Hello there, @usercarterexpress-en.

I've got the information and the steps that you need in generating a payroll for your 1099 contractor in QuickBooks Online.

In QuickBooks Online, the best way to pay your contractors through a check. From there, you'll be able to enter their payroll details. You'll need to add them to the system so you can process their payroll. This way, you can also keep track of their transactions to be added on the 1099 form.

To do that:

- Go to the Payroll menu, then select Contractors.

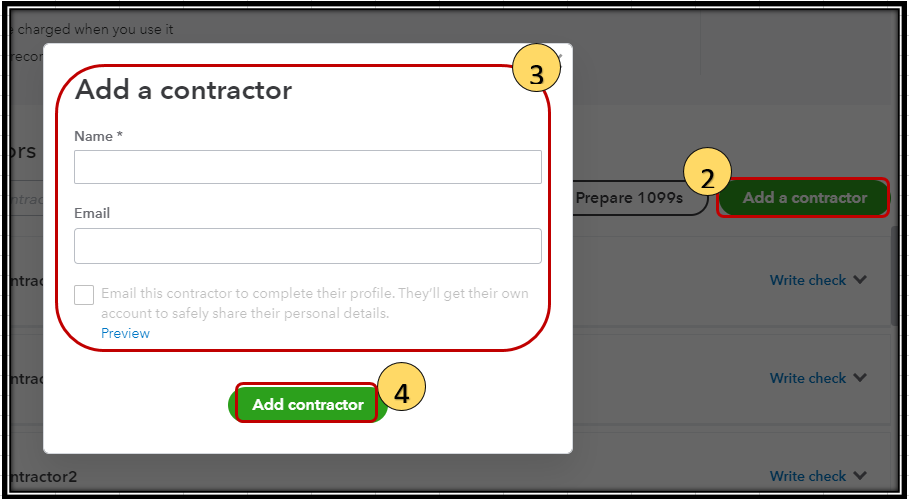

- Select Add a contractor.

- Enter your contractor’s info, or select the Email this contractor checkbox so they can fill it out.

- When you're done, select Add contractor.

After that, you can now start paying them through a check. You can also create a bill or expense transaction for them. Just click on the Write check button from your contractor's profile page:

You can also check out this link, which contains a short video clip about printing the checks: Pay a contractor with a paper check.

On the other hand, you also have the option to pay your contractors through direct deposit. The following article provides information on how this process works: Pay a contractor with direct deposit.

Know that I'm just a few clicks away if you have any other concerns. I'd be pleased to assist you. Have a great day!