Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi there, jimmlafferty,

QuickBooks Online (QBO) lets you import data from another QuickBooks product. However, you can only import the following information below:

You'll want to manually enter those trips into QBO. This is to track your mileage in the the system. Let me guide you through recording them:

Recording your trips is also available in QuickBooks Online. Just download the app on your phone and turn on this feature. For more details, feel free to read though this article: Track mileage in QuickBooks Online for instructions and detailed steps.

Feel free to leave a comment below if you need additional information. I'm always around to help you out.

is there a CVS file I can download and add the previous mileage I haven't recorded?

Hello there, StoufferK.

Right now, the option to import your mileage into QuickBooks Online isn't available. However, you can download the recorded mileage and manually add the other data.

Let me guide you with these steps:

Here's how to download the trips:

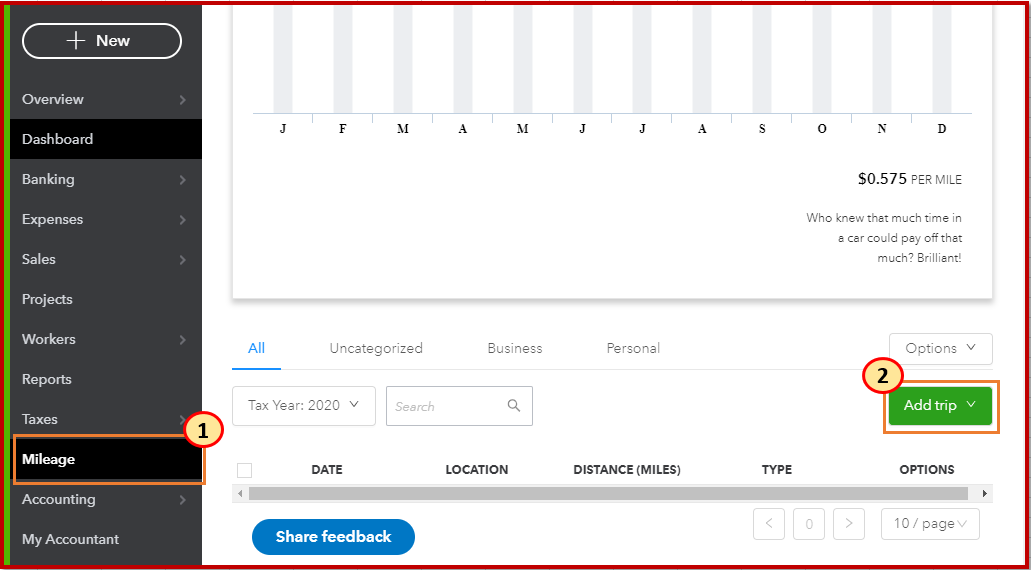

Then, to manually add trips, click the Mileage tab, and then select Add trip.

I've also added this article for detailed information on adding a new vehicle: Track mileage in QuickBooks Online.

Please know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.