I'd be glad to share a few info and steps to ensure you can manage the Medical Loss Ratio (MLR) rebates in QuickBooks Online, @courtney13.

You can create an addition payroll item to track your employees' rebates. Then, ensure to retain their health insurance contributions. Let me guide you how:

- Go to the Payroll menu, and then choose the Employees tab.

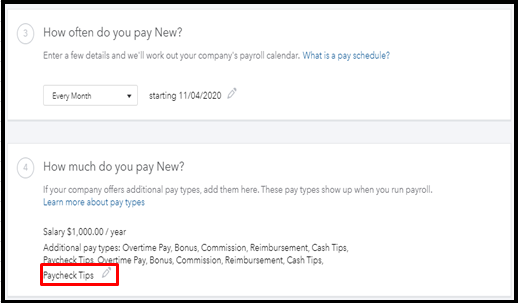

- Select an employee's name, and then click the pencil icon beside Pay.

- Go to How much do you Pay [Employee name] section, and then tap the pencil icon.

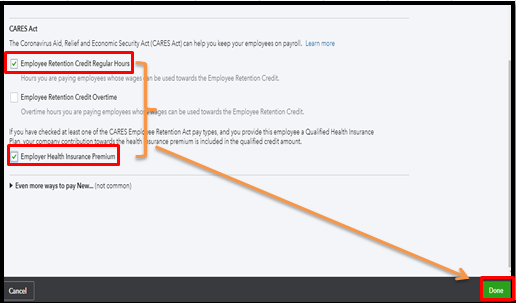

- Hover down to the CARES Act section, and check the Employee Retention Credit Regular Hours box.

- Then, check also the Employee Health Insurance Premium box.

- Click Done when you're ready.

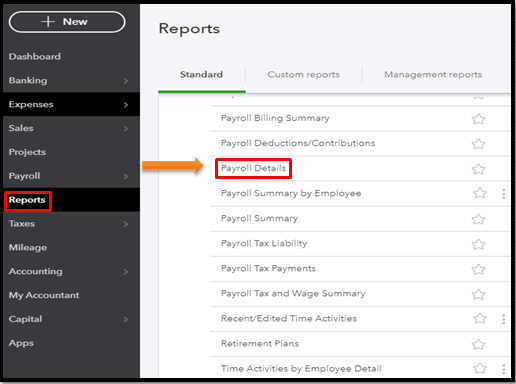

If you want to review the payroll items you've created, then you can run the Payroll Details report. To access the said report, just go to the Reports menu and then select it from the Payroll section.

You can always leave a comment below if you have more questions about managing your payroll in QuickBooks Online. I'll be here to help. Take care and have a great day.