- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Transactions

- :

- Im reconciling my Q/Bs. I overpaid an Invoice by 2p. My Q/Bs amount is correct. Ive tried to put a credit in but it didnt work.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Im reconciling my Q/Bs. I overpaid an Invoice by 2p. My Q/Bs amount is correct. Ive tried to put a credit in but it didnt work.

Solved! Go to Solution.

Labels:

0 Cheers

Best answer August 22, 2019

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Im reconciling my Q/Bs. I overpaid an Invoice by 2p. My Q/Bs amount is correct. Ive tried to put a credit in but it didnt work.

The bank statement shows 2p over, my Q/B amount is correct. This was from last year so I would have to check if it was credited? I'm not too worried about the credit, I just need to get my reconciliation done asap.

0 Cheers

7 REPLIES 7

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Im reconciling my Q/Bs. I overpaid an Invoice by 2p. My Q/Bs amount is correct. Ive tried to put a credit in but it didnt work.

Hello Jenner-Constructi

You can adjust the amount received to be the correct amount including the 2p overpaid.It will then create an unapplied payment for the 2p.Which you can then use to credit a future bill or if you have been refunded mark the refund against.

If you put the credit note in for the 2p for example do you have 2p on your bank statement paid out?If not it is best to put the amount paid on the bill as the amount paid in full out of bank so that should then reconcile.

Has the supplier refunded you back the 2p or are you using that as a credit on a future invoice?

Emma

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Im reconciling my Q/Bs. I overpaid an Invoice by 2p. My Q/Bs amount is correct. Ive tried to put a credit in but it didnt work.

The bank statement shows 2p over, my Q/B amount is correct. This was from last year so I would have to check if it was credited? I'm not too worried about the credit, I just need to get my reconciliation done asap.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Im reconciling my Q/Bs. I overpaid an Invoice by 2p. My Q/Bs amount is correct. Ive tried to put a credit in but it didnt work.

Hi Jenner-Constructi

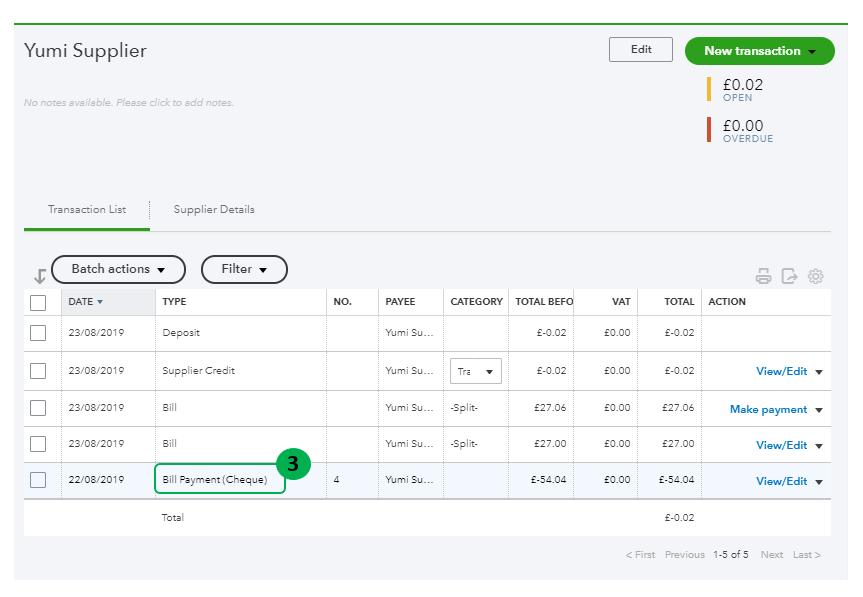

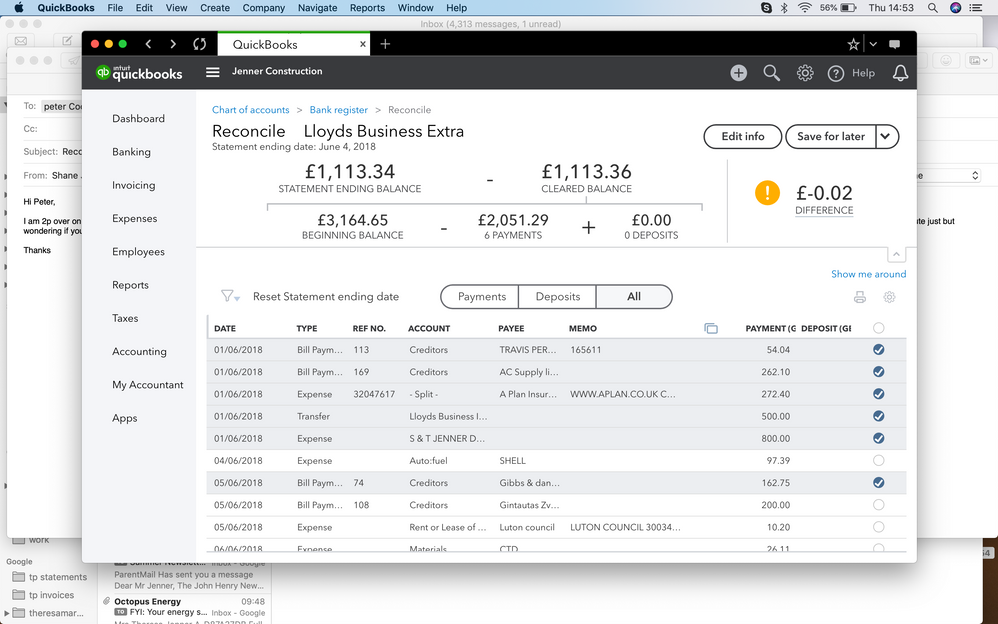

If you do a credit note it will not show on the reconcile page.From what you have said I take it your reconcile is out by 2p? A credit note will not show on the reconcile screen as the bank account is not impacted by the transaction only the creditor and expense account..The QB bill amount paid would not be correct is in the amount you actually paid from your bank if you paid 2 p over the amount of the bill?Could you provide a screenshot showing the bill on the supplier section and your reconcile screen.

Thanks

Emma

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

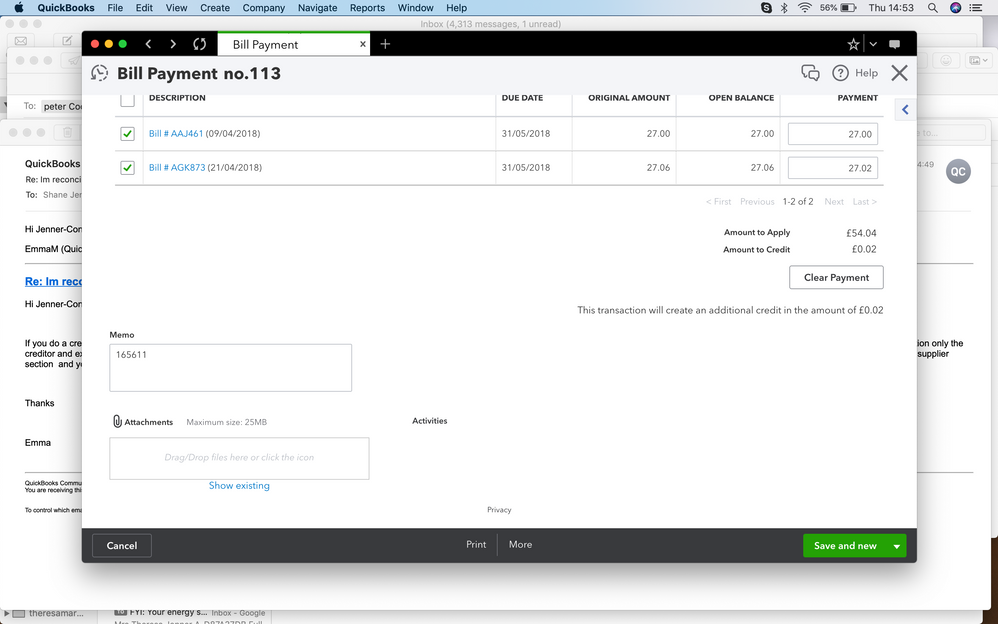

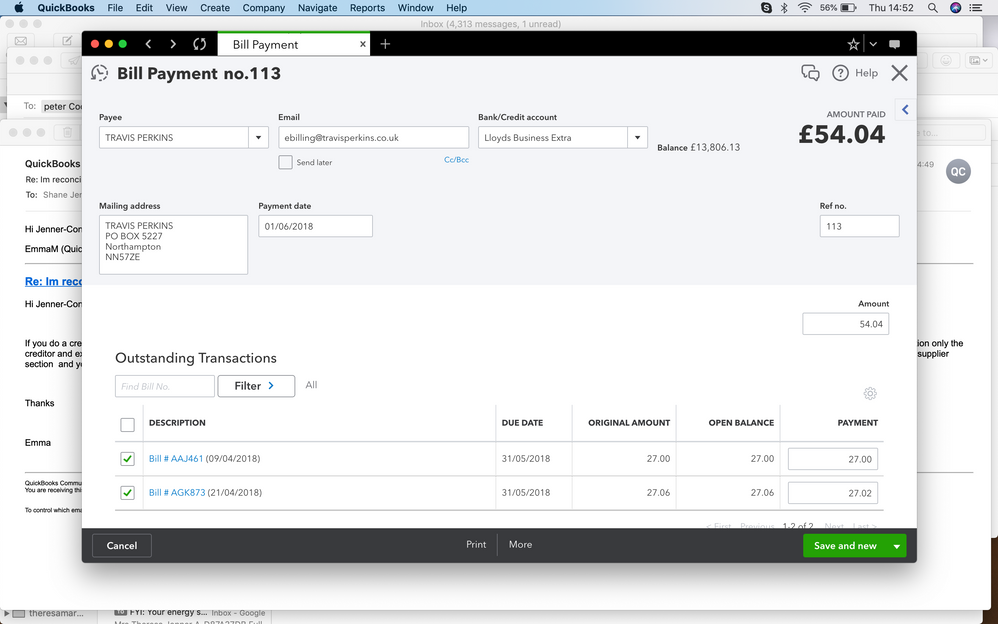

Im reconciling my Q/Bs. I overpaid an Invoice by 2p. My Q/Bs amount is correct. Ive tried to put a credit in but it didnt work.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Im reconciling my Q/Bs. I overpaid an Invoice by 2p. My Q/Bs amount is correct. Ive tried to put a credit in but it didnt work.

Hi there, Jenner-Constructi.

Thanks for the screenshot. This will help me provide the right solution to your concern.

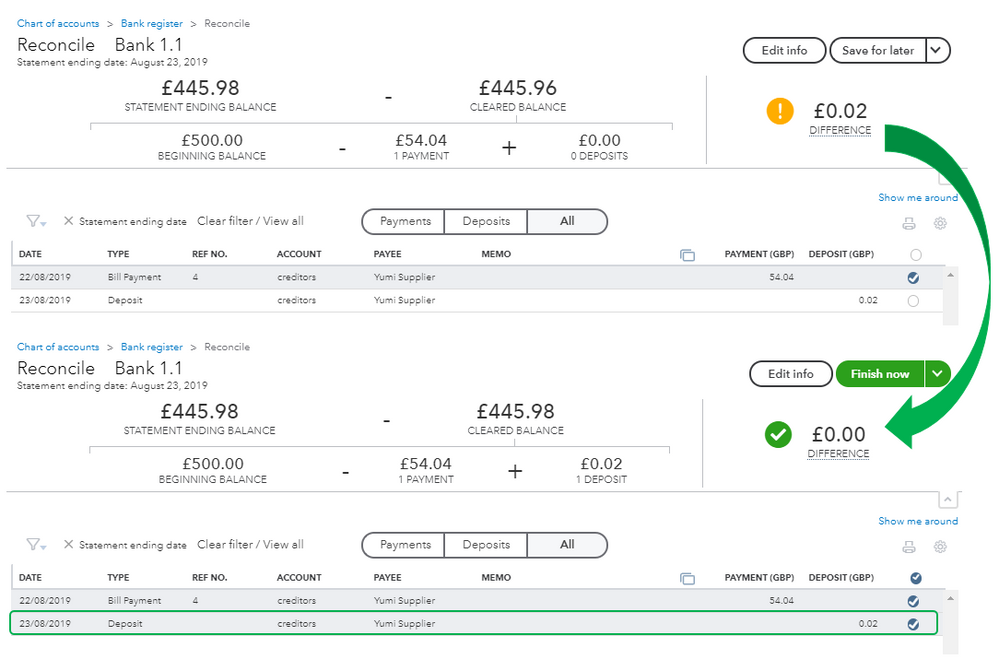

To correct this issue, let's create a bank deposit first. Then, link the bill payment cheque to the deposit and credit. This way, you'll be able to reconcile your account without a difference.

You can follow these steps to create a deposit:

- Go to the Plus (+) icon and choose Bank Deposit under Other.

- Choose the bank account you want to reconcile.

- Scroll down to the Add funds to this deposit section and select the supplier's name in the Received From column.

- Select Creditors in the Account column and enter the amount (£0.02). Then, click on Save and close once you're done.

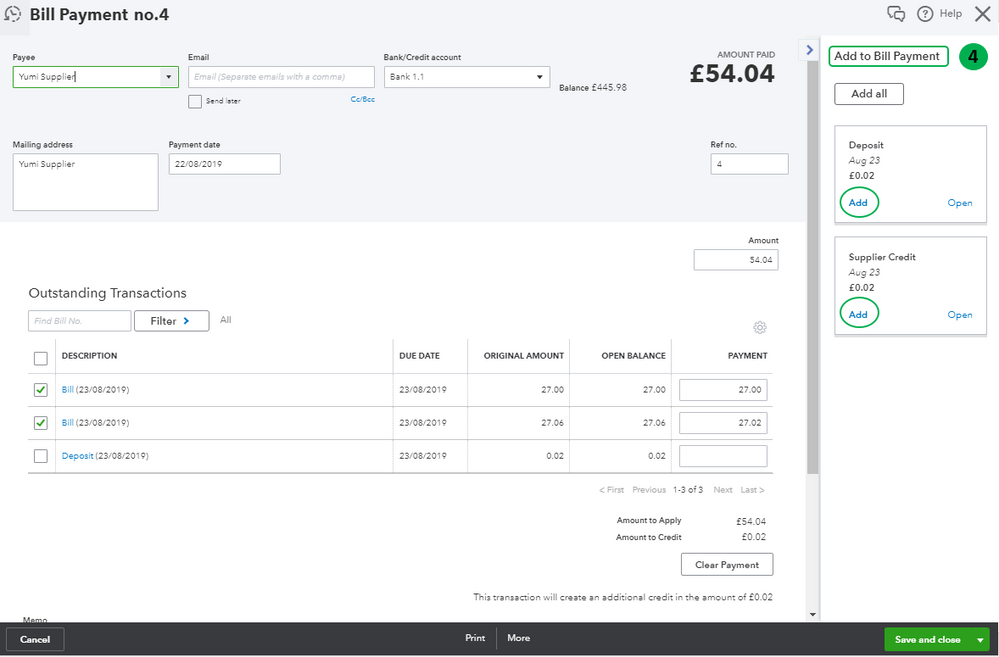

To link the deposit and credit to the bill payment cheque:

- Go to Expenses and choose the Suppliers tab.

- Locate and click on the supplier's name.

- Look for the bill payment cheque and click on it to open.

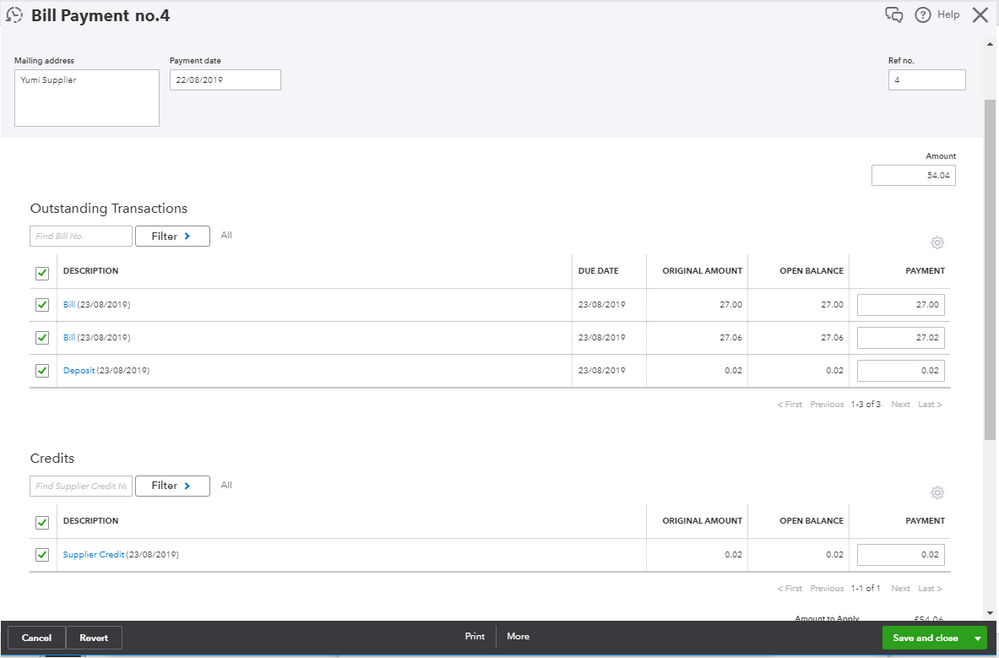

- In the Add to Bill Payment section, click on the Add link on both deposit and supplier credit.

- Once done, click on Save and close. Then, select Yes to confirm.

Now, when you reconcile your account, make sure to select the deposit transaction.

Let me share this article that will help you in the future: Handle supplier credits and refunds.

Please leave a comment below if you have any follow-ups. I'm always here to lend a hand and help you further. Have a good one.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Im reconciling my Q/Bs. I overpaid an Invoice by 2p. My Q/Bs amount is correct. Ive tried to put a credit in but it didnt work.

good morning

thanks for your help. I have followed your instructions and when I get to Add to Bill payment section only the Add link shows on the right hand column. When I clicked Add - a message said that this has already been assigned. (I did try and credit it yesterday so this must be the problem with it now). I'm still 2p out and cannot reconcile.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Im reconciling my Q/Bs. I overpaid an Invoice by 2p. My Q/Bs amount is correct. Ive tried to put a credit in but it didnt work.

Hello Jenner- Constructi

Can you click into the credit note and then in the top right where it says status paid,click on the 1 payment in blue and then the date, it should then take you to the receive payment where the credit note has been allocated.

If this is allocated elsewhere (it may have automatically apply credit notes turned on in the settings) if you hit more and as long as this is not an already reconciled transaction hit delete.

If there is no open bill to allocate the deposit and credit note against, you can create a dummy bill for a penny then save and use the make payment>tick the deposit>tick the credit note>untick the penny dummy bill>save and close>delete the dummy bill

Any queries at all let us know

Emma

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...