Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

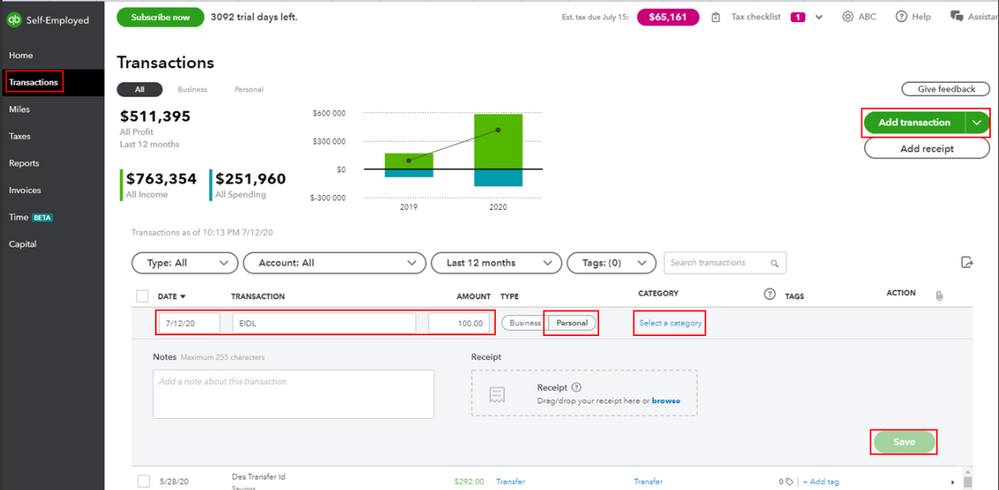

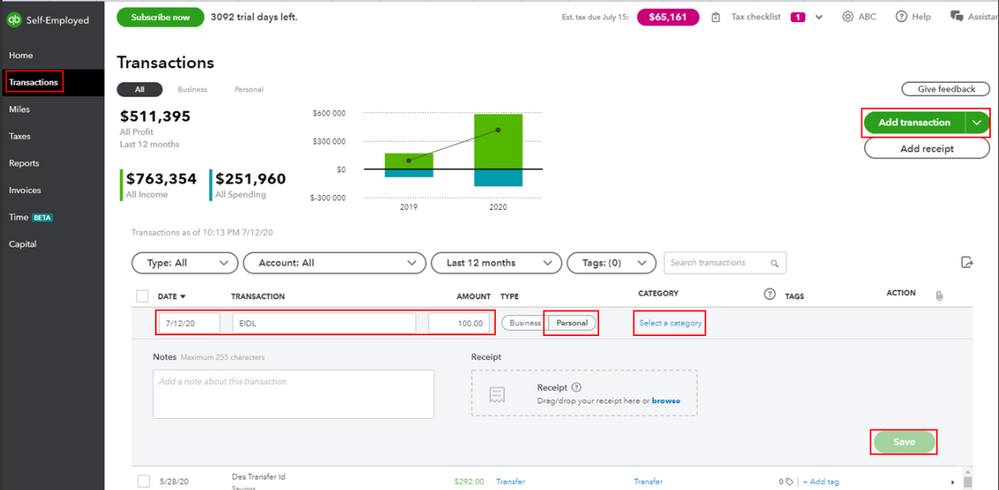

Welcome to the Community, @sandan.

Yes, you're correct. You can categorize the PUA unemployment benefits as personal payments. However, I still recommend seeking help with your accountant for more guidance on tracking it.

Here's how:

Yet, after recording it in QuickBooks Self-Employed (QBSE), you'll still have to manually add the payment on your tax forms when filing it from TurboTax.

You might want to check out this article to learn more about Schedule C categories in QBSE: Schedule C and expense categories in QuickBooks Self-Employed.

Please keep in touch if there's anything else I can do to help you succeed with QuickBooks. I've got your back. Have a great day and keep safe.

Welcome to the Community, @sandan.

Yes, you're correct. You can categorize the PUA unemployment benefits as personal payments. However, I still recommend seeking help with your accountant for more guidance on tracking it.

Here's how:

Yet, after recording it in QuickBooks Self-Employed (QBSE), you'll still have to manually add the payment on your tax forms when filing it from TurboTax.

You might want to check out this article to learn more about Schedule C categories in QBSE: Schedule C and expense categories in QuickBooks Self-Employed.

Please keep in touch if there's anything else I can do to help you succeed with QuickBooks. I've got your back. Have a great day and keep safe.

Could you please give the same solution for categorizing unemployment payments received in Quickbooks Pro instead of Self-Employed?

QueenBee2

Good evening, @QueenBee2.

I want to make sure you'll get the best help possible concerning the PUA unemployment payments.

As another option, you can record a bank deposit for this information. Don't worry. It's a simple process. Here's how:

That's all there is to it! Here's a guide that may be helpful for your business in the future: Payroll 101.

I want to make sure you're taken care of and able to enjoy your QuickBooks Desktop (QBDT) account. I'm only a post away if you need me. Have a wonderful day!

Only one issue here is "Payment" is not a category. If you type that in you get these choices:

Hello there, NinjaUnmatched.

Are you using QuickBooks Desktop or QuickBooks Self-Employed?

Self-employment unemployment is personal, not business funds and unless you are depositing the said funds into your business account as an Owner Equity Contribution, you'll want to deposit it to your personal checking/savings account.

In QuickBooks Self-Employed, you can select the closest category the personal tax payments are posted to. You can also check out this link for more details about Schedule C and expense categories in QuickBooks Self-Employed.

QuickBooks Desktop, on the other hand, you can refer to an accountant on how to record PUA unemployment benefits. They can walk you through the correct account and transaction to use that best suits your business preference.

Feel free to use this link to help you manage tax payments in QuickBooks Desktop.

Keep me posted if you have other questions and any details on what platform you're using is much appreciated. Take care and stay safe!

I notice how many replies refer to the same link. The schedule C description link only informs on expense categories. This of course is not an expense.

I use QBSE. I currently have them Personal with no Category or 'Uncategorized' because frankly not sure where it should go. Only category that fits is 'Income. But I am a tad leary to choose that because I suspect the software will include the amounts for taxes if this is set on them. Taxes are already being taken out. Example would be the PUA.... we all know it's now $300 but the amount shown that you/I get is $261.

So in the software whether one keeps it Uncategorized or chooses Income under Personal. Will the funds be factored in for tax purposes?

I really don't wanna leave it Uncategorized for the schedule C sake.

Hi NinjaUnmatched,

Thanks for joining the thread. I'm happy to share information about the effects of the categories you mentioned on your tax.

The Uncategorized is actually for expenses, and transactions under this category will be reported in your tax summary and estimates. On the other hand, if you tag the transaction as Personal, it will not be included in estimating your taxes.

Here's an article for your additional reference: How QuickBooks Self-Employed tracks self-employment taxes.

I'm just right here if you have further questions. Take care and have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.