Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi,

I have two questions and was hoping someone from the community can help me.

1. I have a third party app that is bringing in sales, sales tax, delivery fees, etc into QBO automatically. QBO creates and invoice number. However, when I run the P&L I don't see the sales in the correct area. I went into sales >product and services and updated the Income accounts to the correct one and checked the box to go backwards and make the adjustments for all items. I still don't see the sales in the correct place. Any suggestions?

2. RE: banking - I have several third party delivery services AND a catering third party app which are dropping deposits into banking. The deposits do not match the original amount due to fees AND in many instances the 3 party food delivery services combine several days into one deposit. Any best practice?

3. RE: banking - I tried to update one bank deposit that came through banking. I was trying to change the income category to UNDEPOSITED FUNDS and also put a negative amount in the system for the fees from the 3rd party app. However, when I hit save the system says "Something's not quite right. Select a bank account". Thoughts?

THanks

Help has arrived, @gibgirlnw.

I’m glad to share insights with you about sales tracking and help resolve your bank deposit concern.

In QuickBooks Online (QBO), making changes to items can't affect past transactions. The updates will apply to the current transactions and won't change the previous sales on your Profit and Loss statement. Please know that QuickBooks depends on the information coming from your third-party app. You’ll want to contact your app provider for this.

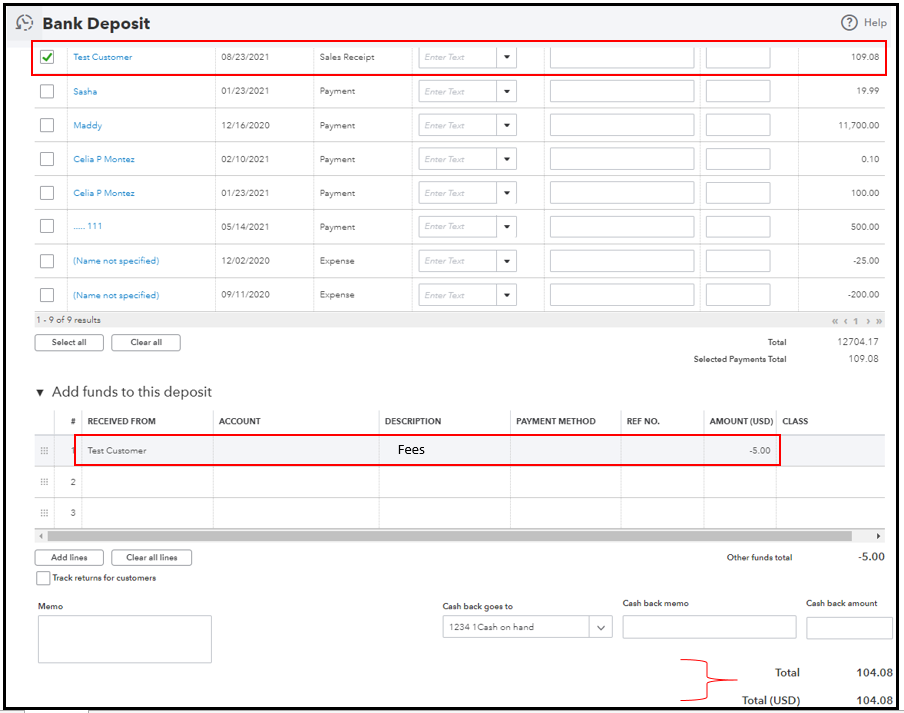

For your second and third questions, you can create a bank deposit in QBO. This way, you can add the fees properly and make the total amount equal to the actual deposit.

Here’s how:

You can visit this reference for detailed instructions: Record and make bank deposits in QuickBooks.

Also, just make sure you’ve selected the Undeposited Funds account when you received the payment. This way, you can successfully match the transactions and reconcile your account in QBO.

I’ll be right in the corner if you need further assistance with your transactions. Always take care and have a great day!

Do you use Grubhub?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.