Creating a bill may not be necessary, as what you've mentioned, the fees are already accounted for and bills are meant for pay-later transactions. Since, the fees were taken out before the deposit was received, we can manually add the fees under the bank deposit entry, Soccer. I'll show you the steps below.

Here's how:

- Open QuickBooks.

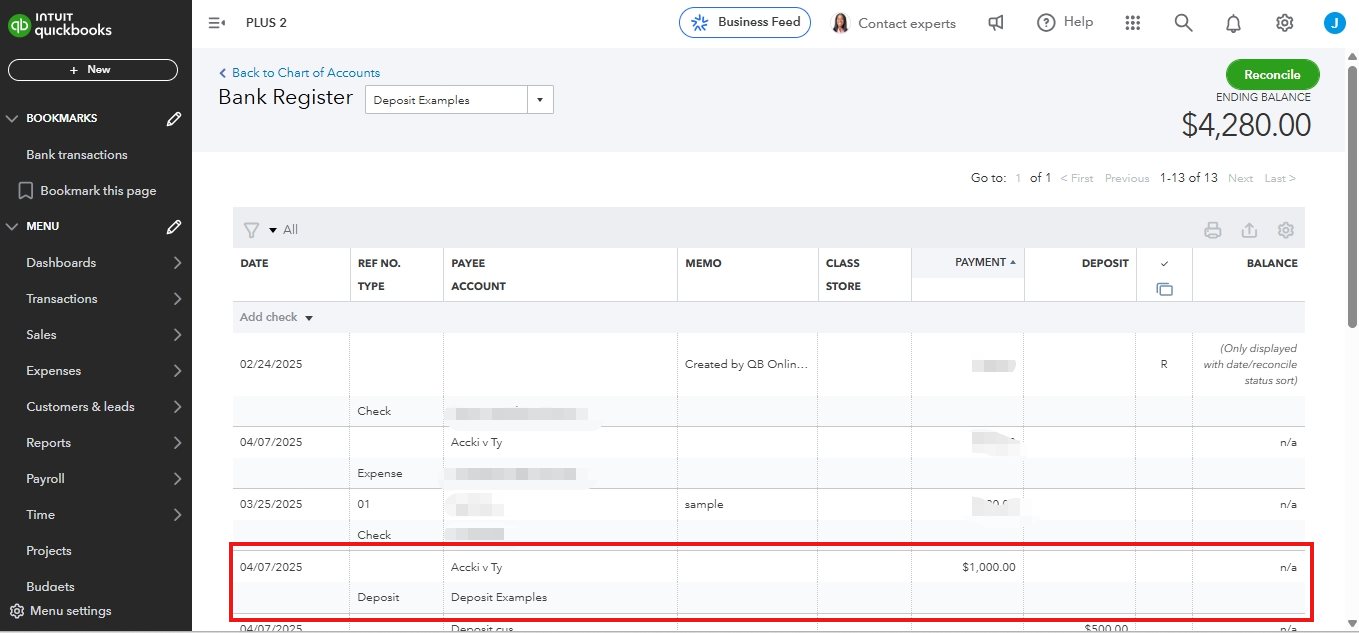

- Click the Gear icon in the upper right corner and select Chart of Accounts.

- Find your bank deposit in the Bank Register.

- Click Edit.

- In the Add Funds to This Deposit section, select a name in the Received From column.

- From the Account dropdown menu, choose an expense account. If you don't have a specific account for bank fees, create a new expense account by clicking Add New.

- Enter the fee amount as a negative number in the Amount field (for example, -$25).

- Check the other details, then click Save and Close.

If you need to enter the amount of the fee as a line item to the invoice, refer to this article: Charge a service fee to customers in QuickBooks Online.

Moreover, need assistance with managing your chart of accounts? Explore our QuickBooks Live Expert Assisted service. Our skilled team of experts is here to help you establish a precise and accurate chart of accounts records.

Additionally, when customers fail to pay on time, you can automatically add late fees to the overdue invoice instead of doing it manually. Check this article to learn how: Turn on automatic late fees in QuickBooks Online.

Would you also want to learn on how to set up automatic or manual invoice reminders in QuickBooks Online? Let me know. If you have questions about banking fees in QuickBooks, reply to this thread. I'm here to help.