Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowOur company has 3 different business divisions. Each with its owning billing category in QB for revenue. We are looking to begin using class to separate the 3 divisions in QB for job cost accounting. However we have some employees that can work in multiple divisions on a single project or in a single pay period. Can a single employee's time be categorized under multiple classes in a single time period in payroll? i.e. From 8 am to 11 am the employee worked in 'Class A' and from 12 pm to 4 pm they worked on a project under 'Class B'

It's nice to know that you have an organized way of tracking your cost, edwardinge. The Class tracking feature is really useful for the situation you have.

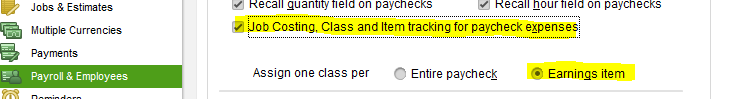

We can categorize the works of an employee to different classes in one day like what you've described. We'll just need to enable the settings to assign classes per item because that's where we assign classes to when creating paychecks.

You can use the same earning item per division or you can create different earning items per division as well. This will also apply to billable jobs performed by employees.

First, we'll enable the settings to associate class to earning items and jobs:

Second, create a paycheck for the employee. Your payroll detail would look like this one.

When you need to know your expenses per class, just go to Reports, choose Company & Financials, then Profit & Loss by Class.

We'll be your guide when you have a special setup in your payroll and reports. Have a good day!

Our tribal organization utilizes QuickBooks Enterprise Non-profit 20.0 R13P software and is in the process of working towards the data integration phase with a third party grants management tool. The basis of the core datasets will be stemming from the profit and loss by class reports. One of the sections of the report focuses on the salary and wages, payroll taxes, and worker's compensation expense. We used a third party tool, QXL, to export the data. The initial table tie in was to go from the Transaction table (EntityRefListID) to the Entity table (ListID) and to the Employee table (ListID). The last is from the Employee table (PayrollInfoClassRefListID) to the Class table (ListID). During payroll, when the employee is using the initial set up to a class, which is stored in the Employee table, the one-to-one connection provides the results I am looking for. However, it is only a partial result. There are instances during payroll where an employee can be assigned multiple Class designations. I have been looking for the proper table(s) that could provide insight to what the connections would be to account for multiple Class designations to an employee. Any assistance could be useful.

Hi jphenryjr!

I can see that you posted this concern twice. I suggest you check the first post because it was answered already by my colleague. Please click this link: https://quickbooks.intuit.com/learn-support/en-us/other-questions/data-integration/00/1027226.

Comment again here if you have other questions. Thanks!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.