Hello, Sharon.

I'm here to give you an overview on setting up a retirement plan in QuickBooks Online Payroll.

You can set up an IRA retirement plan in QuickBooks Online Payroll. However, it depends on what type the Retirement 2055 Rollover IRA is. The program currently supported the following types:

- 401(k)

- SIMPLE 401(k):

- 403(b)

- SARSEP

- SIMPLE IRA

- Roth 401(k)

- Roth 403(b)

Regarding the taxable type, you'll want to reach out to a tax adviser and check to see how the Rollover IRA should be set up.

After getting the important information on the Retirement 2055 IRA, here's how to set it up in QuickBooks Online Payroll:

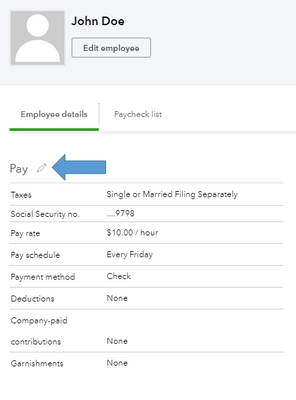

- Go to Payroll, then click the Employees tab.

- Select the employee's profile.

- Click the pencil icon beside Pay.

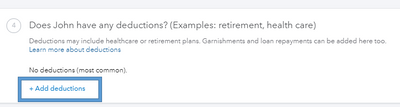

- Under the Does <Name> have any deductions? section, click the + Add deductions.

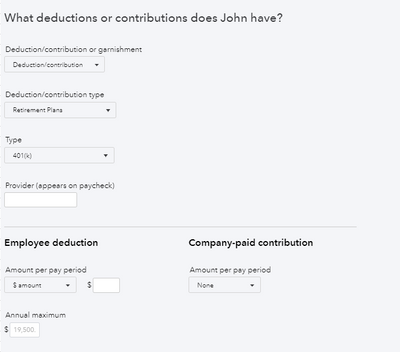

- Choose Deduction/contribution for the first drop-down menu.

- Select Retirement Plans for the second one.

- Choose the Type for the Retirement 2055 Rollover IRA.

- Add the provider if needed, then include the amounts.

- Once done, click OK.

If you need more help setting the IRA up, you can check this article for a guide: Retirement plan deductions/contributions.

Need to process payroll or manage other employees after setting up the IRA? You can read our articles for payroll-related information and guides: QuickBooks Online Payroll articles and topics.

I'm here to help you if you have other concerns about managing your employees or your payroll service. Just reply here and I'll be there to assist you.