Hi QuickBooks support team,

My summer research project regarding transaction matching and cash/bank reconciliation has taken a small pivot after an initial understanding of the QuickBooks's online system and I was wondering if you might be able to clarify a few points for me around the matching process, date tolerance, and auto-match rate from a QuickBooks's perspective and limitations in regards to uploading transaction data to QuickBooks Online versus linking a bank account? I am wondering:

Question 1:

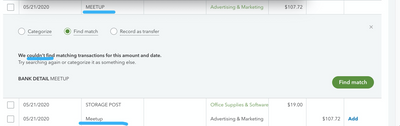

1.1) I uploaded two datasets which have aligned payee information. For example, in one dataset, a payee is named as "MEETUP"; in the other dataset, an aligned payee is also named as "MEETUP". However, when I uploaded these two datasets to QuickBooks Online, one payee remains "MEETUP" while the other became "meetup". Is there a simple explanation of the philosophy or principles underlying this problem?

1.2) (Cont.) When I tried to manually match two transactions (The screenshot is attached below), the system would not allow me to do that, even though the dates, amounts, and payees were matched. Could you please explain that and is there any solution to the problem?

1.3) (Cont.) If I'd like to match two transactions manually, is there any date tolerance for the two dates?

Question 2:

2) How do I determine the Quickbooks' auto-match rate? Is there a particular place where I can have a look at, for example, an exported reconciliation report or somewhere else?

Question 3:

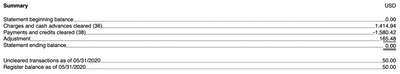

3) This is what my reconciliation report looks like. It seems to me that this report looks a bit weird since there's no place showing any transaction's been reconciled. There are only cleared transactions. Is there any explanations to this problem?