Hello, @88tpm.

I'm here to share some information on how QuickBooks handles your VAT Suspense and VAT Control.

The VAT control account is automatically generated when you turn on Taxes in QuickBooks. Also, every time you post a transaction with a QuickBooks Online VAT code it will be posted to the VAT control account.

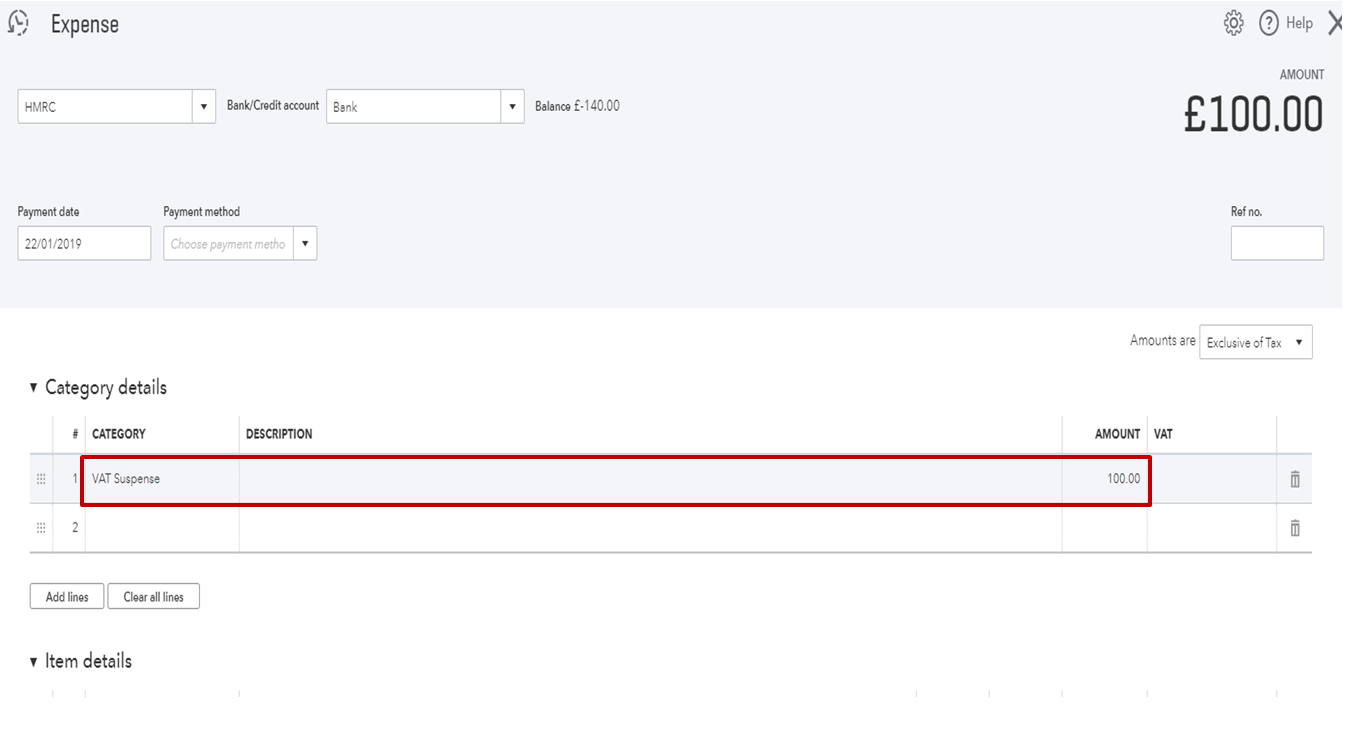

You can record it as an expense transaction. Then, post it under the VAT Suspense account. Here's how:

- Click the Plus sign (+) icon.

- Choose Expense.

- Fill in the necessary fields.

- Click Save and close.

When you file the return the amount in your VAT control account is posted to the VAT suspense account, from where it is cleared by recording a payment or refund against the VAT return. You can read through this article for more detailed insights: VAT Feature Update FAQ.

Keep me posted if you have other questions about managing nay VAT-related transactions in QuickBooks. I'm always here to help.