Good day, adam65.

You can create a separate pay for the nontaxable per diem amounts if the employee has no deductions (Examples: retirement, health care) added on their pay.

To add the pay type, here's how:

- On the left panel, go to Payroll > Employees.

- Select the employee's name.

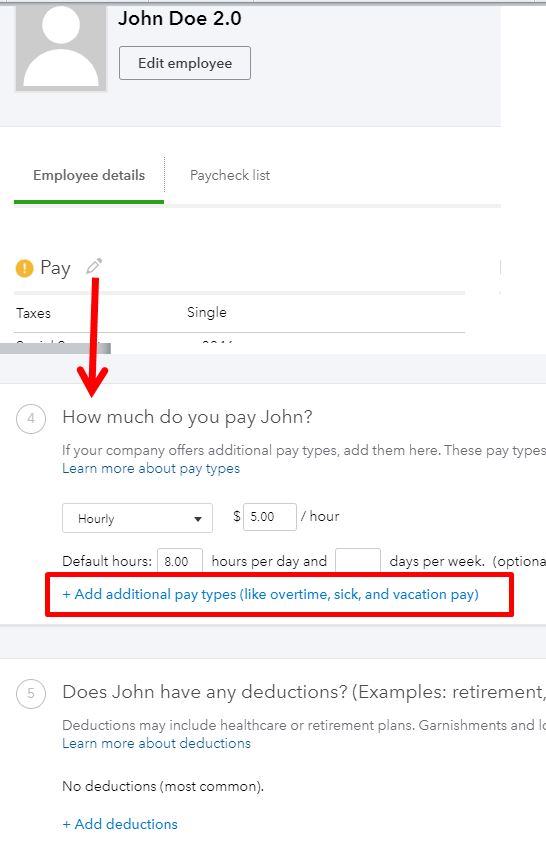

- Click pencil icon next to Pay.

- Go to the How much do you pay employee's name? section, and select the + Add additional pay types (like overtime, sick, and vacation pay) link.

- Under You can also pay section, put a check mark on the Nontaxable Per Diem box.

- Hit Done.

Once done adding the pay type, you can go back to the Employee List page and click the Run payroll button. If you already created a paycheck for this employee and will use the same pay schedule and pay date, just click on the Create another check for link.

Then, add the amount for the Nontaxable Per Diem in the field, make sure to put 0.00 in the Regular Pay Hrs box, and select DD for the Pay Method. Here's a sample screenshot of what it looks like:

For more information about the pay types supported in QuickBooks Online, you can read this article: Supported pay types and deductions explained.

If you need more help with the process, please let me know in the comments below. I'll be right here to help you out again. Thanks.