enter the description for this bill).

- Tap Save (not Save and close or Save and new).

- Hit the Make Payment option.

- You'll then see the journal entries (both for payment and expense).

- Tick the box for both so they will be linked and closed as paid.

For more info about the process, please see this article: Enter bills and record bill payments in QuickBooks Online.

Also, in QuickBooks, accessing a supplier report to view all money you paid is a breeze. For the detailed guide, visit this page: Run a report with supplier totals.

Let me know how this goes and leave a reply below if you need further assistance in managing your journal transactions in QuickBooks. I'm just a post away if you need help. Have a good one.

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...