After 90 minutes with tech support and God bless her, but she had no clue on how to fix this. Said I should review every paycheck. Really? And how was that going to fix it? Here is how I got the form to calculate the correct amounts.

DOUBLE CHECK - Checked all my 941s and State Unemployment returns, payroll amounts were all correct.

Problem: 940 shows exempt payments of $74.40 and balance due of 45 cents.

Isolate the Employee:

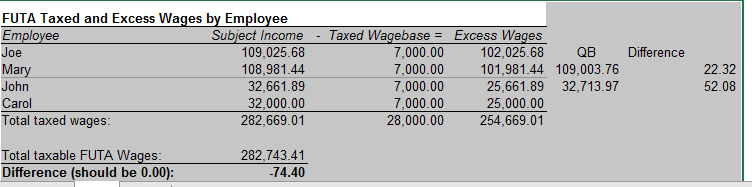

1- Ran the Excel Tax Forms report for 940.

2- Ran a Payroll Summary by Employee

1- On the 940 side. On the Excel report, key in the QB payroll amount, Calculate the difference.

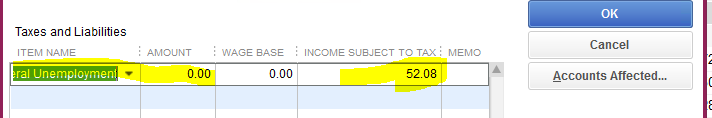

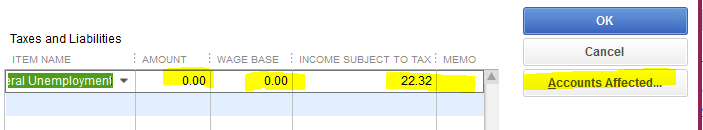

Make a Payroll Adjustment - Federal Unemployment, Amount = 0, Wage Base = 0, Income Subject to Tax = amount

Accounts Affected = Yes