Track healthcare deductions in QuickBooks Self-Employed

by Intuit• Updated 2 years ago

See what healthcare expenses may be deductible.

If you're self-employed, you may be able to deduct some of your healthcare and related taxes. The rules about what's eligible can be tricky. Always check the IRS website for the most up-to-date info on healthcare and Health Savings Accounts (HSA).

Here's a quick overview of the types of healthcare deductions. You can check if you qualify in QuickBooks Self-Employed.

Step 1: Fill out your health profile

If you use QuickBooks Self-Employed, fill out your healthcare profile. This tells you if and which healthcare expenses you can deduct. QuickBooks can also include eligible expenses as part of your federal estimated tax payments you make each quarter.

Step 2: Learn about healthcare deductions

QuickBooks Self-Employed looks at two types of healthcare deductions:

How do healthcare deductions show up

Both types of deductions affect your household’s overall tax picture. However, neither are part of your self-employed expenses, deductions, or profits. And they won’t appear on your Schedule C either. They’re personal deductions, not business ones.

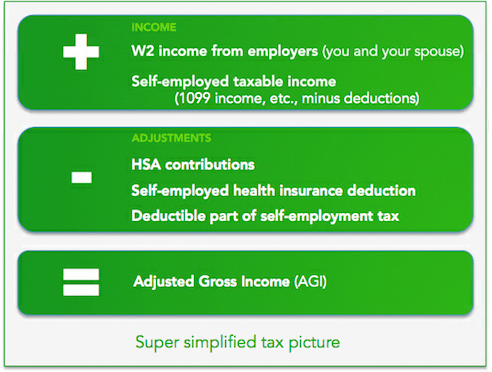

Instead, these deductions are part your adjusted gross income:

Note: Totals for the healthcare categories don't show up in QuickBooks Self-Employed until you complete your health profile and start categorizing the payments.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- Find out if your healthcare is deductible in QuickBooks Solopreneur and QuickBooks Self-Employedby QuickBooks•59•Updated June 18, 2024

- Why some deductions don't automatically export to TurboTax Self-Employedby QuickBooks•273•Updated 2 years ago

- Overview of QuickBooks Self-Employedby QuickBooks•712•Updated over 1 year ago

- Learn how QuickBooks Self-Employed calculates mileage deductionsby QuickBooks•26•Updated 2 years ago