- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- VAT

- :

- FRS

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

My FRS VAT % has reduced from 12.5% to 4.5% from 15/07/2020. My quarterly VAT100 is from 01/05/2020 to 31/07/2020. If change the VAT % to 4.5% in the setting, will the whole quarter turnover VAT tax be charged by 4.5%? Need help.

Solved! Go to Solution.

Labels:

0 Cheers

Best answer October 21, 2020

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Hello @CoastersCoffee,

Thank you for posting here in the Community. I can share some details about how to handle changes with the flat rates in QuickBooks.

Currently, the investigation regarding the flat rate is still ongoing. For now, you can follow the workaround confirmed by HMRC.

For hospitality reduction (between 15/7/20 and 15/1/21), you can reduce the rate for the VAT period that 1/8/20 falls in and increase it for the period that 1/2/21 falls in. Effectively deferring the start and end of the reduction by half a month.

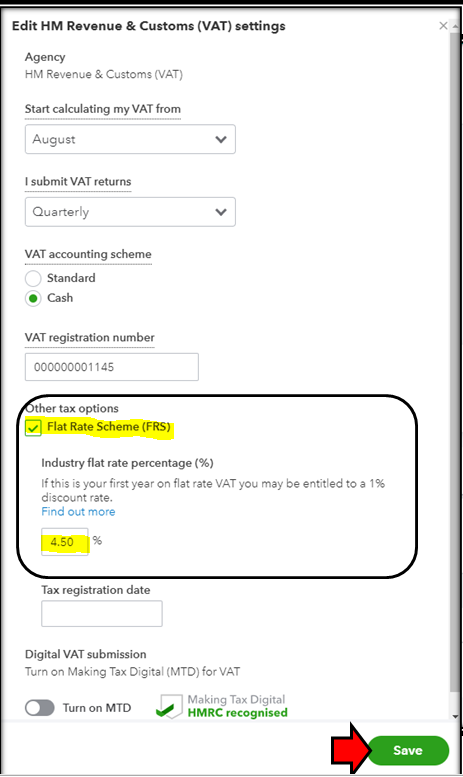

To change the rate:

- Click Taxes in the left panel.

- From the Edit VAT drop-down list, choose Edit settings.

- Under the Flat Rate Scheme (FRS), enter the new percentage of 4.5%.

- Then, hit the Save button.

Our team has not declared a specific time-frame yet for the complete fix. They are still working on it and conducting a further investigation because of the changes to the flat rates.

But rest assured, we take cases like this with urgency and high regard. Also, I recommend contacting support to be part of the notification list.

This way, you'll be able to get updates about it via email. To contact them, you can follow these steps:

- Sign in to your QuickBooks account.

- Click the Help option in the upper-right corner.

- Select Contact Us.

You can also check the articles for more details about the flat rate scheme in QuickBooks: UK Flat Rate Scheme: How does it work?.

Please know that I'm just a post away if you have any other questions. Take care.

0 Cheers

13 REPLIES 13

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Thanks for your interest about how the VAT system in QBO works for updated FRS rates, UK190501,

That's correct. When you update the FRS rate in the VAT Settings, the new percentage will apply when you submit the return. This is because the system only uses one FRS rate at a time. See this:

If you are required to file a return using the two FRS rates, I would recommend contacting HMRC to get further help with this. They can provide a proper advise on how to record and file your return with the correct rates applied.

If they allow manually filing from their website, you can just manually mark the return as filed after. You will see this option when you click the drop-down beside Submit ti HMRC.

For your reference with VAT processing in QBO, check our Resource page through this link: VAT for QBO United Kingdom

Let me know if you have additional questions or clarifications. I'll be right here to help whenever you needed it. Have a lovely day!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Thanks for suggestion. I trust it is not just my problem whom using QBO to submit the FRS VAT 100 Reports. Due to COVID-19, FRS rates has been reduced for some type of business, e.g. catering services including restaurant & takeaway reduce from 12.5% to 4.5% for period from 15/07/2020 to 12/01/2021. Because my client has already signed up for MTD for VAT of which must use commercial software to submit and cannot use VAT online to submit. I believe it is the responsibility of QB as a software provider to solve the changes instead of the end users asking help directly from HMRC.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Thank you for the feedback about the VAT set up, UK190501.

I'll take note of your concern and pass it along to our Product Team. We stay compliant with the Government's regulations when it comes to paying taxes and filing returns.

For now, you can follow the information provided by my colleague above. This is to ensure you have accurate VAT records on your books.

I've added this page to keep you updated with what's new and coming in QuickBooks Online: Firm of the Future Team.

Don't hesitate to post again if there's anything else you need. The Community is always here to answer your concerns.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Thanks for your advice to follow your colleague's suggestion. However, I'll not do this because the whole quarterly ended 31/07/2020 VAT 100 Report will be calculated at 4.5%. This is not correct because the Tax Liabilities will be understated for the period before 15/07/2020. I trust your Product Team may find a solution to allow two rates at the same quarterly/monthly FRS VAT 100 Report. Let's think more about: how to handle the change back to normal rate after the first year 1% reduce benefit of a new FRS register? Hope to have your solution very soon because my client's quarterly ended 31/07/2020 VAT 100 Report will be due to submit by 07/09/2020.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Hi,

I am now in the same situation - has the QB team come up with a solution yet?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Hello @CoastersCoffee,

Thank you for posting here in the Community. I can share some details about how to handle changes with the flat rates in QuickBooks.

Currently, the investigation regarding the flat rate is still ongoing. For now, you can follow the workaround confirmed by HMRC.

For hospitality reduction (between 15/7/20 and 15/1/21), you can reduce the rate for the VAT period that 1/8/20 falls in and increase it for the period that 1/2/21 falls in. Effectively deferring the start and end of the reduction by half a month.

To change the rate:

- Click Taxes in the left panel.

- From the Edit VAT drop-down list, choose Edit settings.

- Under the Flat Rate Scheme (FRS), enter the new percentage of 4.5%.

- Then, hit the Save button.

Our team has not declared a specific time-frame yet for the complete fix. They are still working on it and conducting a further investigation because of the changes to the flat rates.

But rest assured, we take cases like this with urgency and high regard. Also, I recommend contacting support to be part of the notification list.

This way, you'll be able to get updates about it via email. To contact them, you can follow these steps:

- Sign in to your QuickBooks account.

- Click the Help option in the upper-right corner.

- Select Contact Us.

You can also check the articles for more details about the flat rate scheme in QuickBooks: UK Flat Rate Scheme: How does it work?.

Please know that I'm just a post away if you have any other questions. Take care.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

The deferring may only worked for quarter ended 31/07/2020. I think the deferring may not worked for quarters ended 31/08/2020 and 30/09/2020 because the deferred period is too long. Please refer to the suggested posts in Intuit Quickbooks UK users group @ FB (started from 7 Aug).

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Thanks, My period ends 30/9/20 - so I guess the work around above is of no use ?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Hello CoastersCoffee,

Thanks for commenting back on this thread,

Yes you will be able to use the workaround as it says the period that 1/8/20 falls in and not that it starts on 1/8/20. so your period of 30-9-20 you can do the workaround for.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Great thanks.

How would the workaround work now the VAT reduction period has been extended to the 31st March 2021?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Hello there, CoastersCoffee,

Thank you for the information. I'll be sure to inform our product engineers about this.

HMRC have previously confirmed they're good with the workaround. You can use that for now while waiting for the confirmation with the extension.

I'll be sure to update this thread once confirmed. I'll be here if you have other questions.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Hi

Could someone explain why the 4.5% rather than inputting 5%?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

FRS

Hello Debs7,

Thanks for posting on this thread, you would need to speak to HMRC themselves and ask them why it is 4.5% rather than inputting it as 5%

0 Cheers

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...