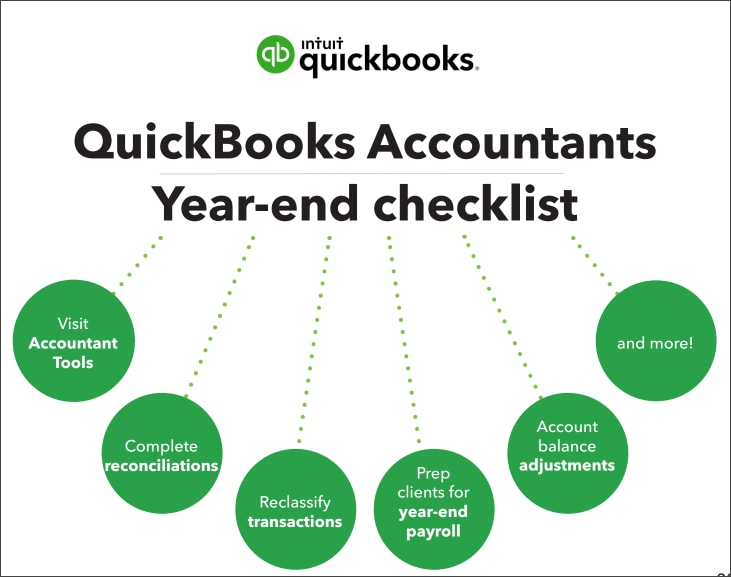

Finish your team and clients' last-minute tasks in Quickbooks before the year-end.

Use your accountant tools

Do your bookkeeping efficiently by using account-specific tools in QuickBooks Online Accountant. This allows you to review your client's QuickBooks Online account, reclassify transactions, and prepare for filing tax returns.

After you review their financial data, you can close your firm’s books for the year-end. It prevents any unwanted changes before filing taxes.

Write off uncollectible debts

You can write off invoices if your clients have uncollectible debts during the current period. However, if the invoice becomes uncollectible from a closed period, you can write off bad debt instead.

Set up default dates for reports

Set up default date ranges to view your client’s financial reports. This helps you to review specific time periods as QuickBooks automatically sets reports to the default date range.

Correct miscategorized transactions

Use the Reclassify Transactions Tool to batch move or change multiple transaction at once.

Prep payroll for year-end

Use these checklists to help your clients close out 2023 and prepare for 2024:

- Year-end checklist for QuickBooks Online Payroll

- Year-end checklist for QuickBooks Desktop Payroll Assisted

- Year-end checklist for QuickBooks Desktop Payroll

Complete reconciliations

If your clients have unfinished reconciliations, you can reconcile their accounts or undo past reconciliations on their behalf.

Here are the tips for year-end reconciliation in QuickBooks Online.

Make account balance adjustments

Run an Adjusted trial balance report if your clients’ account balances need minor adjustments. This helps you to make sure all debits and credits are equal.

Use Prep for taxes

After you review everything in your client’s accounts, their accounting data is ready for tax season. You can use Prep for taxes to map your client’s accounting data and export your client’s tax info to ProConnect Tax Online.