You'll have to create a payroll item for Aflac insurance, @kellybow144.

Here's how:

- Go to the Lists tab and select Payroll Item List.

- Click Payroll Item drop-down and hit New.

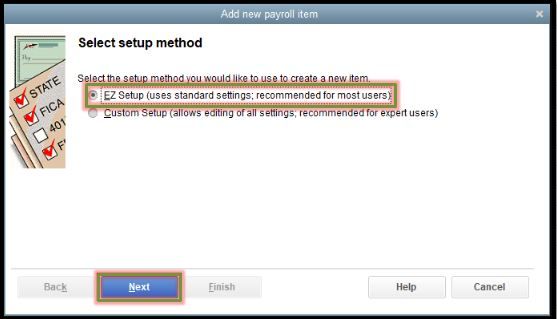

- Pick EZ Setup and tick Next.

- Follow the on-screen instruction to finish the setup.

For more details about the process, please check this article: Set up a payroll item for insurance.

To determine the accurate tax tracking type, I'd suggest consulting your health insurance administrator or your accountant to know the taxability of the item. This is to ensure you're using the correct account for your employees' deductions. If you don't have an account, you may use our Find an accountant tool.

Once the set up is done, assign the payroll item to your employee and enter the amount of the deduction.

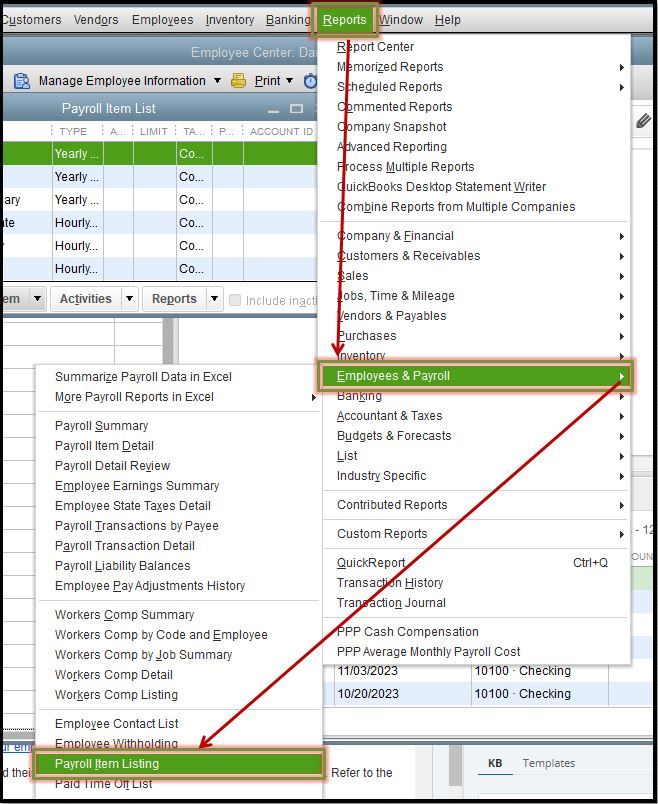

Then, to see the list of your company payroll items and their details, you may pull up the Payroll Item Listing report. Refer to the steps below:

- Select the Reports tab.

- Choose Employees & Payroll.

- Click Payroll Item Listing.

You can always get back here if you have other concerns or questions about setting up payroll deduction in QuickBooks. I'll be here to help you. Stay safe.