Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowChat support just repeats what the website says, might as well just be a bot.

Trying to run a 941 but getting amounts on Line 19 that I don't know where they are coming from, how it's calculated or how to get it to zero.

I was able to override my line 5(a)(i) and 5(a)(ii) with the correct number, but still getting an amount on Line 19, Health Plan Expenses. But this client doesn't have any.

Any ideas?

For giggles, here is what our paid "support" contract gets us:

Thanks for sharing such detailed information, Bphill.

I’m determined to find a solution to your concern about the Line 19 on Form 941.

The new Line19 on the Form 941 is calculated based on the qualified health plan expenses apportionable to qualified sick leave wages.

Just like what the chat support agent mentioned, QuickBooks did not separate the value of the health premium by family and sick leave wages. To better understand the balances of the credit, you may need to pull up a QuickReport for the COVID-19 Expenses account.

However, based on the chat thread you’ve provided, you mentioned that you don’t have an account for COVID-19 Expenses account. This type of account is set up for your employee’s paid leave.

For additional information about this, please visit this article. You can scroll down to Step 2 for the steps on how to set up your expense account for the paid leave: How to track paid leave and sick time for the coronavirus.

Here’s a great article that explains how QuickBooks calculates the taxes on 941 form for each line (Scroll down to New Line 19 for more information): How QuickBooks Populates The 941.

If you require to speak to a live support, you’ll want to reach them back at a later time.

While we’re experiencing high call/message volumes, our staffing is also affected due to COVID-19.

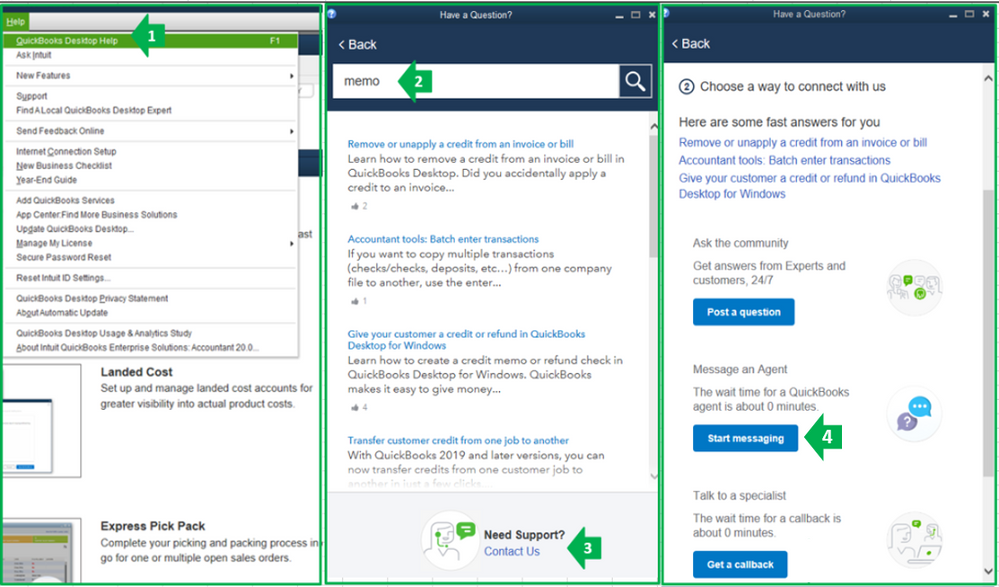

When you’re ready, here’s how to contact us:

If you have a case number handy, you can give it to the representative so they can trace your previous interaction. This will help them know the troubleshooting steps you’ve done so far.

Please take note our operating hours for chat support depends on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

Get back to me if there's anything I can help you with. I'd be happy to assist you further. Enjoy the rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.