Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWelcome to the Community, @LYMaccounts.

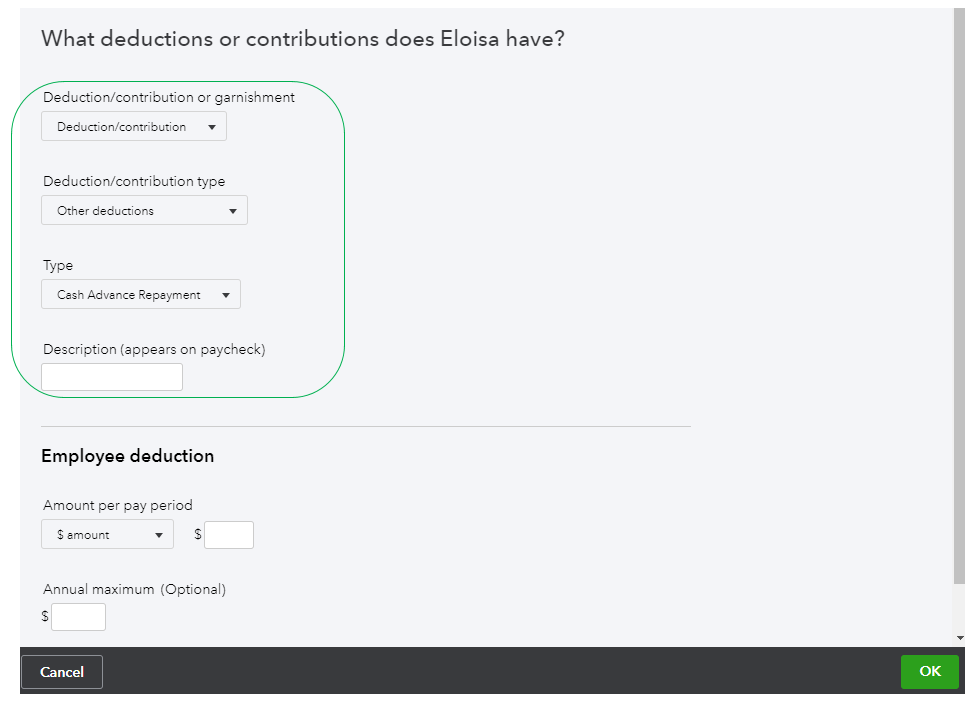

To ensure I'm on the same page, are you referring to a cash advance repayment from your employee? If so, you'll have to set up a cash advance repayment deduction in QuickBooks.

However, I'd recommend consulting with your accountant or tax adviser first to ensure if this right for your business.

Here's how to set up a cash advance repayment deduction:

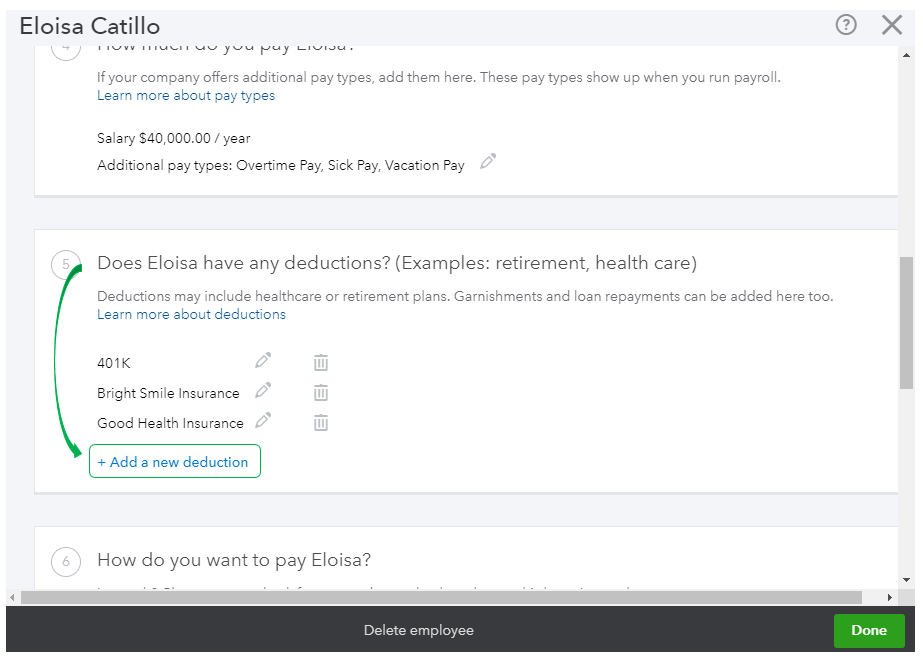

Once you're done with the setup, you can assign the cash advance repayment deduction to your employee:

You can check this article for additional details: Set up cash advance repayment deduction.

If you're referring to a garnishment, you may refer to this article: Setting up a wage garnishment.

Let me know if you have additional questions. I’m always here and ready to help. Take care!

Thank you for providing the solution. However, there is no option of PAYROLL SETTINGS when I go to the GEAR icon. Hence I cannot execute the instructions you have given.

Is there another way?

Hi LYMaccounts,

You can directly set up the cash advance repayment deduction item to the employee's profile.

Here's how:

Otherwise, record the cash through a journal entry. Beforehand, I'd recommend reaching out to an accountant or tax adviser for further guidance and discuss which accounts to be used in recording a journal entry.

Here's a handy article just in case you want to reverse a journal entry: Reverse or delete a journal entry.

Let us know if you have further questions. We're always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.