Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Sending good vibes to you, crowsol.

I'd be happy to assist you in removing the old tax preparer's information on your QuickBooks Online account.

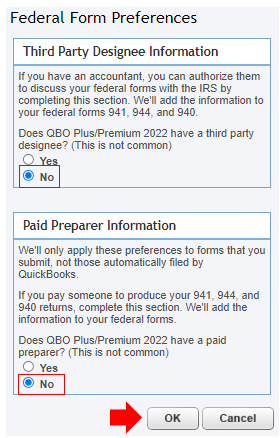

You can go to the Federal Form Preferences page to enter the new preparer information. Let me guide you through the steps:

The paid preparer's information you enter will appear on Federal Forms 941, 944, and 940. You might want to visit this article: Quick links to federal tax forms. It provides you links on how to file and manages IRS tax forms.

Feel free to get back to me if you still need help with the steps, I want to make sure able to remove the old preparer's information on your account. I'll be around to help you out. Have a good one.

I'm having the same issue with QB Enterprise Desktop. Need to remove previous tax preparer info on my 941 form, and cannot find the settings to do so

Thanks for following this thread, @cheryljo. In QuickBooks Desktop, you're only allowed to change the preparer information when you're an Enhanced Accountant payroll subscriber.

Here's how to edit the paid preparer information in QuickBooks Desktop Enhanced Accountant payroll:

For future reference, check out our year-end resources to learn more about completing necessary tasks in QuickBooks.

Let me know if you have additional questions. We're always around to help in any way we can.

Thank you for this info @katherinejoyceO. I should perhaps submit a ticket to QB support to assist with this? I purchased QB Enterprise with enhanced payroll 3 months ago and installed our last QB file when parting ways with our CPA. I'm sure this is why their info still appears, but I want them removed from our tax form info. Is this a payroll service support issue or QB desktop support issue?

Hi there, @cheryljo.

Allow me to step in and help you with your old payroll info.

In QuickBooks Desktop, we have the Payroll Preparer fields that you can access.

First option is to go to the Company menu. Here's how:

The other way is to be going to the Employees menu. Here's how:

I'm also attaching some articles that you may find helpful:

Please don't hesitate to comment below if you have other payroll concerns in QuickBooks. I'm just around to help. Take care always.

Didnt solve the problem, the paid preparer is still showing up on 941 forms and we no longer use one

Let's determine why this is happening. I'll guide you on how, Gieschen.

If you've followed the steps provided by @Rose-A on the topmost part of this thread, let's try to make some changes to the process so the paid preparer won't show up on the 941 form. I'll show you how:

As you can see above, under the Paid Preparer Information, instead of Yes, select No and then click OK.

However, if the issue persists, I recommend reaching out to our payroll support team to double-check why this is happening and investigate further. They have the tools to pull up your account in a secure environment.

I've added these resources to guide you in filing your taxes and accessing your tax forms:

Looking forward to working with you again. Mention me if you have any questions about payroll.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here