Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Banking

- :

- Re: Missising invoices

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Missising invoices

I just noticed invoice #s skip from 1029 to 1036 from 12/16/24 to 1/16/25. Any way to find out what happened?

Labels:

8 Comments 8

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Missising invoices

It's great that you're keeping a close eye on your invoices, jpatriarca. The gap in invoice numbers from 1029 to 1036 between December 16, 2024, and January 16, 2025, might happen for a few different reasons. Let's work together to determine what might have happened during that period.

Here are some possible reasons why there were skipped invoice numbers on the said date range:

- Someone created an invoice and unintentionally changed the invoice number.

- There are recurring invoices that lead to skipping the invoice number.

- Deleted invoices.

To clarify, have you created an invoice on the said date range? If yes, it could be that those invoices have been deleted. To verify this, let's run the Audit Trail report and see those invoices.

Here's how:

- Navigate to Reports.

- Select Accountant & Taxes, then click Audit Trail.

- Click the Customize Report, then go to the Filters tab.

- On the FILTER section select Transaction Type, choose Invoice, then click OK.

- Filter the dates.

With this, we can see the invoice numbers, the dates that were created/modified, and other details.

I would like to know if you've run a report that shows you the list of invoices. If yes, can you verify what report it is so we can help you run through the necessary steps to bring up those missing invoices?

In addition, we can use the Transaction List by Customer report to bring up the invoices by filtering the report.

Here's how:

- Navigate to Reports.

- Select Customer & Receivables, then click Transaction List by Customer.

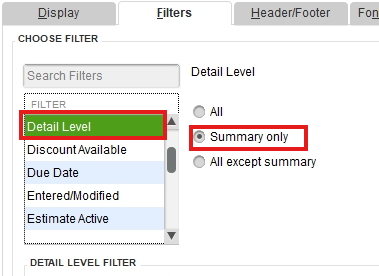

- Click the Customize Report, then go to the Filters tab.

- On the FILTER section select Transaction Type, then choose Invoice.

- On the Current Filter Choices, click Detail Level and select Summary only.

- Click Paid Status, choose Either to show the paid and unpaid invoices and then click OK.

- Filter the Dates.

We can now see the invoices with their numbers, dates, and other details based on the filters we've set.

Here's a detailed article you can read to help you generate customized reports: Customize reports in QuickBooks Desktop.

Just in case you want to export this report to Excel, you can check out this article for detailed steps and information: Export reports as Excel workbooks in QuickBooks Desktop.

If you have any other questions about bringing up your invoices or need further help, please don't hesitate to let me know. The Community team and I are here to support you and keep things running smoothly. Take care and stay safe!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Missising invoices

Thanks for the detailed reply, CharmieH!

I ran your 2 suggested Audit Trail reports which show the gap I reported. They DO NOT show invoices #1030-35

I ran the "Invoices for All Customers" report from the Customer Center: Invoices...it still shows the gap.

I have shared my company files w/2 new employees so they may review/learn. We are not sharing/hosting, etc.; they don't have access to my computer where the company file resides. Yesterday I learned one of them created an invoice in their QB company file on their computer. I got a copy of the invoice, it's #1031!?!?!?!

I don't understand how that could have any effect on my company file.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Missising invoices

I appreciate your effort and patience as we resolve this issue, Patriarca. I recognize the importance of addressing this concern to ensure your financial records remain accurate and updated. Let me help clarify and resolve this situation.

If you've given your employees user role rights to access your company file, any changes they make will reflect on your computer. QuickBooks Desktop supports real-time data updates across all users connected to the same file. This means that activities such as creating invoices, adjusting invoice numbers, or deleting transactions will be visible to everyone.

If your employees have access to the company file, they might accidentally edit or delete invoices. This could directly affect the invoice sequence for everyone using the same file and cause discrepancies.

On the other hand, if you have provided your employee with a backup company file and they have made edits to that file, those changes will not automatically reflect in your main company file. However, if the altered backup file is later used to overwrite or update the main company file, it could lead to discrepancies such as missing invoices or changes in invoice sequences.

Moving forward, to prevent any unnecessary updates to your company file, I recommend creating a new company from your existing file. This allows employees to freely review and learn how to configure QuickBooks to its full capacity. Here’s how to proceed:

- Open your QuickBooks Desktop company file, then go to the File menu.

- Choose New Company from Existing Company File.

- Next, click Browse to locate the company file you wish to copy.

- Select the file and click Open.

- Then, create a new name for the new company file in the field provided.

- Once done, click Create Company.

For reference, please see the screenshot below:

Once completed, share the file with your employee and instruct them to restore the company file.

Furthermore, you can consider consulting with our live support team. They can further examine and identify the reasons behind these discrepancies, as they have the appropriate tools and expertise to assist in diagnosing the issue you're facing.

Additionally, here's an article that you can check if you need help in personalizing your sales form template in QuickBooks: Use and customize form templates.

The Community forum is always available for you if you have other questions or concerns about this issue, Patriarca. Just click the Reply button and we'll be glad to help you any time.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Missising invoices

SheandL,

I have not given my employees user role rights. They have a copy of the backup file I emailed to them. None of those backups have been used to overwrite or update the main company file.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Missising invoices

I seem to be having the same issue, i have physical copies of invoices from february 2024 that i printed out that are no longer on the system and i am the only one who has access. I think maybe this is a quickbooks issue if there are more people having the same problem

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Missising invoices

Let’s get those missing invoices sorted out, Greg. I’m committed to guiding you through the recovery to get your system back on track.

In QuickBooks Desktop, there are two primary scenarios we need to explore. First, the invoices may have been unintentionally deleted. Second, you're working within a restored backup that precedes the creation of these invoices.

To investigate, let's leverage the Audit Trail feature to track all transactions and activities within your QuickBooks Desktop. This will provide a detailed history of modifications or deletions.

Here's how:

- Navigate to Reports at the top menu bar and choose Account & Taxes.

- Select Audit Trail.

- On the report screen, click Customize Report.

- Go to the Filter tab and search for the Transaction type.

- Choose Invoice and hit OK.

- Filter the dates to cover the period when the invoices were created.

This customized report will display all activities on your invoices, including any deletions. If invoices have been deleted, the Audit Trail will provide the details needed to recreate them. Please note that while you can view the information about deleted invoices, QuickBooks Desktop doesn't have a direct function for restoring them. Therefore, manually recreating them is necessary.

On the other hand, if you're working from a restored backup, it's essential to ensure that the backup file includes the missing invoices.

If none of these scenarios apply to you, I recommend running the Verify and Rebuild Data tool in QuickBooks Desktop. Verifying the data checks for corruption and ensures all entries are accurate and complete. Rebuilding the data refreshes the information and helps to eliminate inconsistencies.

Furthermore, I recommend bookmarking these valuable articles on managing your invoices in the program. These resource guides empower you with tips and best practices to streamline your invoicing process and enhance your overall experience.

This thread is available whenever you have questions or need clarification regarding your entries. You can also create a new discussion here in the Community space for assistance. We're always here to assist you in navigating our program effectively.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Missising invoices

I agree w/you Greg. None of the solutions provided work.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Missising invoices

I appreciate your efforts in trying the previous recommendations, @jpatriarca. To ensure we resolve this promptly, I will connect you with our live support team who can assist you further. They have the right tools and expertise to handle this effectively.

You can follow these steps to contact them:

- Open your QuickBooks Desktop.

- Go to Help, then select QuickBooks Desktop Help/Contact Us.

- Enter a question, keyword, or topic you need assistance with.

- Click Contact Us to be connected with our support team.

Additionally, here's an article to help you design and personalize the invoices that you send to your customer: Use and customize form templates.

You click the Reply button if you have further questions about those missing invoices in QBDT. We'll be right here to help you anytime.

Featured

Hi Community! Have you felt overwhelmed learning QuickBooks Online? Are

the...

Make your QuickBooks Online invoices, estimates, and sales receipts work

fo...