Hi there, @Acc_Steve!

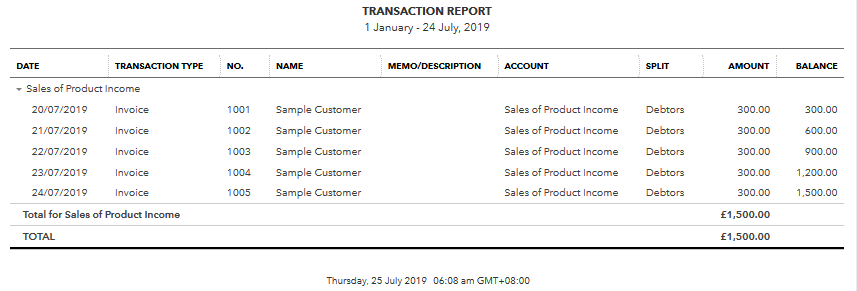

Let's pull up and review all your transactions so you can identify the reasons why your VAT have different posting accounts.

To start with, QuickBooks is unable to automatically track your VAT from a suppliers invoice or non-sales transactions. This is the reason why they have different posting accounts.

Thus said, reviewing your transactions from your reports allows you to edit and select your preferred account when tracking your VAT.

To do so, follow the steps below:

- Go to Reports.

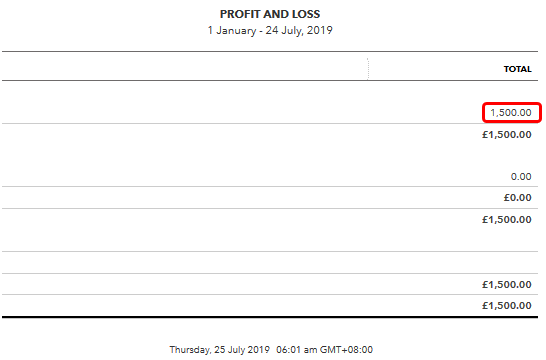

- Select Profit and Loss or Balance Sheet.

- Find and click the amount of your accounts.

In addition, here's a screenshot for your visual reference.

As always you can visit our Help Articles page for QuickBooks Online if in case you need some tips and related articles for future use.

If there's anything else that I can help you with, please let me know in the comment section down below. I'll be always around ready to help.