Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWe have been using QB for several years and now need to setup divisions within our company as we grow.

Divisions are as follows:

I need to set a chart of accounts specific to each division so that we can track "everything" per division and report per division. I see the online QB version has locations which may work but we are using desktop and I am not seeing how class tracking will work in this application. All accounts on our COA will be specifically allocated to a division. I do not see how I can tag an account to a class. My first try I added the class "Maintenance" and went to my COA Bed Maintenance income account. There are no options under edit to tag a class to it.

We sync QuickBooks with our CRM Service Autopilot so I do not see me manually adjusting classes on invoices and such only to sync with Service Autopilot and it is reverted. Our invoices are generated in Service Autopilot and synced to QuickBooks so this may come into play also.

Thank you for any suggestions or insight.

Solved! Go to Solution.

Welcome to the Community, @MichelleMM1.

Within one company file, you can only have one chart of accounts. A solution that may work well for you, would be to create sub-accounts under each "division" to give you more details of account transactions. In order to keep your account organized and make reports easy, QuickBooks offers you the option to set up sub-accounts under various account headings, so that you can track multiple kinds of expenses within an account. A great example would be creating an account for "travel", but also the types of things you may need to purchase while traveling, like meals, car rental, hotels, etc. This way, all of these sub-accounts show up under the travel heading, making reports easier to consolidate and read. You can add sub-accounts to any parent account in your chart of accounts.

Here's how:

Keep me posted if this solution works for you, I'm here to help! Have a great day.

Hello @MichelleMM1, thanks for coming back to the Community! This should be an option for you in your account. Let me link this article to walk you through the steps: Tracking payroll expenses by class, department, or location.

Take a look at that article and let me know if that's what you're looking for. If not, definitely reply back and we can continue to take a look. :)

Thanks for keeping us updated on how the troubleshooting went through, MichelleMM1.

I read all the responses in this thread and it looks like all of the possible troubleshooting steps have already been shared. In this case, I recommend contacting our QuickBooks Support Team. They can securely look into your account to find the root cause of this.

Here's how:

You can also go to this link to get in touch with our supports outside of QuickBooks: https://quickbooks.intuit.com/learn-support/en-us/contact.

Additionally, I suggest visiting this article for additional reference when preparing your year-end tasks: QuickBooks Desktop Year-End Prep and Resources.

You can always find me here if you have any other concerns or follow-up questions.

Welcome to the Community, @MichelleMM1.

Within one company file, you can only have one chart of accounts. A solution that may work well for you, would be to create sub-accounts under each "division" to give you more details of account transactions. In order to keep your account organized and make reports easy, QuickBooks offers you the option to set up sub-accounts under various account headings, so that you can track multiple kinds of expenses within an account. A great example would be creating an account for "travel", but also the types of things you may need to purchase while traveling, like meals, car rental, hotels, etc. This way, all of these sub-accounts show up under the travel heading, making reports easier to consolidate and read. You can add sub-accounts to any parent account in your chart of accounts.

Here's how:

Keep me posted if this solution works for you, I'm here to help! Have a great day.

Ok thank you for the info. I understand there can only be one COA which I have set up already with sub accounts. So within my current COA I need to be able "auto-allocate" certain accounts to certain classes. I assume the only way for me to divisionalize in QB Desktop is through classes, is that correct? I was looking for a way to permanently assign a class to an account in my COA. I am not seeing that option so the only way to utilize classes it to manually choose it when you post anything?

Thanks for sharing additional details, @MichelleMM1.

Yes, you’re correct. You can use classes to organize your Chart of Accounts (COA).

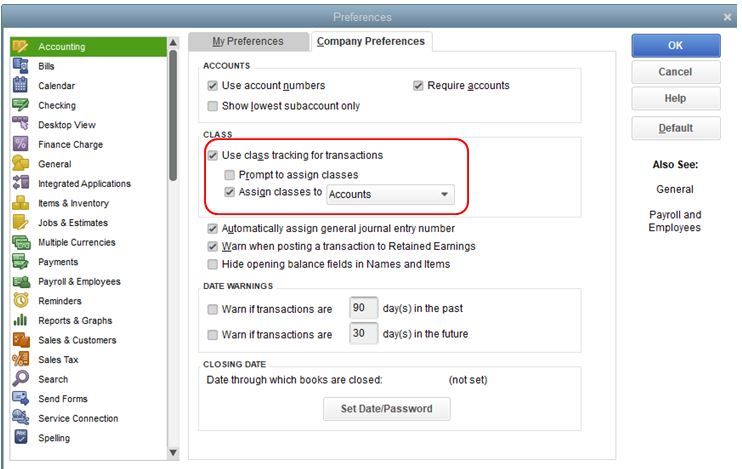

In QuickBooks Desktop (QBDT), you can track your account balances by departments, divisions, and locations. To achieve this, let’s turn on the class tracking feature. Let me guide you how:

You can also check this link for more details: Set up and use class tracking in QuickBooks Desktop.

To assign the classes :

To be guided in managing your classes, you can run reports by class. Feel free to check out this article for the complete guidelines: Filter, sort, or total reports by Class.

Let me know if you have other follow-up questions supervising your accounts, you’re always welcome to get back to me. Keep safe and more success in your business!

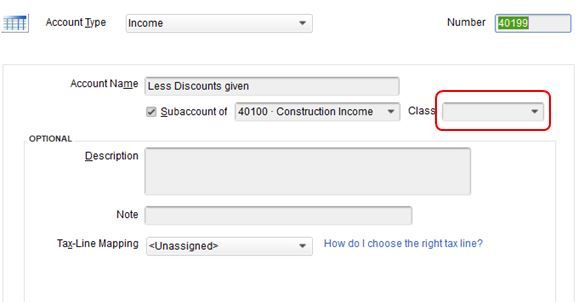

Perfect, thank you Jason. The issue I encountered is that I do not have the class drop down selection when I edit an account on the COA. Am I missing a setting somewhere?

I see that I do not have the same company preferences options as you do...

I am missing the assign classes checkbox. I am using QuickBooks Desktop Pro 2020. Is my version an issue?

Hello @MichelleMM1! Thanks for coming back to the Community. I'm happy to help explain that setting. :)

The reason why you don't see that assign classes checkbox is because that feature is only available in QuickBooks Enterprise. There are a couple of workarounds that may work for what you're trying to accomplish.

First, you can use the Class column instead and then select the right income or expense account when creating transactions like invoices, bills, etc. This way, you can link the correct class to its corresponding account properly.

Second, you can add the class name on the account's Description field. You can also set a class if it's a sub-account.

Both of these options are explained in detail (with screenshots) in this related Community post: How to Assign Class to Ledger Account. Scroll down to the agent ReyJohn_D's comment where he outlines each option.

Please feel free to reply to this post if you need anything. We're all eager to help you!

Thank you Kiala, so when I run payroll my guys work in different divisions/classes throughout the week. Is there a way to assign a class to each line item on the paycheck? If not, do you happen to know if this feature is in the Enterprise version? I do know that I can assign an employee to one class either in their main info or in the upper right of their paycheck screen. Appreciate the help!

Hello @MichelleMM1, thanks for coming back to the Community! This should be an option for you in your account. Let me link this article to walk you through the steps: Tracking payroll expenses by class, department, or location.

Take a look at that article and let me know if that's what you're looking for. If not, definitely reply back and we can continue to take a look. :)

Hello Kiala, the article regarding class with payroll checks was very helpful. So I ran into an issue when I went back in time and changed a line item class in a paycheck. After I changed the class, the payroll item deduction for health insurance now sits in our P&L report as unclassified and in the payroll summary report it is not included anywhere as there is no column in that report for unclassified.

Do you have any suggestions on this one?

Good day to you, @MichelleMM1.

Let me share with you some insights on why the paycheck shows unclassified in your Profit &Loss reports.

An unclassified transaction shows in your report when QuickBooks can’t identify the class for some transactions. A possible reason this happens is when:

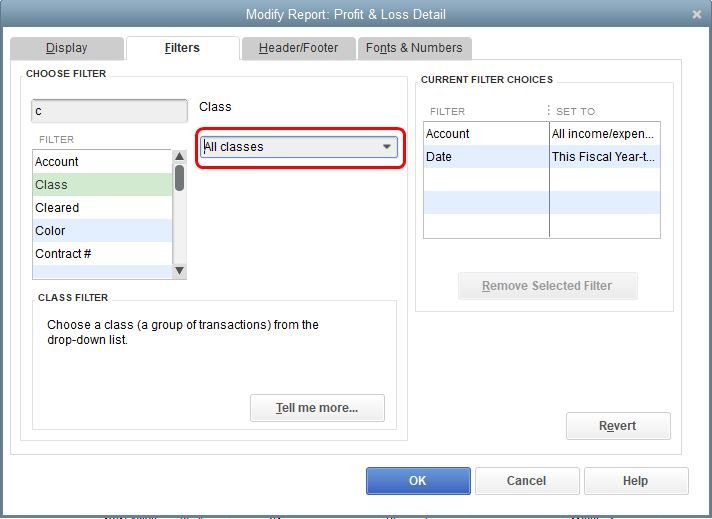

Thus, this could be the reason why the payroll item doesn’t show in your payroll summary report. To get around this issue, you’ll want to ensure to use the correct class for the check. You can also filter the report to a specific class you assigned to the paycheck. This way, the check will show on the report. Let me show you how:

You can also read through this article for more details about customizing reports in QuickBooks Desktop (QBDT): Customize reports in QuickBooks Desktop.

You might also want to run the Profit & Loss by Class and Profit & Loss Unclassified reports. This way, you can easily locate the transaction by class and identify those unclassified ones.

In addition to this, it’s also a great practice to memorize your customized reports. This way, you can easily pull the data you need without going through the customization process again.

If you have other questions or clarifications in mind, you’re always welcome to share them with me. I’ll be around to help you. Have a good one and take care.

The article was informative but for some reason my payroll health insurance deductions for my General and Administrative class are not being classed on the paychecks. They show on my P & L as unclassified. I have classes turned on of course and set by earnings item since I have employees that work between different classes during the week. I don't understand why this deduction will not push to the correct class. It seems to be allocating just fine for my other classes. Any insights? I appreciate the help, Michelle

Good morning @MichelleMM1! I'm happy to have you back and getting this figured out. I read over the other agent's posts and the next best step is to verify and rebuild your data in your account. These steps will help fix errors, especially in reports.

Here's the link to an article that walks you through step by step : Verify and Rebuild Data in QuickBooks Desktop.

Once you have gone through this process, please let us know if that fixed your issue. All of us here are eager to get this working for you!

Hello there, I verified my data and it returned no errors. I went ahead and ran the rebuild but the issue still remains. I can't wrap my head around the fact that these insurance deductions are for our G&A, the employee paychecks are all classed to G&A, and their class in employee info is G&A yet they still won't class to G&A. Any other suggestions are most appreciated! Michelle

Thanks for keeping us updated on how the troubleshooting went through, MichelleMM1.

I read all the responses in this thread and it looks like all of the possible troubleshooting steps have already been shared. In this case, I recommend contacting our QuickBooks Support Team. They can securely look into your account to find the root cause of this.

Here's how:

You can also go to this link to get in touch with our supports outside of QuickBooks: https://quickbooks.intuit.com/learn-support/en-us/contact.

Additionally, I suggest visiting this article for additional reference when preparing your year-end tasks: QuickBooks Desktop Year-End Prep and Resources.

You can always find me here if you have any other concerns or follow-up questions.

I was thinking the same and will initiate a "help" call. Thank you everyone for all your help! Michelle

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.