I'm here to take care of your reconciliation today, @Anonymous.

If the business bank returns the expense amount made by the petty cash, then you can create a bank transfer transaction.

Here's how:

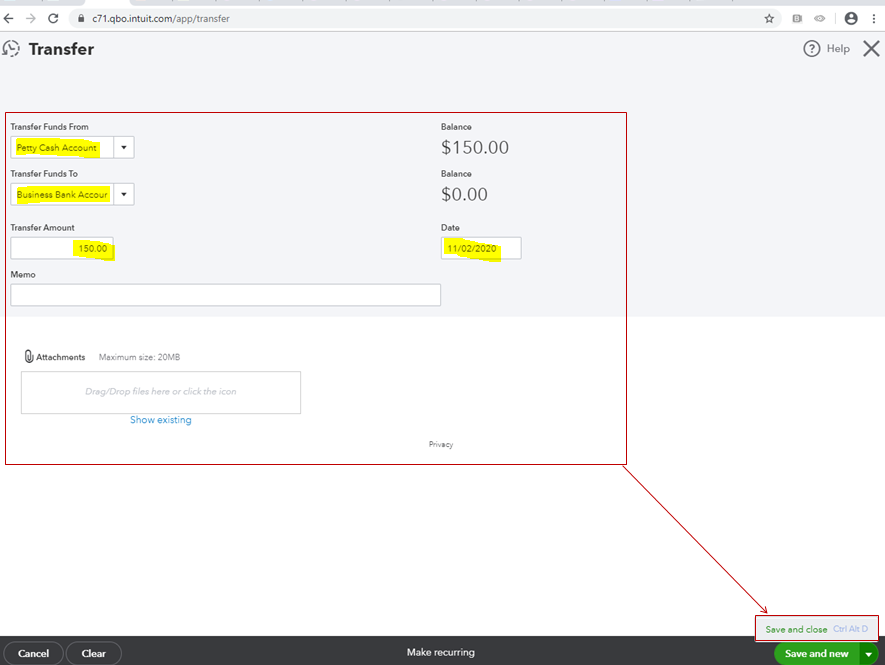

- Open your QuickBooks Online account, then select Transfer from the (+) New icon.

- Choose the petty cash account under the Transfer Funds From section, then your bank account from the Transfer Funds To.

- Enter the amount, then save the transaction.

If not, then you only need to reconcile your account base on your bank statement. You can use these articles as your guide:

Just in case you'll encounter issues during the process, feel free to read the instructions from these links as your guide in fixing them:

Please keep me posted if there's anything else you need assistance with QuickBooks or banking. I'm more than happy to help. Happy weekend!