Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWe are a CA based company who occasionally works in NV. Our employees have a different employee profile for wages earned in CA and wages earned in NV. Two new employees NV profiles were set up incorrectly in January and their NV wages had CA UI and CA Disability taken out instead of NV UI and CEP. The checks are cashed and cleared. What is the cleanest way to fix this? We are trying to do NV quarterlies, and the wages for those two employees are not being pulled into the quarterly return and of course show no NV UI or CEP in the company side. Help!

I'm glad to hear from you today, Shellyblasting. I can help you fix the wrong state unemployment taxes and show no NV UI or CEP for the company side in QuickBooks Desktop.

To fix the employee's wrong state unemployment taxes, as an initial step, ensure to disable the CA UI and CA Disability from the employee's profile and set up the correct NV taxes. This way, the system will take out the accurate tax information for the next payroll.

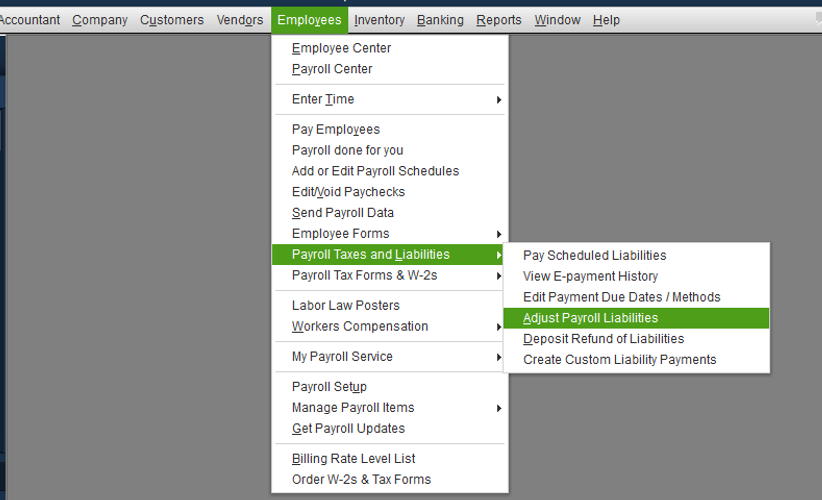

Once done, you can create a liability adjustment to correct the NV tax amounts. Here's how:

After that, you can make the NV UI or CEP for the company side inactive through the Payroll Item List.

I'd also suggest consulting an accountant to ensure your books are accurate and not messing up other data. They can provide more expert advice regarding an accounting perspective.

For more details about this process, check out this article: Adjust payroll liabilities in QuickBooks Desktop. On the same link, you'll find a write-up about how to correct your year-to-date additions and deductions in QuickBooks.

Additionally, we always want to make sure we're compliant with the state rules and regulations. With this, you can visit this website: Nevada Payroll Tax Compliance. It has in-depth details about Unemployment and Tax Forms as well as tax payment frequency detail.

I'm just a reply away if you have other questions with QuickBooks. Just add the details of your concerns in this thread and I'll help you out. Have a good one and take care.

Hi, Shellyblasting.

Hope you're doing great. I wanted to see how everything is going about fixing the NV UI or CEP taxes you had the other day. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I'd be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.