Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello,

I hired a Canadian Citizen for a week.I made him filling out a W-8BEN. Because of the Canadian/U.S. treaty, this employee won't have to pay taxes in U.S.

How do I run his payroll without withholding any taxes for him?

Thanks very much.

Solved! Go to Solution.

Welcome to the Community, @FAD.

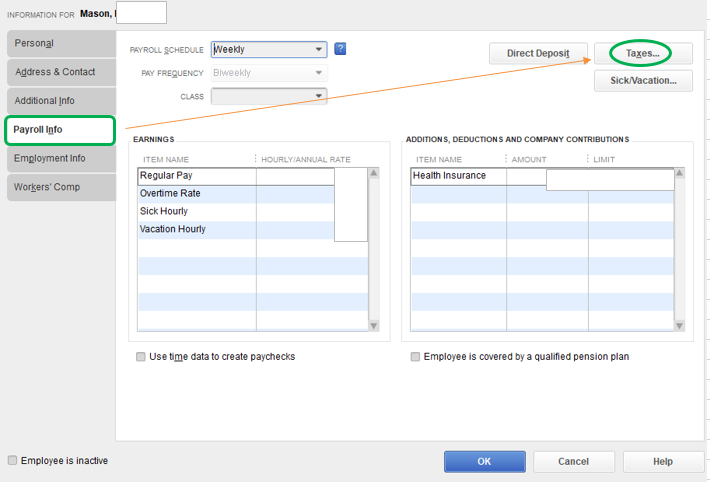

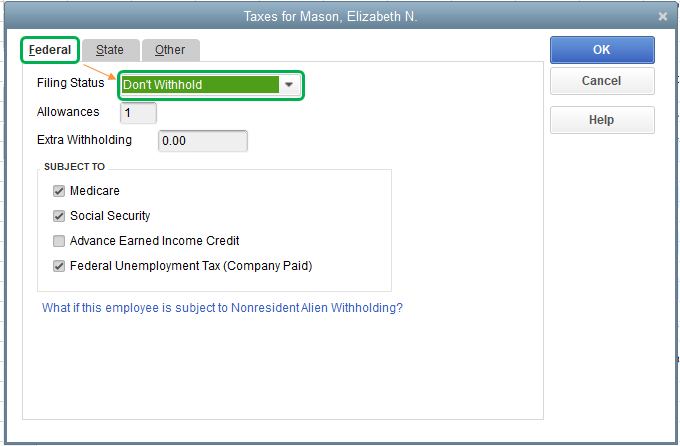

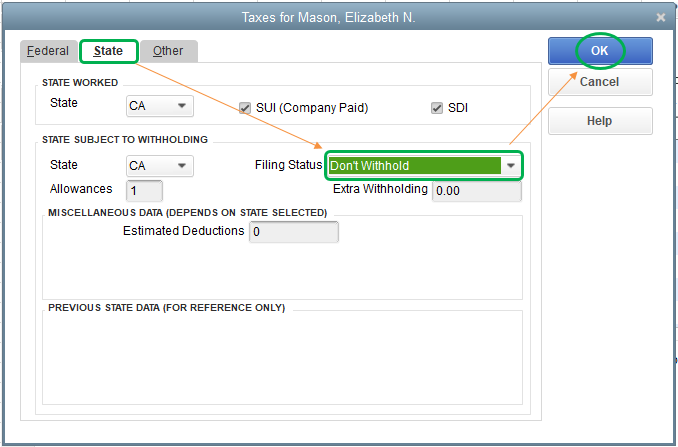

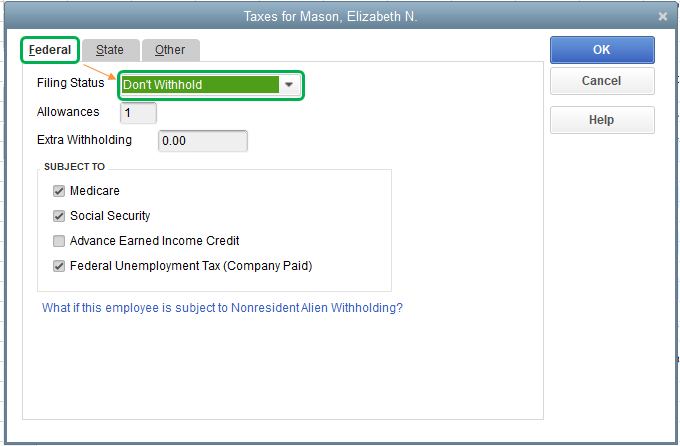

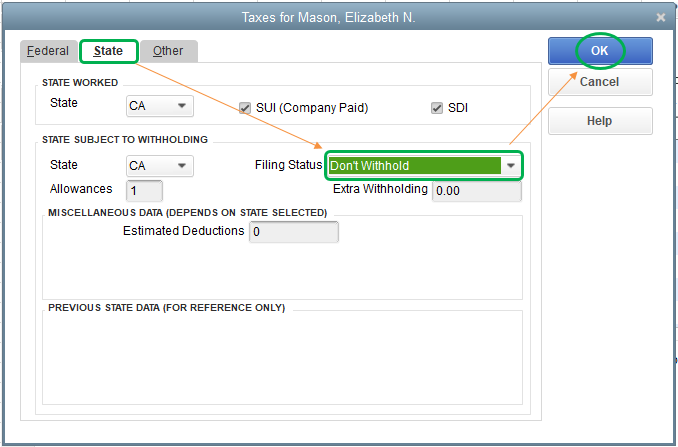

To run this employee's payroll without withholding any taxes, he must be set up as tax-exempt in QuickBooks Desktop (QBDT). This can be done by going to his Payroll Information.

Here's how:

Once done, run his payroll to double-check. For more information, consider checking out these articles:

Please let me know if you have any other concerns or issues in the comment section below. I'm more than happy to help. Have a great rest of the day!

Welcome to the Community, @FAD.

To run this employee's payroll without withholding any taxes, he must be set up as tax-exempt in QuickBooks Desktop (QBDT). This can be done by going to his Payroll Information.

Here's how:

Once done, run his payroll to double-check. For more information, consider checking out these articles:

Please let me know if you have any other concerns or issues in the comment section below. I'm more than happy to help. Have a great rest of the day!

Thank you SO much!

You're most welcome, @FAD.

I'm happy that I was able to help set up your employee as tax-exempt in QBDT.

For tips and other resources, I recommend visiting our website for reference: Self-help articles.

Thanks for being a part of our QuickBooks family. Reach out to me if you have any other issues or concerns, and I 'll get back to you right away. I'm always here to assist. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.