Welcome to QuickBooks Online family, @perspool1956.

I'll share some information about accessing and filing 1096 in QuickBooks Online (QBO).

Each QBO has 1096 forms stored. That way, you can file it to the state if necessary. You'll need to go to the 1099 page so you can see this form.

The 1096 forms aren't required by the IRS when you e-file the 1099 forms. Further, if your state belongs to the combined Federal and State Filing (CF/SF) Program, you don't need to E-file the form. The IRS will forward the electronically filed data to your state.

But if you need to print it, please go to the 1099 page and follow the steps below.

Here's how:

- Choose Expenses from the left menu, then select Vendors.

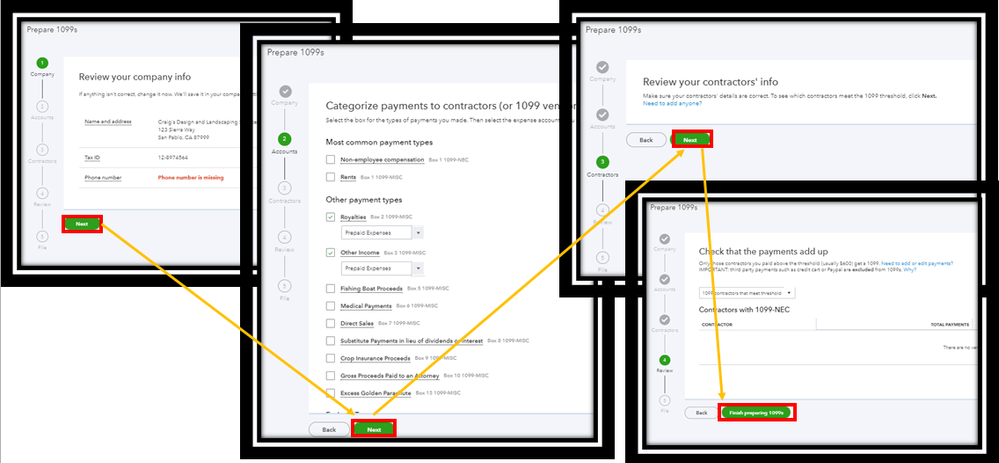

- Click Prepare 1099s.

- Enter all information correctly for the tax year, then hit Next until you've to see Finish preparing 1099.

4. Tap Print and mail.

5. Pick the 1096 form, then tap Yes, looks good!

6. Select Print on a 1096 Form and hit Print.

7. Follow the on-screen instructions to mail the form.

If you only print the said form, then there's no cost. Though if you mailed it in the system, you'll need to pay some pennies. For the complete instructions, visit this article: Print a 1096 form.

You can always check the form status by signing in to the 1099 E-File service website using your Intuit credentials. Then, click View past forms to see the returns.

I've added some pages about printing old vendor forms and the state's payroll tax regulations.

Let me know if you need more help. I'm just one post away. Keep safe!