I'll help you establish everything, @jmasters1.

You're correct that you can enter your IRS table amount for group life insurance on the payroll item page. I have just the steps you need in setting up your insurance in QuickBooks Desktop.

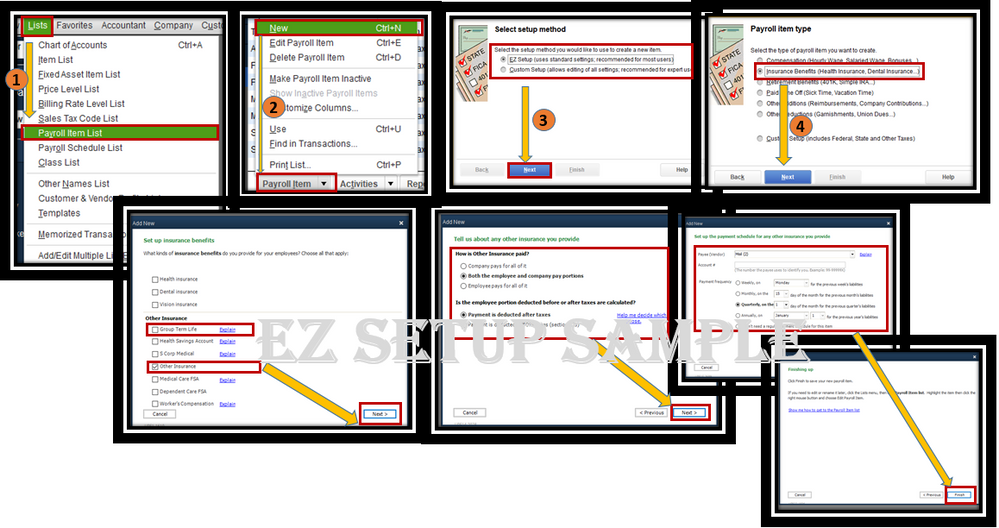

Here's how:

- Go to the Lists, then choose Payroll Item List.

- Select Payroll Item and click New.

- Pick either EZ Setup or Custom Setup, then Next.

- Choose Insurance Benefits for EZ Setup and follow the on-screen instructions.

5. Pick Deduction for Custom Setup and click Next.

6. Type a name in the field, then Next.

7. Complete the Agency for employee-paid liability, Tax Tracking type, Taxes, Calculate base don quantity, Gross vs. net sections.

8. Enter the correct amount in the Default rate and limit page, then click Finish.

Once done, you can always go to the Payroll Item List to modify any information. For the complete instructions, check out this article: Set up a payroll item for insurance.

To learn more about how the life insurance reported on paychecks and calculates, visit these articles for your later reference:

Drop a comment below if you have additional questions on setting up an item in your account. I'm constantly here to help you. Keep safe always.