Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi there, @lornabethgoldsmi.

This is not the experience I want you to undergo. Adding an expense account on your 1099 MISC is my top priority. I'm here to provide complete instructions to accomplish this.

You can add the expense accounts by creating a new account in the Accounting tab. But before doing that, let's pull up the 1099 Transaction Detail Report to identify the amounts paid and which accounts.

After that, you can now add a new one by following the steps below.

Once done, please transfer the payments to the new account by creating a Journal Entry. For more information, check out this article: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

Lastly is to prepare the form in QuickBooks. For the detailed instructions, follow these steps:

6. Tap Next, and review the information.

7. Hit Next and click on Finish preparing 1099s.

After following these steps, the added accounts will show on the form. I'm also attaching an article that will guide you on how to prepare 1099-Misc form.

To become more familiar with the boxes on the form 1099, you can have these article handy:

You can always get back to me if you have follow-up questions. I'm just a comment away. Have a good one.

Hi Michelle!

I've looked through your links. I actually spent time on the phone with a QB help person on Friday night. Honestly, they were kind, but had no help for me at all. I asked a simple question: what expense accounts are associated with the MISC form? And he could not give me an answer. We've been using Commissions in years past even though that wasn't technically what we're paying, it was reported just fine. Now with the new NEC form, and the split, I need a different account. Commissions is not what we're paying. We're paying Royalties (which is not NEC). I've confirmed that this is the case. After all this, I tried to set up an "Other Expense" that would be Royalties, and at that point, I went back in to prepare the 1099s, and those payments had completely disappeared (whereas before they were there but insisting on using the NEC form, which is wrong). So now, I'm giving this one more shot, and then I'll handwrite the forms (and honestly feel like QB has let me down). Can you walk me through getting this vendor 1099 to print on the MISC form either by helping me connect a new expense account to MISC, or by telling me there is actually already an account for royalties and other MISC form expenses, and letting me know what it is. Everyone has been very kind, but also, I need actual help, and the links given so far do not tell me the answer to my question. They do say what the 1099 MISC form is for, which I know and have confirmed is what I need. But I have not found a way to actually use an account that connected to it. I may not be using perfect language here, but please read carefully, and ask me to clarify. I'm happy and grateful to work through this.

Thank you!

Lorna

Hello, Lorna.

I appreciate the feedback with our support. I'm more than willing to work with you and help you file your 1099-MISC correctly.

The expense accounts depend on where you're tracking your royalty payments. The "Other expense" account you've set up likely doesn't contain the payments, which is why they disappeared when you set up the 1099 mapping again.

You might not need another account at all, so you'll want to use the same account where you previously tracked the royalties. However, I recommend consulting an accountant or a tax advisor for the best possible way to handle the account mapping. They can guide you on what accounts should be associate with the form and help you file it correctly.

Alternatively, you can visit the IRS guidelines on the 1099 forms: About Form 1099-MISC, Miscellaneous Income.

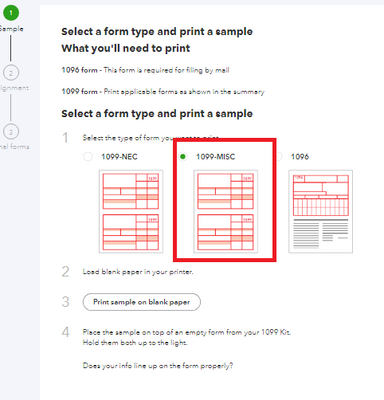

Also, make sure you've selected the 1099-MISC form after mapping your accounts (if you're filing manually).

I also suggest checking out this article if you need more help with the 1099 form: Troubleshoot common 1099 issues.

If you need help with other areas in QuickBooks Online, you can check our help content for guides and important pointers.

I'm all ears if you have other concerns regarding QuickBooks Online. Reply to this thread with the details and I'll address them.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.