I've got your back, @pjcard072260.

I have some ideas to make sure you can edit your deductions.

First, if you're trying to edit the 401 (k) or the IRA deduction item, you won't be able to do so. This is because QuickBooks Online is compliant with the IRS and each of them has their maximum amount limit.

For more insights, please review this article: Retirement plan deductions/contributions.

You can create a new deduction item instead. This way, you can increase the maximum amount limit. Here's how:

- Go to the Payroll menu, and then choose Employees.

- Choose the employee name, and then click the pencil icon beside Pay.

- Go to Step 5, and then choose Add a new deduction.

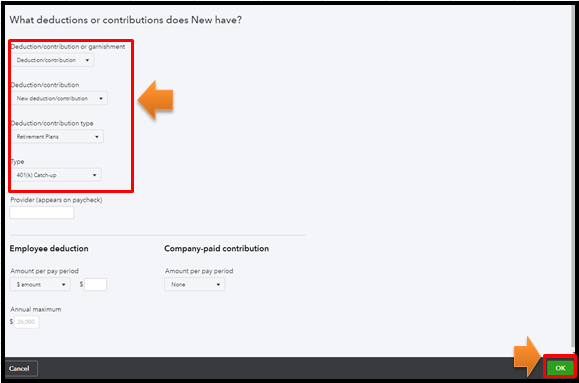

- Select New deduction/contribution and Retirement Plans from the Deduction/contribution type drop-down.

- Choose the desired Catch-up type from the drop-down list.

- Fill out other needed info, and then click OK.

On the other hand, if you're referring to the other deduction types, you should be able to edit them. If you're unable to do so, then this can be a browser issue due to a piled-up cache.

To isolate this issue, please in to your account using a private window/incognito. This is a good place to isolate a browser-related issue since it doesn't store any cache. You can use the shortcut keys below to access one:

- Ctrl+ Shift + N for Google Chrome

.

. - Ctrl + Shift + P for Mozilla Firefox

and Microsoft Edge

and Microsoft Edge  .

. - Command + Shift + N for Safari

.

.

Once there, modify your deduction item again as you normally would. If it works this time, please go back to your regular browser and clear its cache. If the issue persists, I recommend using another supported browser instead.

If everything's fine, you can run the Payroll Deductions/Contributions report to monitor your company deductions. To achieve this, go to the Reports menu, and then select the said report from the Payroll section.

You can count on me if you have additional questions about this. I'd be happy to help you some more.