Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi there, @4545.

I got you covered in matching your bank transactions in QuickBooks Online.

There are two ways on how you can handle merchant fees in the system in order to match your bank transactions.

The first is to utilize the Resolve Difference option on the Banking page. This helps match your transaction and resolve its difference until it will be equal to zero.

To do that:

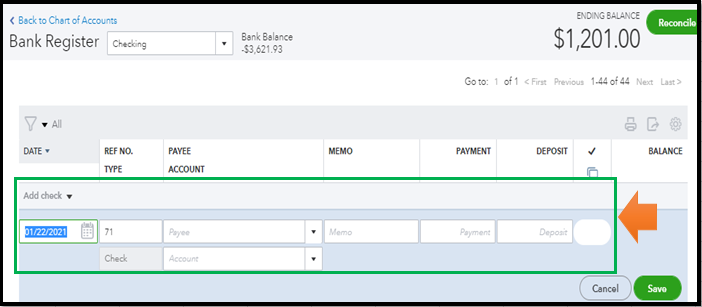

The second is to enter the bank service fee amount directly into the register. This way, the register's balance matches the bank statement balance. Entering the bank service fee, you will then enter the fee as a negative amount on the Bank Deposits screen when depositing a payment.

Here's how:

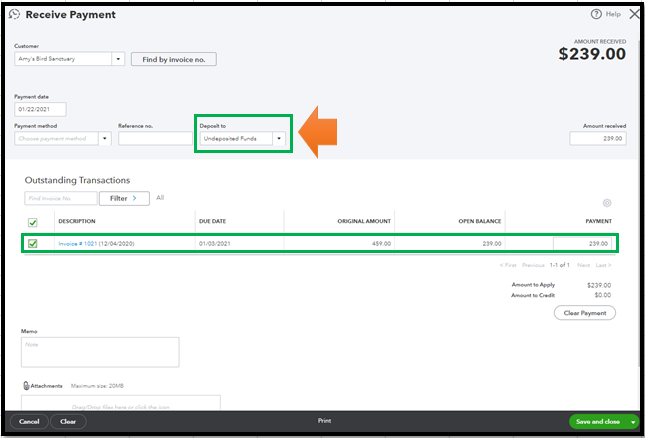

After that, you can now enter the fee as a negative amount on the Bank Deposits screen when depositing a payment.

To do that:

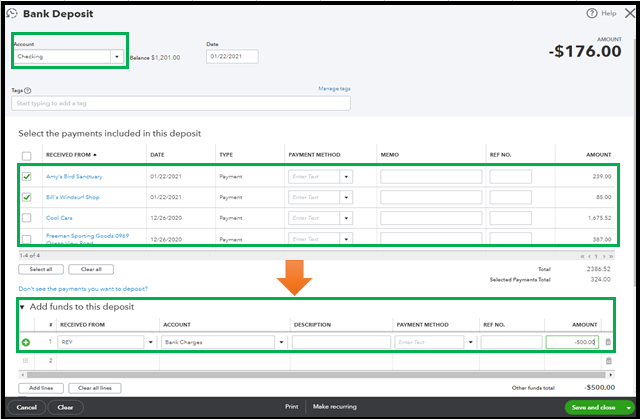

Once done, create a bank deposit and add the fee as a negative amount:

For more details about this process, please refer to this link: Enter a bank service fee while using a third-party merchant service.

Also, to learn more about matching transactions, feel free to check out this article for more guidance: Categorize and match online bank transactions in QuickBooks Online.

Feel free to post a reply below if you have other concerns with your bank transactions in QuickBooks Online. I'll be more than happy to assist you again. Have a great day and take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.