Hi @nolan-l-west-gma,

Whether you're referring to a sales receipt or a bill, I'll provide insight on how you can proceed.

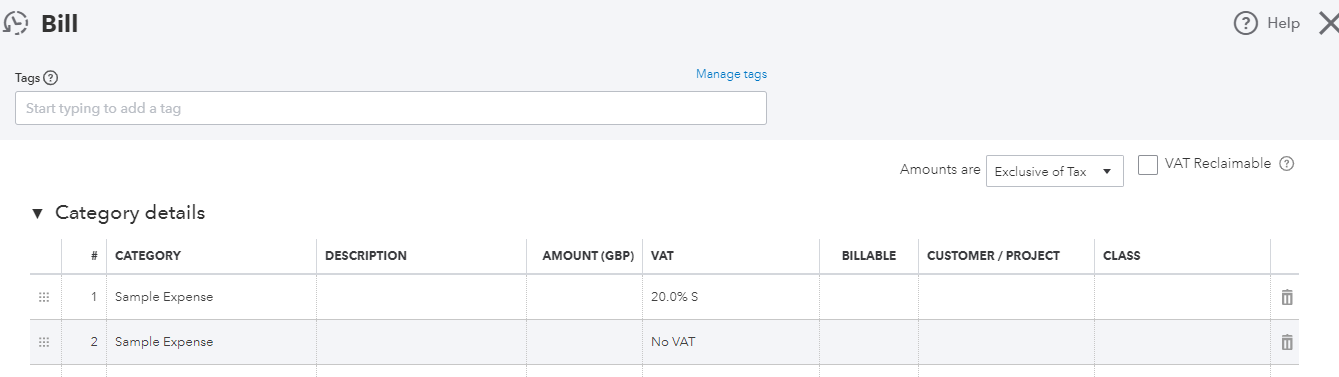

In QuickBooks Online (QBO), you can assign a VAT code for each line item. Taxes for your transactions can either be exclusive, inclusive or none at all.

See the screenshots below for reference:

If you need to add a custom tax for your QBO company, check out this article: Set up and edit VAT settings, VAT codes, and VAT rates. Scroll down and look for the Add additional tax rate, group rate, or custom tax section.

Have other questions? Place them below, and I'll get back to you.