Hi there, ltremain.

To update the balances and reflect the fund activity in the Balance Sheet report, I suggest making sure that all funds transactions in QuickBooks Online are associated with the Investment fund activity account. With that said, you'll need to go to the Register page to review them and edit them if necessary. This way, the Balance Sheet report will automatically update all the funds entries entered in the system.

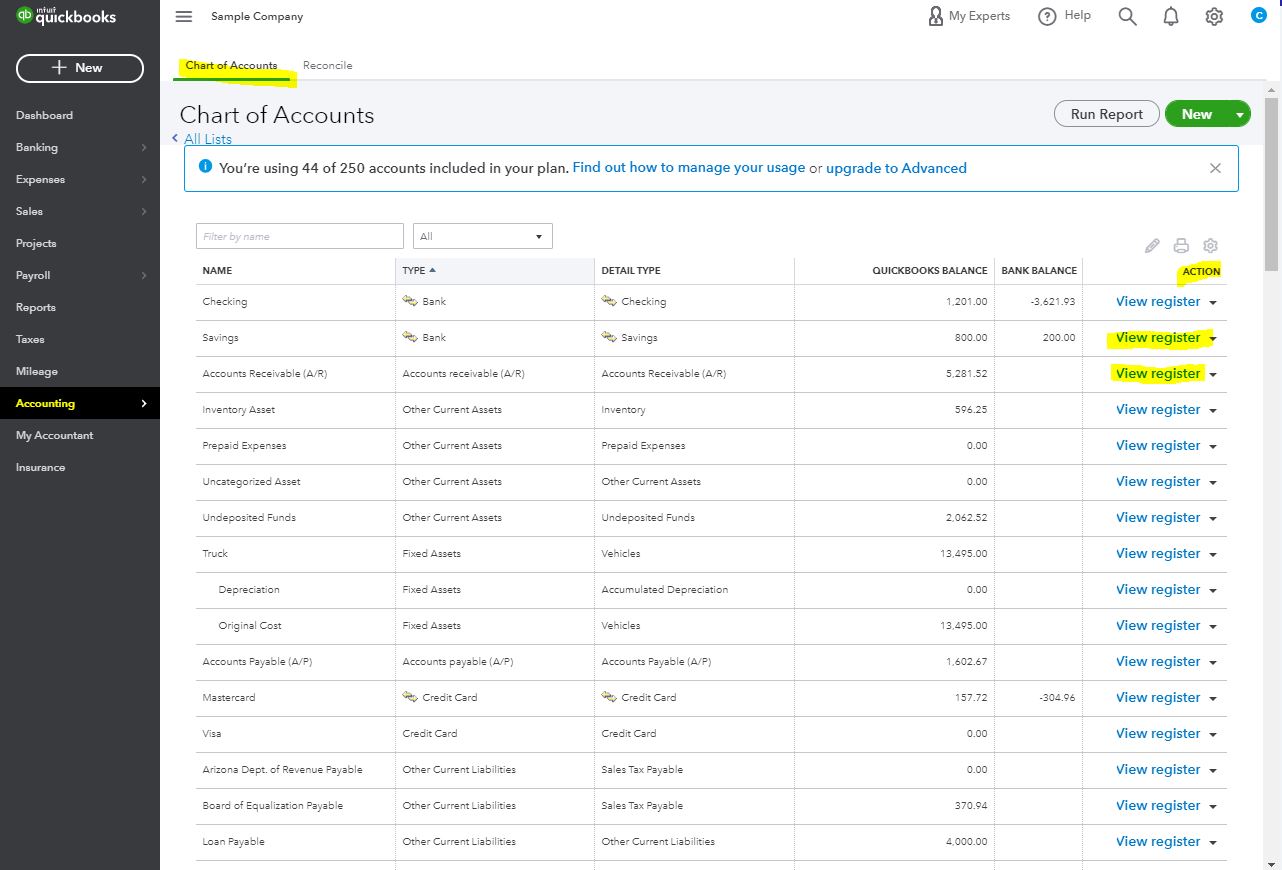

- Click the Accounting menu on the left panel. Then, choose Chart of Accounts.

- Find and select the register you want to review.

- From the Actions column, select View register.

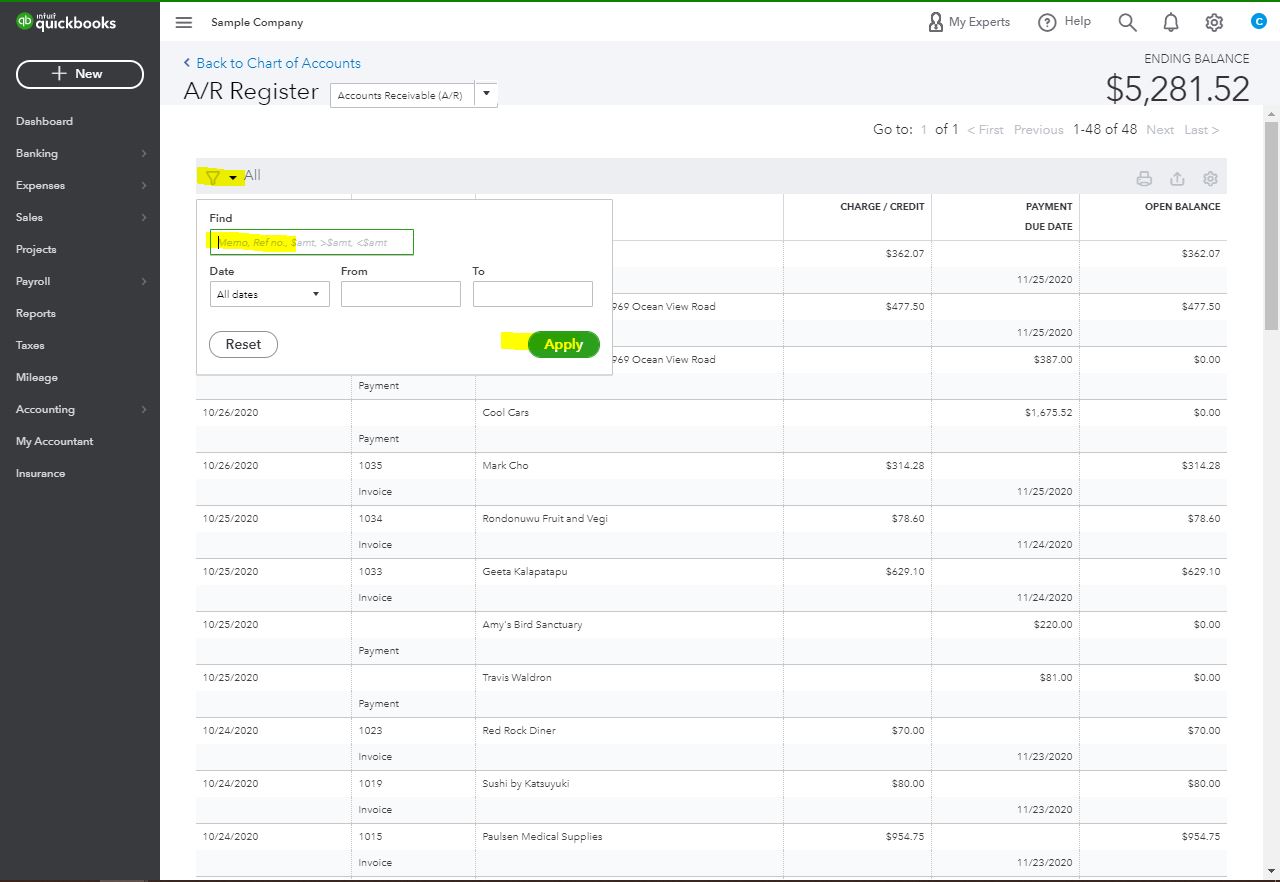

- Select the Filter icon. Then select the filters you want you to apply. You can use the Find field to search by amount, reference number, or memo.

- To remove a filter, select the X next to the filter name.

- Hit Apply.

For additional information, you can click this article: Find, review, and edit transactions in account registers.

Once done, you can now run the Balance Sheet report to see the updated balances that reflect all funds activity. You can also customize this report to focus on the details that you want to view.

If the balance is still underestimated, you can create funds transactions like Bank deposits. Then, make sure to post this on the correct Investment fund activity account. This way, this will show on the report with updated information.

Here's how:

- Select + New icon.

- Choose Bank deposit.

- From the Account drop-down menu, select the bank account you're depositing the money into.

- Enter the date you deposited the money.

- In the Add funds to this deposit section, enter the name of the investor in the Received from field.

- Select the appropriate account from the drop-down list in the Account field.

- Specify a payment method.

- Enter the investment amount in the Amount field.

- Hit Save and close.

For additional information on how to enter funds entries once you're running a nonprofit organization, you can open this article: Track funds you receive from donors in QuickBooks Online.

Please refer to this article to see details about Fund Accounting for non-profits and how you can use Class tracking and banking sub-accounts to track individual funds: Fund Accounting for non-profits.

Please let me know if you have other questions. I'm always around to help. Have a great day.