Add or remove a company director in QuickBooks Online Standard Payroll

by Intuit•2• Updated 6 months ago

Note: If you're managing directors in QuickBooks Online Core Payroll, see this article.

Learn how to add a company director in QuickBooks Online Standard Payroll.

Company directors are considered employees, and their earnings are subject to National Insurance Contributions (NIC). They pay NIC on their income from salary and bonuses over a certain amount. This amount is based on their annual earnings, not their monthly or weekly pay.

For more information, read National Insurance for company directors.

Add a company director

First, add the employee in QuickBooks or simply select an existing employee. Then follow these steps:

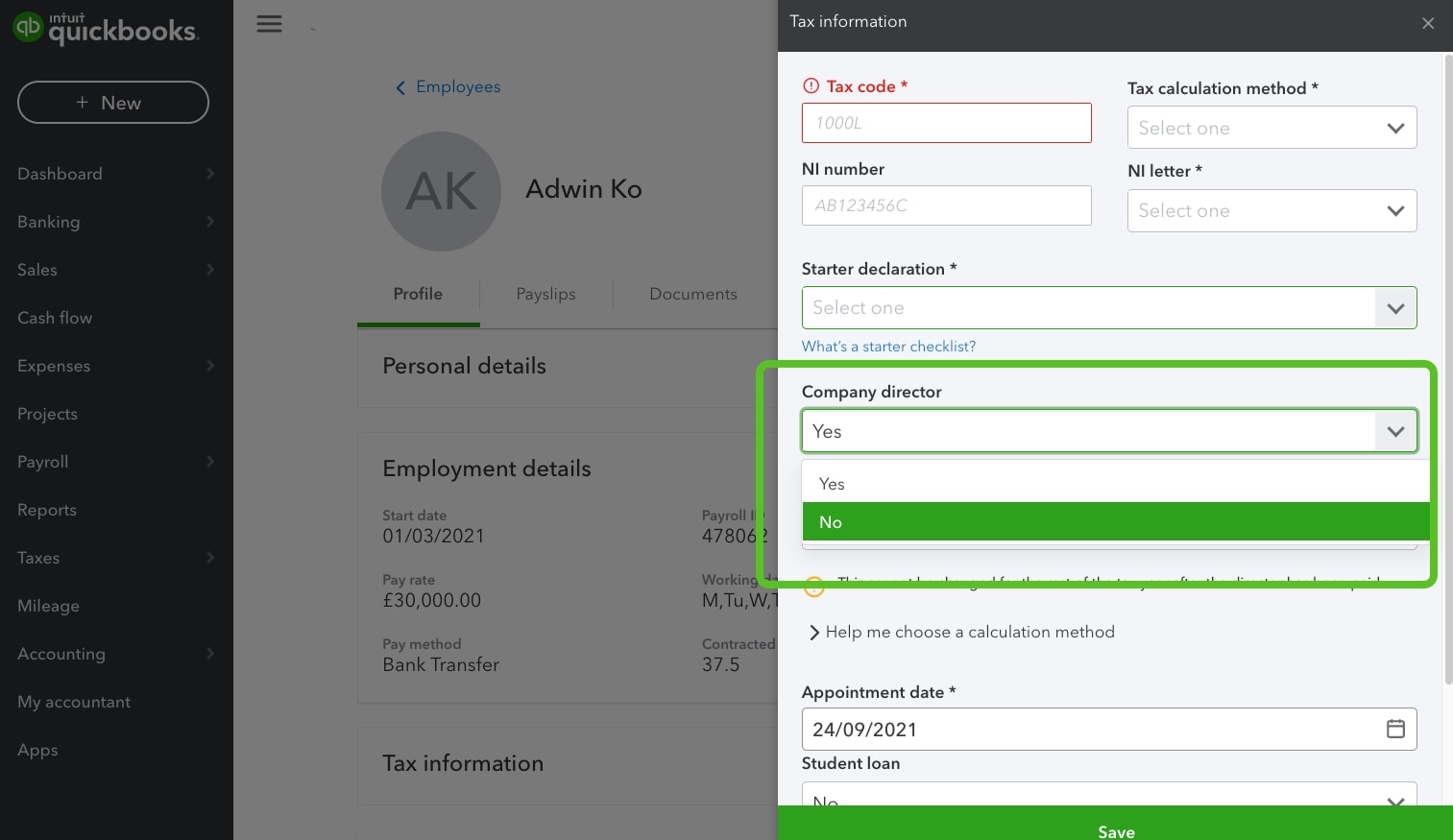

Click to enlarge image

- In the employee's Tax Information section, choose Yes for Company Director.

- Select the calculation method for the directors National Insurance (NI).

- Annual - for employees who are paid irregularly, like those who are primarily paid in bonuses. Note: This cannot be changed or the rest of the tax year after the director has been paid.

- Alternative - for employees who are paid regularly and consistently with a salary.

- For Appointment date, select the effective date this person was appointed as the company director.

- Save your changes.

Remove a company director

If a director is leaving the company, follow the same steps as you would for a regular employee leaver.

Make sure you prepare a P45 and give a copy to the employee. After you’ve paid the employee for the last time, tell HMRC by deleting the Director’s NIC calculation method entry in the FPS. Deduct any NI the director owes from their last payment.

If the director is staying on as a regular employee:

Click to enlarge image

- Go to the Employees or Payroll menu.

- Select the employee.

- In the Tax Information section, choose No for Company Director.

The employee will continue to pay NI as a director until the end of the current tax year (6 April).

See also

You must sign in to vote.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

Take control of your business finances with QuickBooks

![[object Object]](https://digitalasset.intuit.com/content/dam/intuit/sbsegcs/en_gb/quickbooks-online/images/sdr/refer-an-accountant-hero.jpg)

Not relevant to you? Sign in to get personalised recommendations.