QuickBooks Online allows one company per subscription, Inquire.

Having said that, you'll have to get a different account for your new EIN. Once you're able to create another company, you can add it under the same user ID, then activate payroll. I'll guide you with the steps.

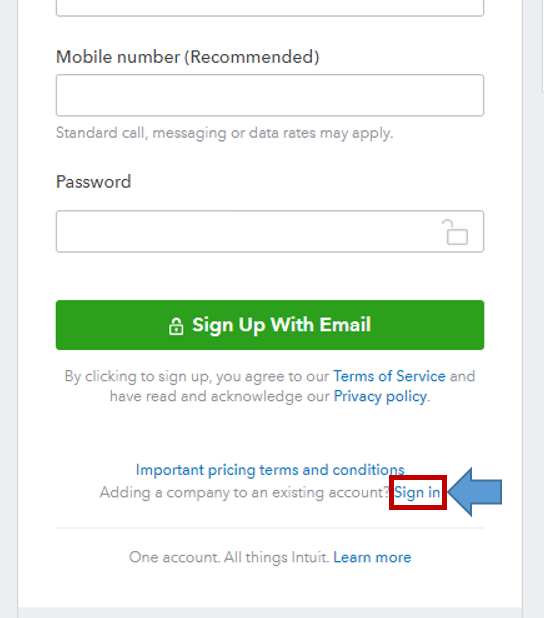

First, you can visit our website to purchase a new subscription, then add it under the same user ID by clicking Sign in in the Adding company to an existing account? section.

Then, set up the payroll subscription. Here's how:

- Click Workers, then go to the Employees tab.

- Select Get started with Payroll to begin setting up.

- Fill in the necessary fields.

Once you're done setting up, you can get started with payroll already.

If there's anything else that we can do for you, please feel free to get in touch.