- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Transactions

- :

- Matching credit card payment and credits to a single invoice

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Matching credit card payment and credits to a single invoice

Hi

I hired a van for just over a week

I paid a deposit of £350 via credit card on the 20-01-20

made anther payment of £23.54 via the credit card on the 27-01-20

They processed a refund of 176.45 via the credit card on the 27-01-20

They sent me an invoice on the 29-01-20 for £197.09

How do i match the two payments and 1 refund to the invoice?

Kind Regards

Solved! Go to Solution.

Labels:

0 Cheers

Best answer April 07, 2020

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Matching credit card payment and credits to a single invoice

Thanks for the details, jgelectrical.

Essentially you would need to create the expense or bill for the full amount paid out and then record the credit from the supplier in a supplier credit (to adjust the expense account used originally )as mentioned above and a second transaction in +new bank deposit >selecting in add funds to this deposit the supplier and then in the next box on that line the creditors account, the amount that was refunded and save and close(to record the money received back to the bank and adjust the creditor).

Then you would need to go to pay bills select the supplier and tick the supplier credit and bank deposit so they offset each other and save and close.

That will then give you a match for the refund and record the bank correctly for what was paid out and paid back. The 2 payments out will not match unless you were to do 2 separate expenses for them. But you can exclude any that do not match as long as they are recorded manually.

We do see this quite complex, you're welcome to give our support team a call to go through this on a screen share on [Removed] or come back here with any questions we'd be happy to help

0 Cheers

4 REPLIES 4

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Matching credit card payment and credits to a single invoice

Greetings, @jgelectrical.

The option to match an expense to an invoice is not possible in QuickBooks Online (QBO). You can only link payment from your customer to an open invoice. To resolve this, you'll want to record the refund as a Supplier credit to zero out the invoice sent to you. Let me guide you how.

In your Quickbooks Online (QBO) account:

- Go to the + New button.

- Select Supplier credit.

- Enter the name of the van owner.

- In the Category column, select the account you used for the expense in renting the van.

- Enter the refunded 176.45 amount in the Amount column.

- Click Save and close.

Then, let's create a bill for the full amount paid originally 373.54:

- Go to the + New button.

- Click Bill.

- Enter the name of the van owner.

- In the Category column, select the account you used for the expense in renting the van.

- Enter the 373.54 in the Amount column.

- Click Save.

- Once done, click the Make payment link.

- Select the Bill and the Supplier Credit should show, select that amount. The remainder paid will be the amount they billed you for after the credit

- Then click Save and close or Save and new.

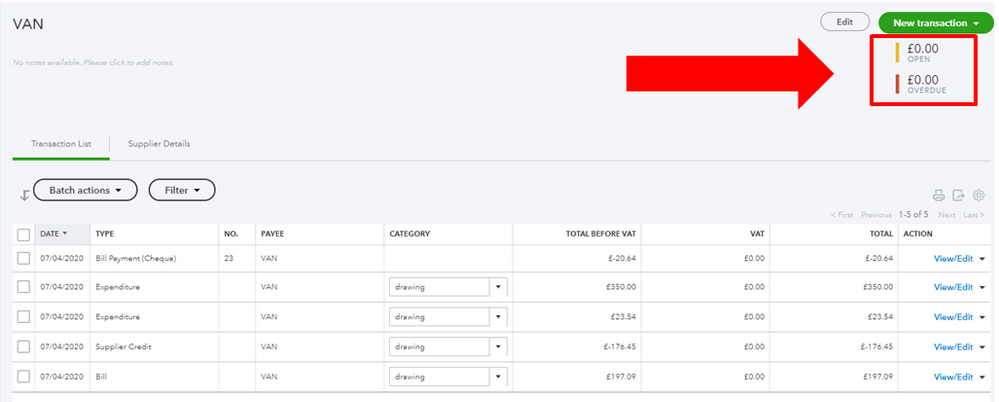

I've added a screenshot for visual reference.

Also, I encourage you checking our Help articles page for future reference. From there, you can read helpful articles that can guide you in managing your QBO account.

Should you have other concerns or questions in the future, you can always get back to us. I'll be around to help. Keep safe and stay healthy.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Matching credit card payment and credits to a single invoice

Hi

Not sure if a explained it right.

on my CREDIT CARD bank feed i have the following transactions

"Spent" £350 via credit card on the 20-01-20 (deposit for hire of the van)

"Spent" £23.54 via the credit card on the 27-01-20 (payment on account)

"Received" £176.45 via the credit card on the 27-01-20 (refund on account)

I have added an invoice to my "enterprise car hire" vendor account for £197.09

How to i match the three transactions on my credit card to clear of my vendor"enterprise car hire" account?

Kind Regards

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Matching credit card payment and credits to a single invoice

Thanks for the details, jgelectrical.

Essentially you would need to create the expense or bill for the full amount paid out and then record the credit from the supplier in a supplier credit (to adjust the expense account used originally )as mentioned above and a second transaction in +new bank deposit >selecting in add funds to this deposit the supplier and then in the next box on that line the creditors account, the amount that was refunded and save and close(to record the money received back to the bank and adjust the creditor).

Then you would need to go to pay bills select the supplier and tick the supplier credit and bank deposit so they offset each other and save and close.

That will then give you a match for the refund and record the bank correctly for what was paid out and paid back. The 2 payments out will not match unless you were to do 2 separate expenses for them. But you can exclude any that do not match as long as they are recorded manually.

We do see this quite complex, you're welcome to give our support team a call to go through this on a screen share on [Removed] or come back here with any questions we'd be happy to help

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Matching credit card payment and credits to a single invoice

Maybe post the credit card feed transaction to 'creditors' as a payment on account then match them of int eh supplier record.

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...