Multi-Currency: Journal Entry Error Message

by Intuit•9• Updated 1 week ago

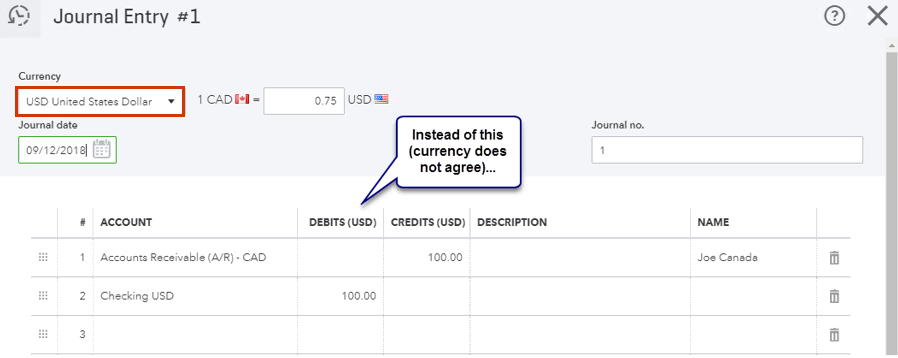

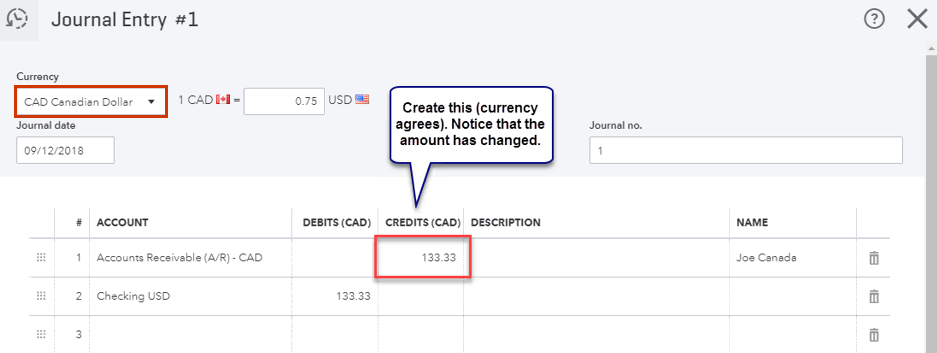

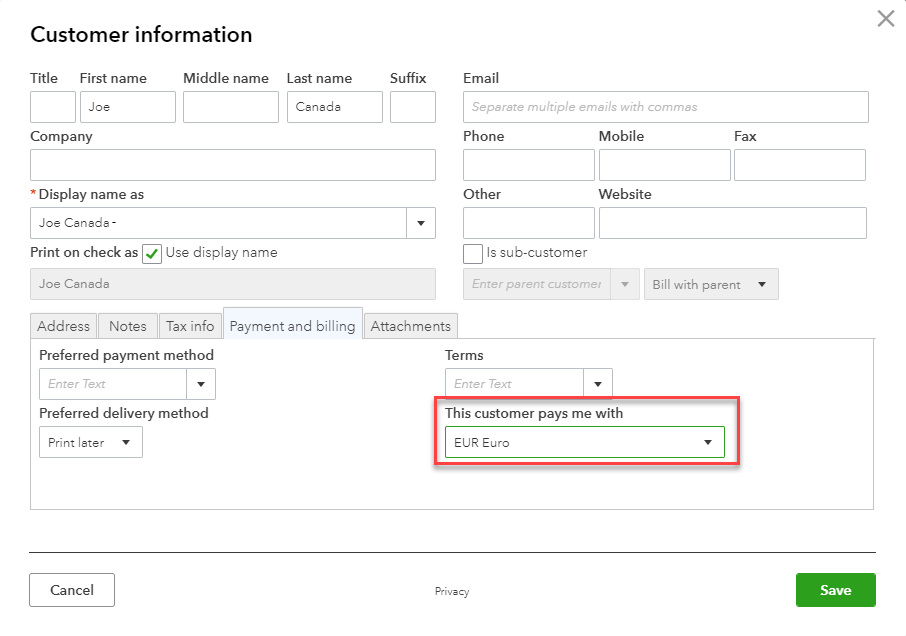

When working with multiple currencies in QuickBooks Online, all customer or vendor transactions must be recorded in the currency assigned to that customer or vendor or you will encounter the error message: Something’s not quite right: You can only use home currency balance sheet accounts with home currency A/R and A/P accounts.

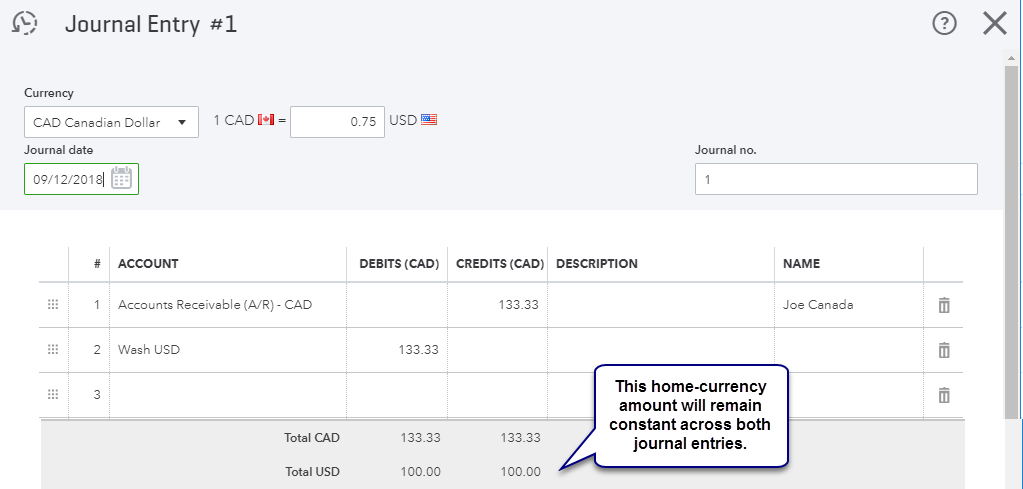

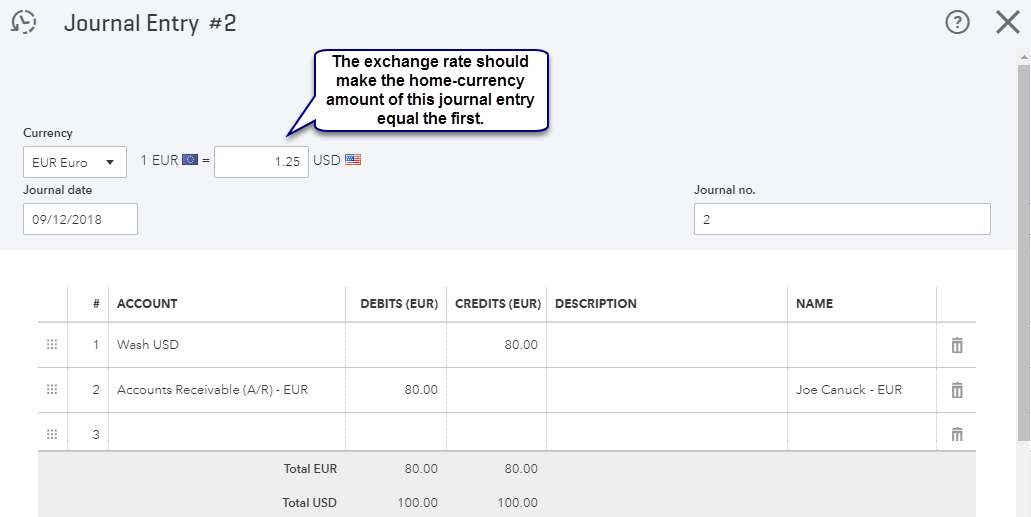

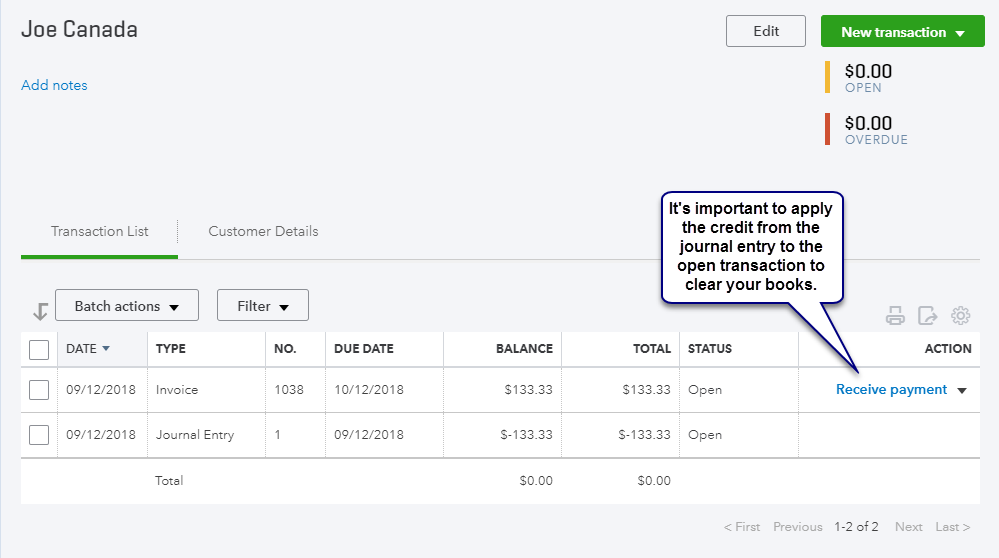

This means that when creating a journal entry that includes accounts receivable (A/R) or accounts payable (A/P), the currency of the transactions, the A/R and A/P accounts, and the customers/vendors must all match.

QuickBooks Online blocks journal entries that mix currencies for customers or vendors because these may lead to incorrect open balances or incorrect exchange gains or losses.

Here are some ways you can record these payments.

More like this

- Reverse or delete a journal entryby QuickBooks

- Import journal entriesby QuickBooks

- Make adjusting journal entries in QuickBooks Online Accountantby QuickBooks

- Set up and use Multicurrencyby QuickBooks