I'm glad you're choosing QuickBooks Desktop Payroll, cnyce.

The Federal Unemployment tax is set to be a company contribution by default, and there's no setting to deduct it from an employee's pay. When you open a paycheck detail, you can see this tax in the Company Summary section.

Can you please add more details about the Federal Unemployment tax you mean? Is it showing in the Employee Summary section of a paycheck detail? If you can add a screenshot to your question, that would be a lot helpful.

You can also check your payroll item list report to see how many Federal Unemployment items you have.

- Click the Lists menu

- Choose Payroll Item List.

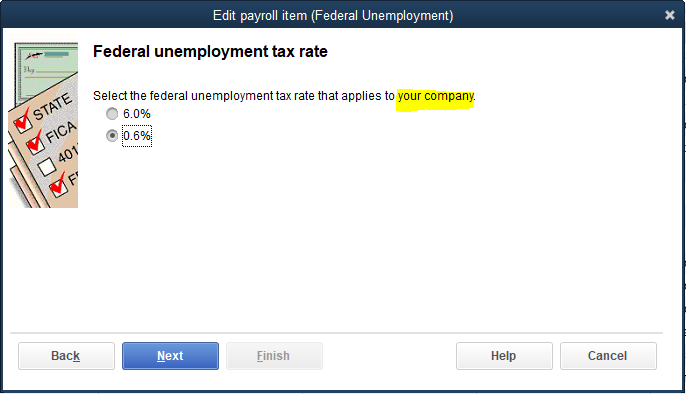

- Double click the Federal Unemployment tax.

- Click Next until you see this section.

Please let me know what you will find out. We're just right here to help you with your payroll.