Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi there, @fortunelending01.

In filling the 941 forms in QuickBooks Online (QBO), it will depend on what payroll you’re running. This form is used by employers to report the federal withholdings from most types of employees.

The 941 is based on Pay Date, not Pay Period. Think about this fact: You owe Taxes because you issued Paychecks. That's why the Pay Period is not "PERIOD" when you look at Liabilities.

Period, for Liabilities, is based on the Cycle of your due date, and then the Pay Date. Examples:

It notifies the IRS of several important figures, like the employment taxes taken from employee pay and the amount owed to the IRS.

Let's check to see if your 941 form in QuickBooks Online is ready. I've provided the steps below on how to check:

This will put you on track with your Quarterly 941 in QuickBooks Online.

Here are a few Community Articles that you may find useful:

Let me know in the comment section down below if you have any other concerns. I'm always around happy to help.

Maryann, I am not sure my question was understood. I do payroll through QB's on the 15th & 30th of every month; after each payroll period I then pay my 941 payroll taxes due on the 15th & 30th of each month. Typically, until the 10/15/2020 pay period, once I complete payroll, QB's informs me that payroll taxes are due (immediately after I finish payroll), then I pay the 941 payroll taxes online through QB's. Today, 10/15/2020, the notification did not come up, and within the Taxes section on the left hand side of the home page of my QB's there is no taxes due. There has to be payroll taxes due because I just paid payroll. I am not talking about Quarterly taxes; they are due by the end of October. I have used QBOE for approx 10 years and have always paid 941 payroll taxes, through QB's immediately after finishing payroll. Something has changed and I can't get QB support to call or assist.

I have used QBOE for 10 years; since using I have always paid 941 payroll taxes immediately after finishing payroll for each pay period. Prior to 10/15/2020, once I completed payroll, I would get a notification that payroll taxes are due (immediately after payroll), I would then pay the 941 payroll taxes for the pay period (I pay on 15th & 30th of month). The Tax section within QBOE does not reflect any taxes due other than quarterly taxes, which are not due until 10/30/2020. 941 Payroll taxes are due 3-5 days after each payroll period is completed. I need to know why it is not available, not showing up, and not allowing me to pay, when for the past 10 years it has allowed me to. QB's support is not very helpful when trying to contact anyone, and I have requested a chat meeting twice with no luck. If something has changed it would be nice to know.

Thanks for getting back to us so quickly, @fortunelending01!

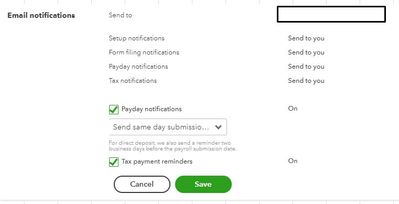

Are you using the same email address? Let's review your contact info and email preferences for your payroll from the Payroll settings page. You'll have to login as a master admin so that you can view the payroll settings.

Let's also perform basic troubleshooting steps to isolate the issue. To start, we'll have to access your account on a private browser. You can refer to these shortcut keys to open an incognito window in all supported browsers:

If it works, then your main browser may have accumulated too much historical data, which can impact processes and cause this kind of behavior. To ensure this doesn't happen again, I'd recommend that you clear it's cache. Otherwise, you can switch to another browser if the same thing happens.

I've got these articles for your reference:

Visit me here again in the Community and keep me posted on your progress with this payroll notification issue. I want to make sure this gets resolved for you.

Thank you for your replies; however there is no issue with my browser cache or cookies, the issue is QBOE: I know how to navigate thru QB and how to pay my payroll taxes. The issue is the same way I have done this for 10 yrs, most recently on 9/30/20, is no longer available in QB. I have not changed anything. I need a QB agent to contact me as this is ridiculous.

Hey there, fortunelending01.

Thanks for dropping by this evening, I'm happy to provide you with the information necessary to reach our support team. Follow these steps to reach an expert.

Contact us through your product

If you have any other questions, feel free to post here anytime. Thank you and have a nice evening.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.