The Community has you covered, @Rocky2079.

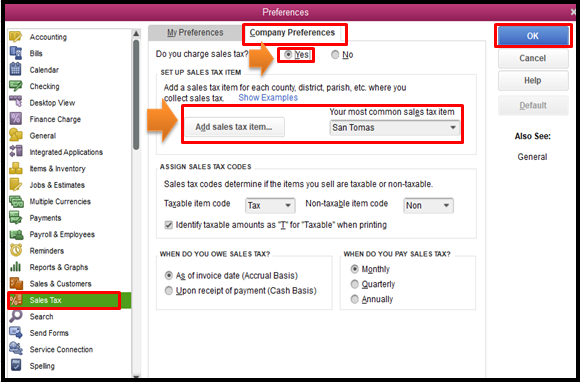

I've got some info on how to make your sales receipts inclusive of tax. First, let's ensure to turn on the sales tax feature on the Preferences page. Let me show you how:

- Go to the Edit menu, and then choose Preferences.

- Select Sales Tax, and then go to the Company Preferences tab.

- Click Yes to turn on sales tax.

- Choose Add sales tax item to set up the sales tax items.

- Click OK.

For more info, please check out this article: Set up sales tax in QuickBooks Desktop.

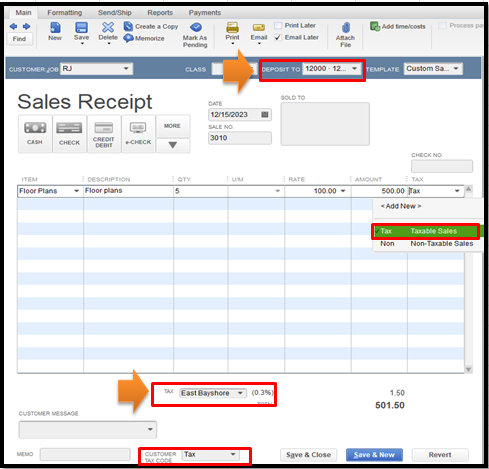

Once done, create your sales receipts as you normally would. This time, select a tax amount or percentage from the Tax drop-down.

Then, choose Taxable Sales both in the Tax column and Customer Tax Code drop-down. After that, choose the Undeposited Funds (UF) account from the Deposit to drop-down list. Please note that both the sales amount and the tax value will be posted to the UF account.

To post your sales tax amount to an expense or liability account, you can create a bank deposit instead. To do that, please see Deposit payments into an account other than a bank account under Step 2 in this resource: Record and make bank deposits in QuickBooks Desktop.

When you're ready, you can begin paying your sales taxes to stay compliant and keep your records accurate.

You can count on me if you have more questions about managing your sales taxes in QuickBooks. Have a nice day.